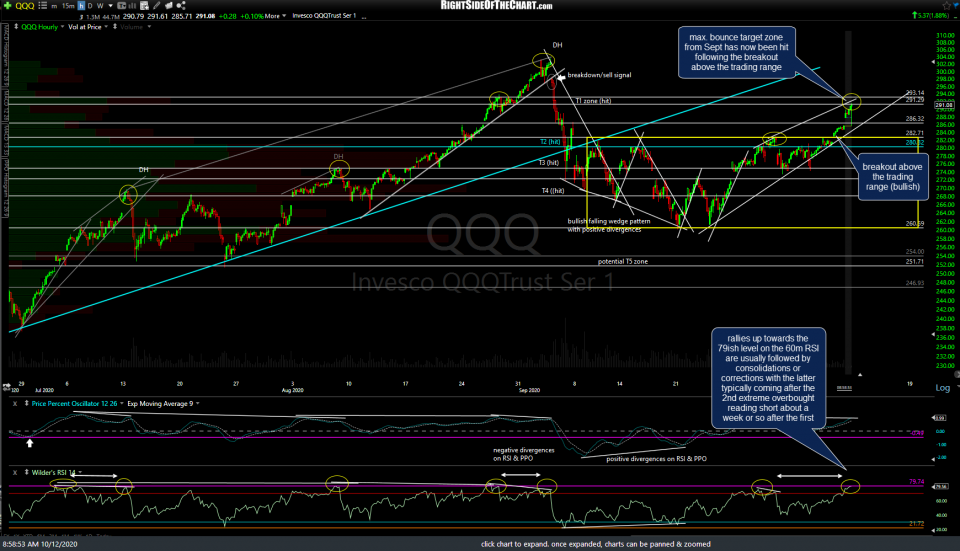

Both QQQ & /NQ (Nasdaq 100 futures) continued to rally into the close on Friday, solidly breaking out above the key Sept-Oct trading ranges with the futures picking up on Sunday evening where they left off when the closed trading for the week on Friday & rallying since last night’s open. While the solid breakout above the range was a bullish technical event, the 3½% rally in the Nasdaq 100 futures since the breakout coupled with the facts that /NQ has hit the bottom of the upper-most bounce target zone from Sept as well as hitting an extreme overbought reading of 87 on the 60-minute RSI, puts the very near-term outlook for the Nasdaq 100 back from bullish (since Friday afternoon to now) to bearish.

In other words, I believe the bulk of the initial post-breakout rally has now fully or mostly run its course with a correction or at least a consolidation likely from here or up to by not much above those maximum bounce target zones on QQQ & /NQ that have been highlighted over the past several weeks. While I have been stating that a solid break above or below the recent trading range would likely determine the next tradable trend in the market, which may still prove to be the case, with the elections now rapidly approaching, about the only thing I have a high degree of confidence in is that volatility, including whipsaw signals, are likely to increase leading up to and immediately following the elections. As such, I’ll be focusing largely on the very near-term outlook for the stock market vs. the intermediate or longer-term outlooking until the post-election dust has settled.

In the QQQ 60-minute chart above, the bottom of the max. bounce target zone from Sept has now been hit following Friday’s breakout above the trading range (the continued buying the Q’s into the close instead of fading the rally, as I had suspected they might heading into the weekend). As with /NQ, rallies up towards the 79ish level on the 60m RSI are usually followed by consolidations or corrections with the latter typically coming after the 2nd extreme overbought reading short about a week or so after the first.

Bottom line: I’m near-term bearish on the Q’s right now with a minimum pullback target of 286 & a potential pullback target as much as the top of the trading range.