QQQ is starting to cracking below the trading range although SPY & IWM are still above the bottom of their respective ranges, at least as of now, so this could/would prove to be a whipsaw **IF** those other indices hold & rally off the bottom of their ranges (again). Otherwise, this sell signal on QQQ will be confirmed if/when the other indices break down. Plus, ideally you need to see a solid 60-minute candlestick close below support when trading on the 60-minute time frame to confirm a breakdown. Additionally, a move back inside the trading range could also provide an objective long entry for another bounce trade back to the top of the trading range (like yesterday) and/or trail up stops on that position as I think the odds are favorable that if QQQ reverses here soon & makes another run at the top of the trading range, it is likely to break above it. A big ‘IF” and first things first so watching these key support levels SPY, QQQ, IWM (and their respective futures) as solid breaks below on all will trigger a sell signal.

SPY still within the mid-late Dec trading range along with IWM as QQQ has started to undercut it’s comparable. range. Bullish if these hold, bearish if all 3 indexes break below their ranges.

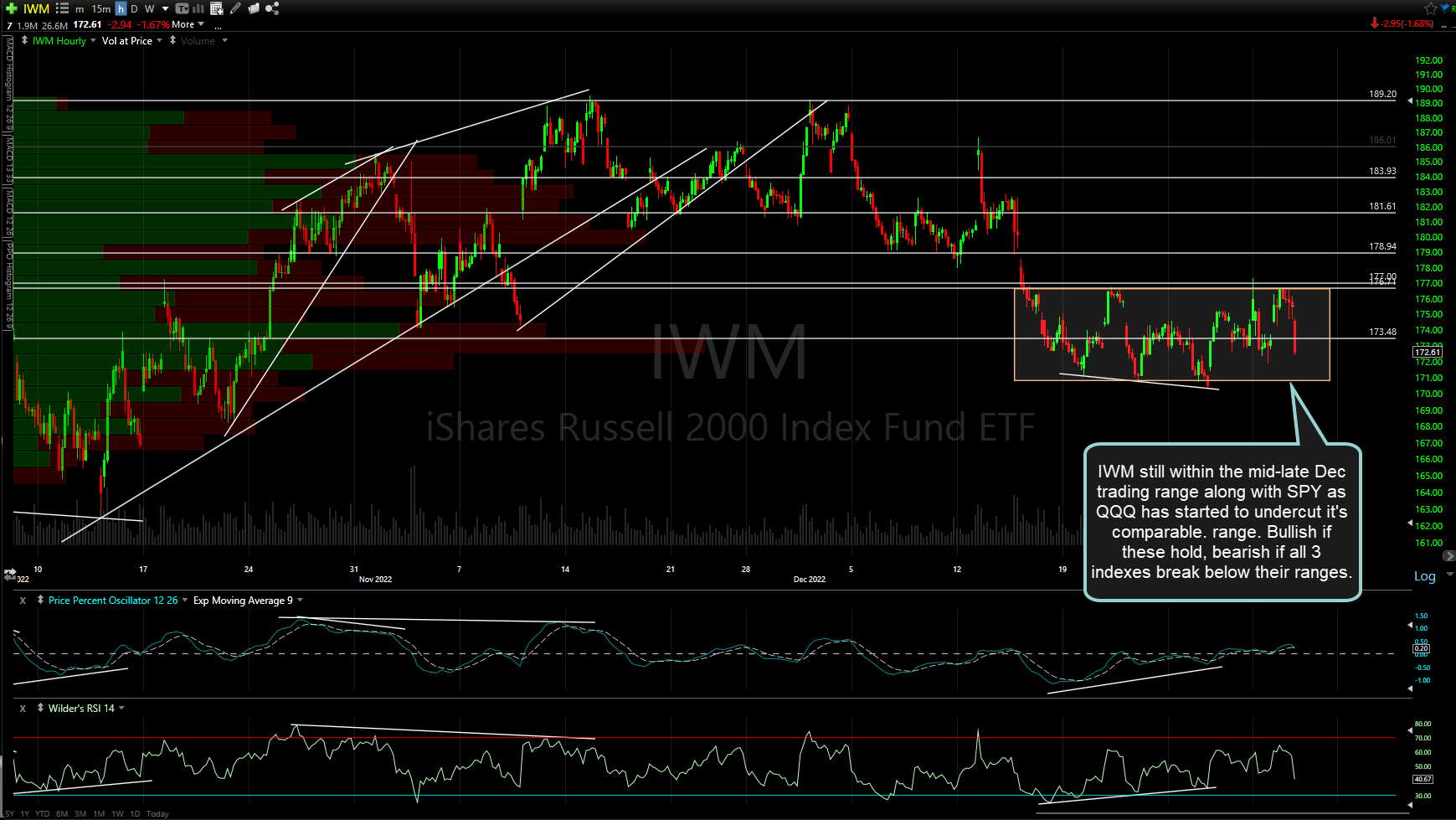

IWM still within the mid-late Dec trading range along with SPY as QQQ has started to undercut it’s comparable. range. Bullish if these hold, bearish if all 3 indexes break below their ranges.

Those short should be aware that should the stock indices successfully defend these support levels, especially following the (so far) dip below on QQQ, that has the potential to spark a powerful rally, especially if all 3 rally & break out above the tops of their ranges. While the odds might not be very high, should QQQ move back inside its range, that has the potential to spark a powerful short-covering rally as today’s breakdown almost certainly drew in a fresh bout of short selling. Likewise, solid breakdowns on all of the indices has the potential to trigger a powerful wave of selling & the next major leg down in the bear market. Stay nimble & follow the charts.