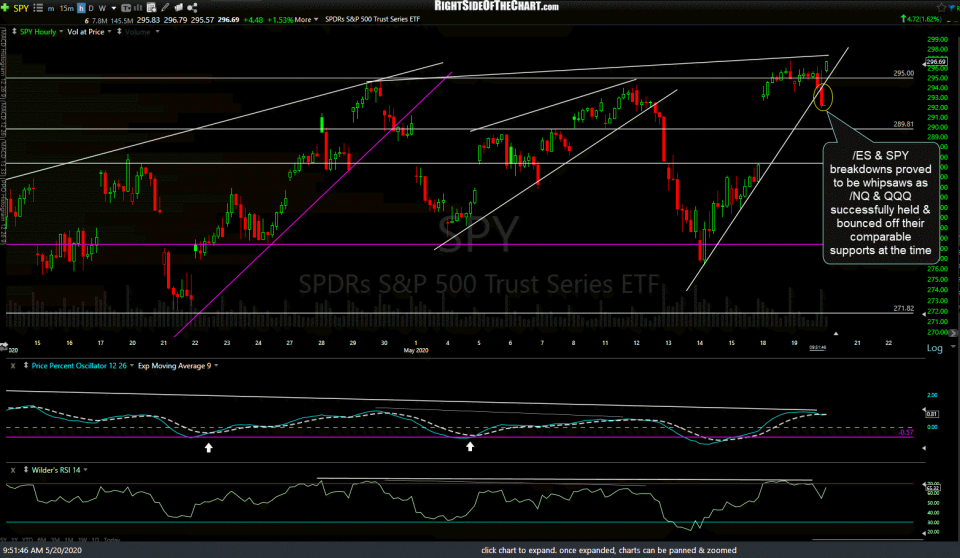

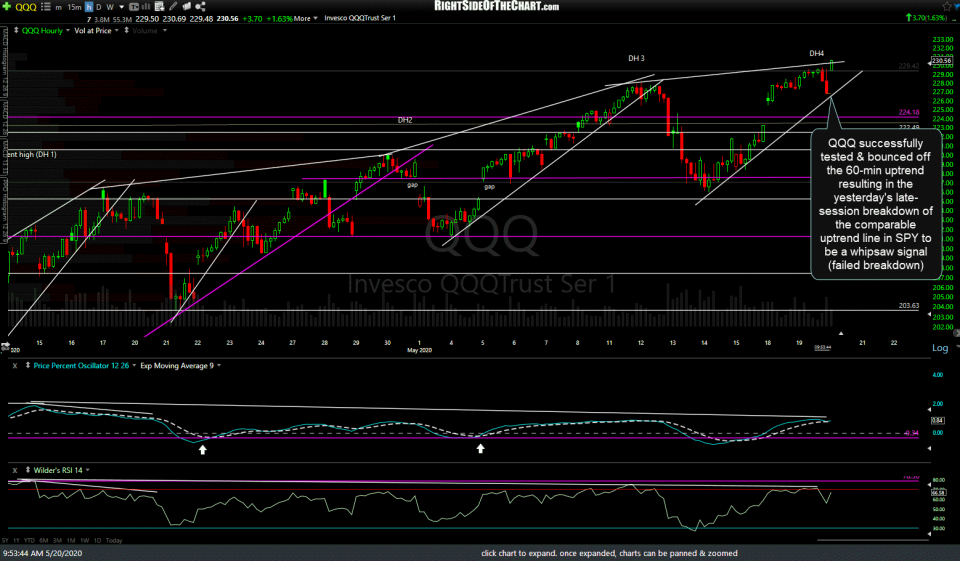

Both QQQ & /NQ successfully tested & reversed off the trendline (QQQ) and 9300 (/NQ) support levels which resulted in the breakdowns in both SPY & /ES to be whipsaws (i.e.- false breakdowns), as laid out as a potential scenario & something to watch for in yesterday’s closing video.

- SPY 60m May 20th

- ES 60m May 20th

- QQQ 60m May 20th

- NQ 60m May 20th

False breakdowns are typically followed by impulsive rallies as the breakdown (in this case, only on SPY) draws in short-sellers that quickly realize that the reason they shorted (an impulsive breakdown below support) is no longer valid. As they cover (buy-to-cover) their positions, that adds to buying pressure along with long-side traders that also jump in once they see the support level recovered. Additionally, the pullbacks to those support levels on both QQQ & /NQ were successfully defended & those were also objective levels in which that particular subset of traders would have stepped in to buy.

Just how high that false breakdown & the successful test of support on the Q’s will carry the major indices is hard to gauge although the next significant resistance levels on SPY are the 200-day SMA (simple moving average) around and 299.50 price resistance around 302.50. QQQ doesn’t have much resistance until the key February 19th ATH at 237.47. The negative divergences are still intact on the 60-minute charts for now although the post-whipsaw rally in SPY has so far caused the PPO’s on both SPY & QQQ to ‘bounce’ or turn back up as they were both poised to make bearish crossovers today had QQQ also broken down to confirm the breakdown in SPY. Should this rally be faded today or later this week, those same trendlines on SPY & QQQ are still levels that will likely spark a wave of selling if both taken out with conviction.