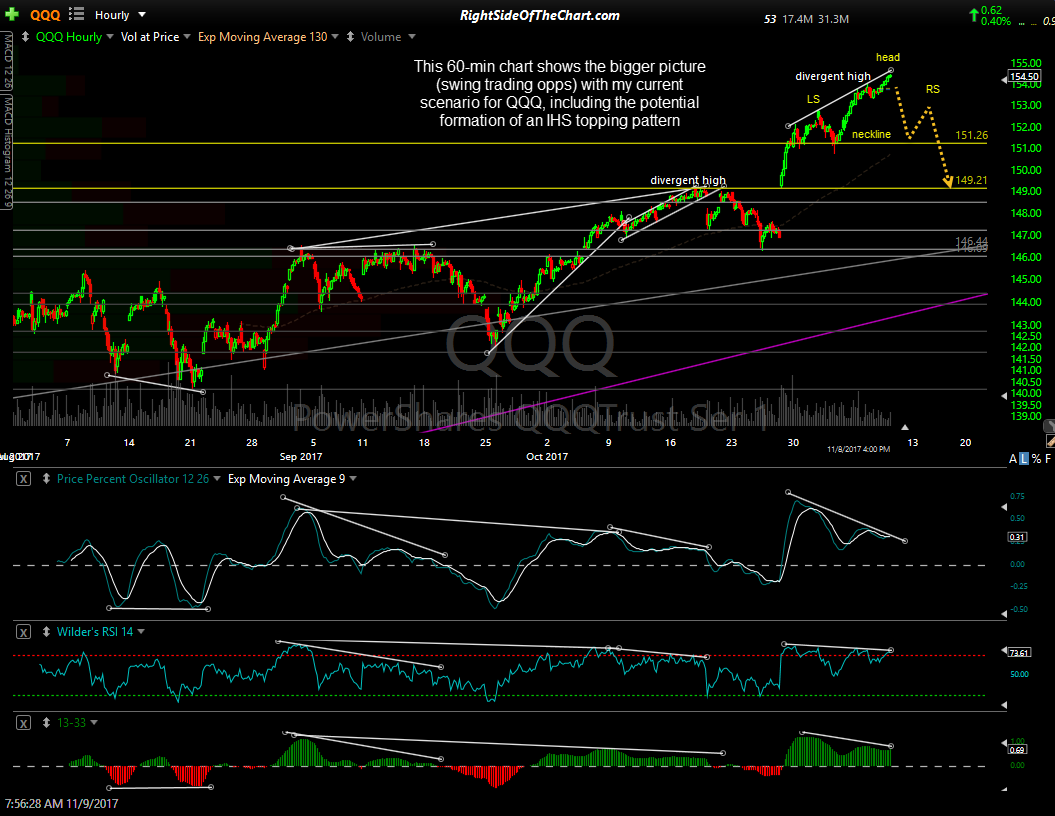

This 60-min chart shows the bigger picture (swing trading opportunities) with my current scenario for QQQ, including the potential formation of a Head & Shoulders topping pattern. Of course the H&S is only a possibility at this time as there is still a lot of work to be done. Ideally, QQQ would need to move back down to the neckline (151.25 area), ideally on increasing volume, bounce from there to roughly the 154 area & then move back down to the neckline once more in order to finalize the Right Shoulder.

Regardless of whether or not an H&S pattern forms on QQQ, the current negative divergences in place on virtually all time frames indicate that the momentum of the current trend has been waning with the odds of a correction elevated at this time. This 5-min chart shows some near-term support levels/targets in which a day trader or active swing trader could micro-manage a position in QQQ or /NQ. These charts reflect prices as of yesterday’s close. Currently, QQQ is trading at the bottom of that first target zone in pre-market with just over 1 hour & 15 minutes until the market opens.