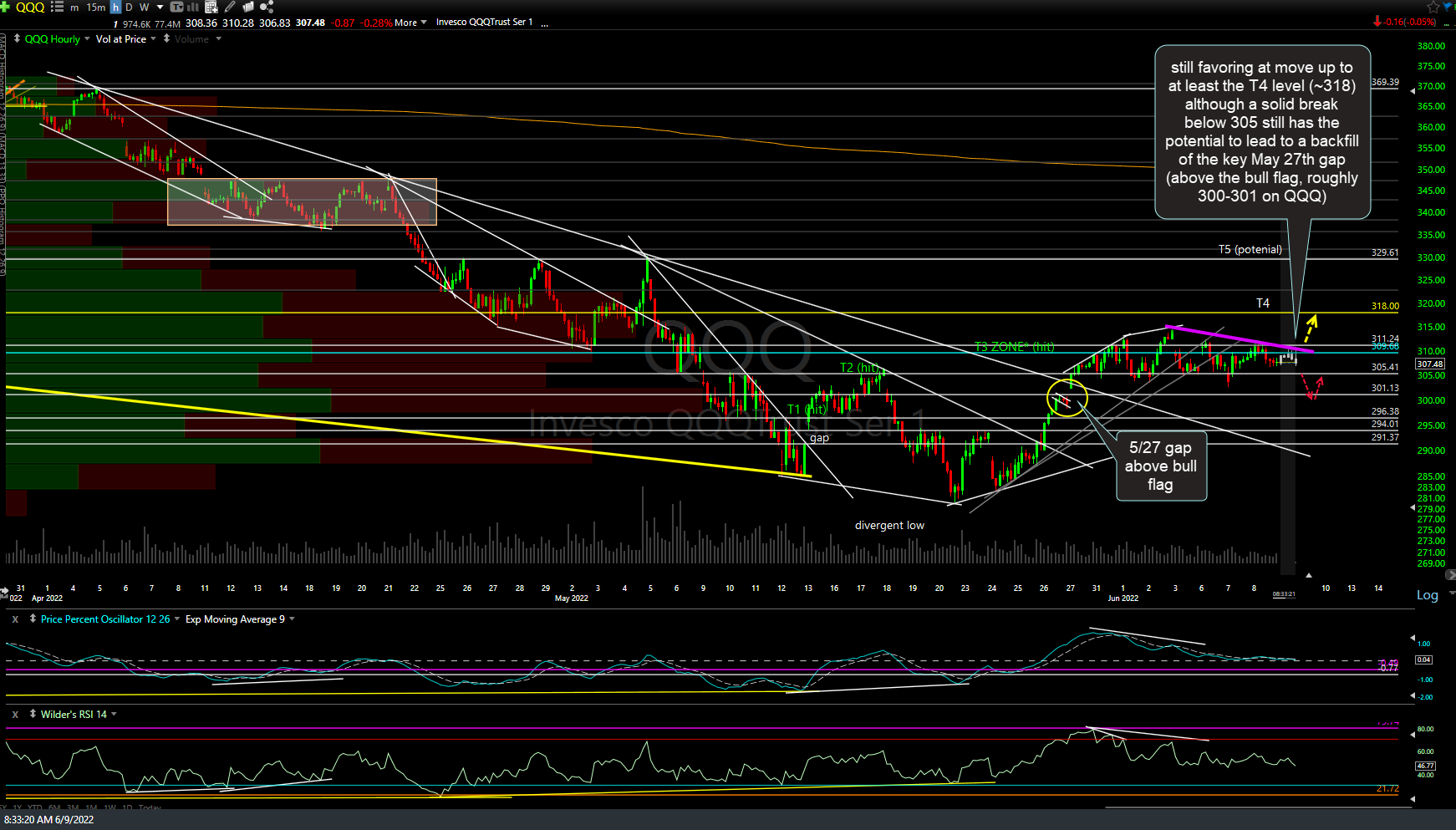

As of now, I’m still favoring a move up to at least the T4 level (~318) on the QQQ 60-minute chart although a solid break below 305 still has the potential to lead to backfill of the key May 27th gap (above the bull flag, roughly 300-301 on QQQ).

Zooming out to the daily chart, the Nasdaq 100 continues to consolidate within this trading range with a solid break above it likely to bring QQQ to at least the 318 area & quite possibly at high as the 337ish area.

Remember, the easy money was made on the initial leg off the key support levels & long-term swing targets that the major stock indexes, as well as market-leading stocks such as AMZN & NVDA, hit last month. The consolidation that we’ve seen over the past 7 or so trading sessions was perfectly normal & has simply been a reaction in the form of consolidation at the T3 (309-311-ish resistance zone) on QQQ as well as the rally into resistance & price targets on other key indexes, sectors, & stocks (such as AMZN hitting my initial preferred target, T2).

With that being said, the markets won’t consolidate/trade sideways forever & the longer they trade in this range, the more powerful the next trend is likely to be once it clearly breaks that way. While I continue to favor more upside in the coming weeks, a case can certainly be made (and will, in the next video) that this counter-trend bear market rally may have run its full course. Again, not my preferred scenario at this time although that can certainly change.

On an admin note, my son’s college orientation turned out to be surprisingly grueling/time-consuming for the parents with a packed schedule that left little-to-no free time for me to sit down & go over the charts and/or post any updates other than the PGJ China ETF trade idea I fired off on my phone during a presentation I was attending. I will follow up with that chart, including price targets shortly.

Upon returning home late last night, I found that one of my two main charting platforms is not working properly (my go-to for futures charts) so I need to pick back up where I left off with the tech support department last night so I’ll post or cover (via video) some updated futures charts asap.

As I continue to get caught up on the charts today, I will let you know asap if my outlook for anything has changed. As of now, I’m still (cautiously but not very) bullish on the equity markets, precious metals, & Bitcoin while still bearish on natural gas, crude oil, and the energy stocks (both oil & gas as well as coal) but still some work to be done to firm up the case for anything more than a starter (fractional) position there just yet.