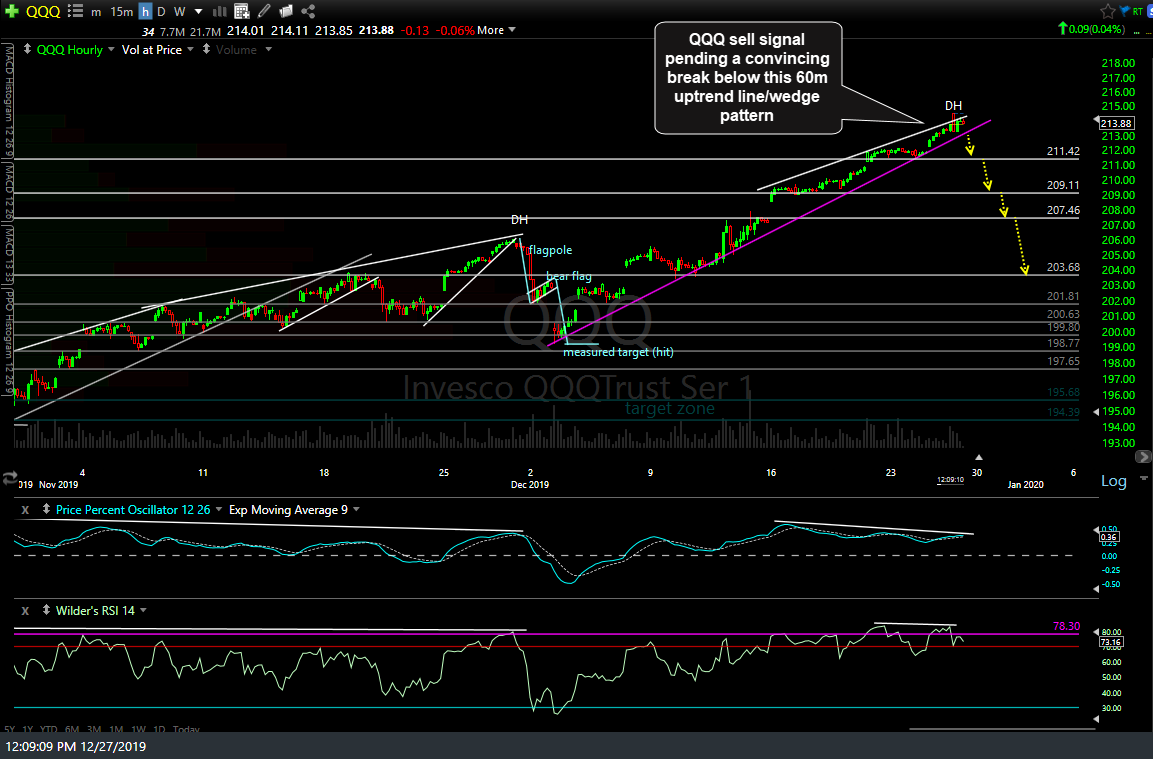

QQQ remains in an uptrend for now with a sell signal pending a convincing break below this 60-minute uptrend line/wedge pattern. Should a sell signal trigger soon, my minimum pullback target would be the top of the December 16th gap around 209 with a backfill of that gap (around 207.50) quite likely & potentially more, although we’ll just have to assess the charts once the next sell signals on QQQ as well as the other major stock indices come.

As one of the most widely held stocks, I figured that I would share some potential targets & pending sell signal on AAPL (Apple Inc.). A sell signal will come on a break below this 60-minute price channel with an additional sell signal & objective short entry (or stop-loss on a long position set somewhat below) to come on a break below 279. Should the 279 level get taken out with conviction, that would likely open the door to a drop to the 267.70 support level & quite possibly the larger downtrend line off the early August lows, which comes in just below.

The case for a deeper correction can also be made when viewing the more significant daily time frame. Apple just put in the latest of what I like to call “double-tap” extreme overbought readings, with two tags of the RSI 80 level in close proximity. As you can see, the previous two double-taps didn’t end so well. In the fall of 2018, AAPL didn’t immediately start correcting following the second tap of the RSI 80 level, instead making a marginal new high while gaining another 1.26% to put in a divergent high (negative divergence) a few weeks later before the 39% plunge started.

As of now, both the uptrends in both QQQ & AAPL remain solidly intact. If both continue to rally over the next week or more, the key levels & potential targets on these charts may need to be revised. For those wondering why I am posting potentially bearish setups on the leading index as well as the top components of the Nasdaq 100 and one of the best-performing stocks the answer is simple; stocks tend to fall much faster than they rise and once the next tradable pullback in the market comes, it will likely play out quickly as we get a rush for the exits on a trade that is becoming more & more crowded with divergences & overbought conditions reaching extremes. As such, I prefer to get the key levels, price targets & potential developments to watch for out to you in advance as personally, I don’t care much hindsight analysis or find it very useful unless sharing it as an educational example.