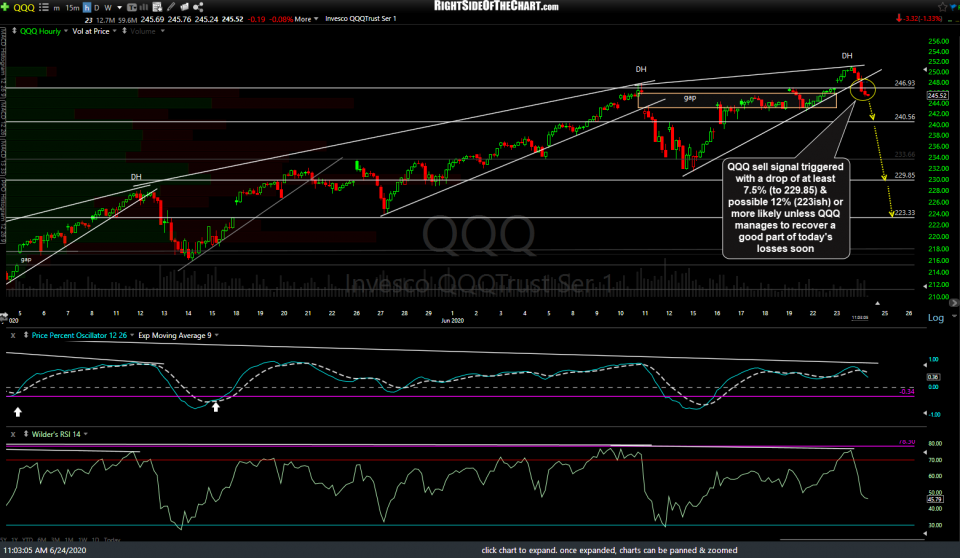

QQQ has triggered a sell signal on a break below the 247ish support with a drop of at least 7.5% (to 229.85) & possible 12% (223ish) or more likely in the coming days to weeks unless QQQ manages to recover a good part of today’s losses soon via a stick save (sharp reversal/rally into the close to print a daily close back above the 247 level. 60-minute chart below.

Likewise, /NQ also triggered a sell on the impulsive break below /NQ 10107 with the Nasdaq 100 futures now coming up on the 10000ish support. Both levels/potential sell signals on QQQ & /NQ were highlighted (in advance) in recent videos. However, it should also be noted that most of the market-leading FAAMG stocks are still trading above their respective uptrend lines for now. As such, the odds of that potential 7.5% -12% drop will increase substantially, should we soon get confirming sell signals on the majority of the FAAMG stocks.

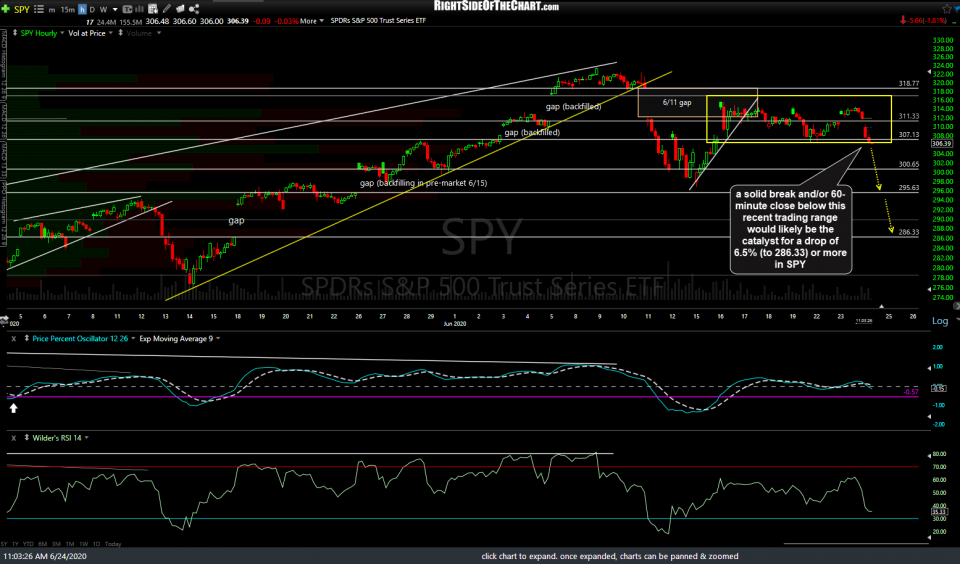

While the Nasdaq 100 has triggered a sell signal, a solid break and/or 60-minute close below this recent trading range would likely be the catalyst for a drop of 6.5% (to 286.33) or more in SPY. Essentially, we have what appears to be a decent sell signal on the $NDX although far from an “all-in” or “all-clear” sell signal until & unless most of the market-leading mega-caps stocks soon trigger some solid sell signals as well.