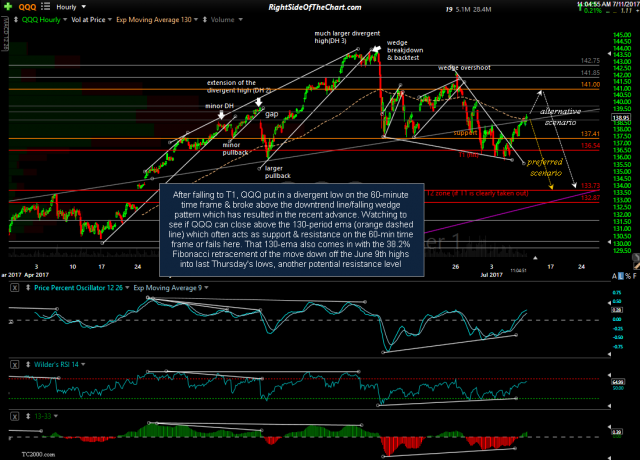

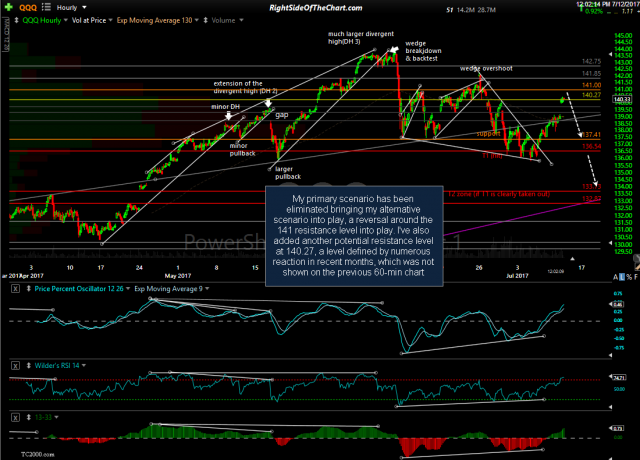

The primary scenario posted yesterday has been eliminated bringing my alternative scenario into play, a reversal around the 141 resistance level into play (2nd chart). I’ve also added another potential resistance level at 140.27, a level defined by numerous reactions in recent months, which was not shown on the previous 60-min chart posted yesterday (1st chart below). So far today QQQ has struggled with that level so watching for the possibility of a reversal here soon.

- QQQ 60-minute July 11th

- QQQ 60-minute July 12th