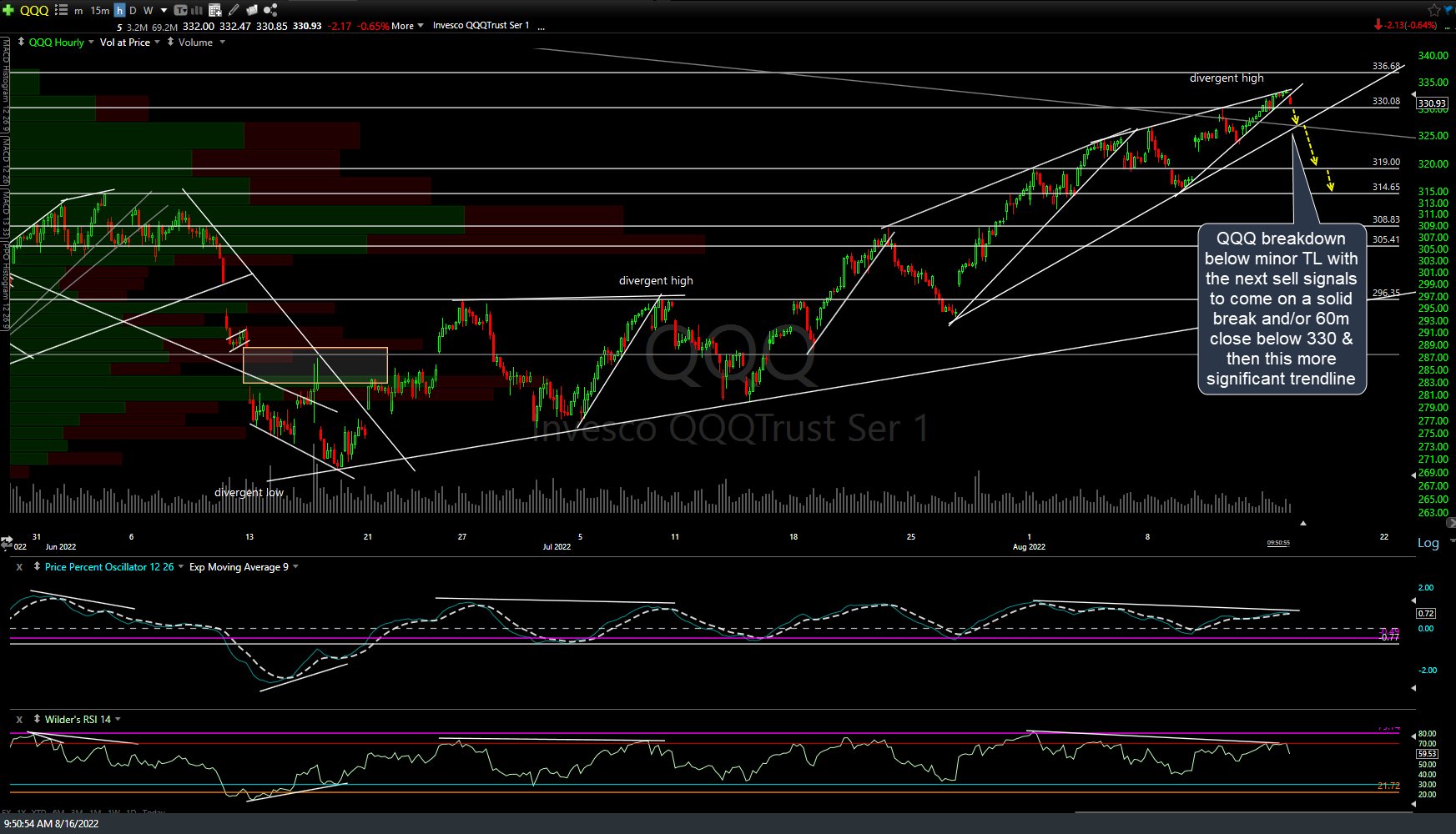

QQQ has hit my final “near-term” pullback target (uptrend line off the mid-June lows) in the pre-market session with the odds for a tradable bounce off or slightly below this level high to very high. However, I remain longer-term bearish & still suspect the June lows will be taken out with the next big sell signals to come on a solid break below the uptrend line & then the 296ish support. A couple of the previous (Aug 16th & Aug 18th) and the updated 60-minute charts below.

Additional evidence to support the case for a tradable bounce here is the fact that AAPL (Apple), the largest weighted component of both the Nasdaq 100 as well as the S&P 500 has also fallen to its primary uptrend line off the mid-June lows.

With that being said, I would be remiss not to point out the fact that /NQ (Nasdaq 100 futures) appears to have formed what appears to be a textbook bear flag continuation pattern on the 60-minute time frame although I suspect any breakdown below the flag will be capped by the uptrend line off the mid-June lows followed by a reversal off that level, thereby setting up a bear trap, should the flag break to the downside today.

Bottom line, it appears to me that the Nasdaq 100 is poised for a tradable bounce/reversal likely to start anywhere from where we are currently trading in the pre-market session (QQQ uptrend line) or down to but not much below the comparable trendline on /NQ and/or the key 296.35ish key support on QQQ (i.e.- the max. downside “initial swing” target I’ve highlighted in recent weeks), which comes in about 2% below current levels. As such, the R/R for existing short positions & especially new short positions is no longer very favorable at this time but will be once the next bounce appears to have run most or all of its course.