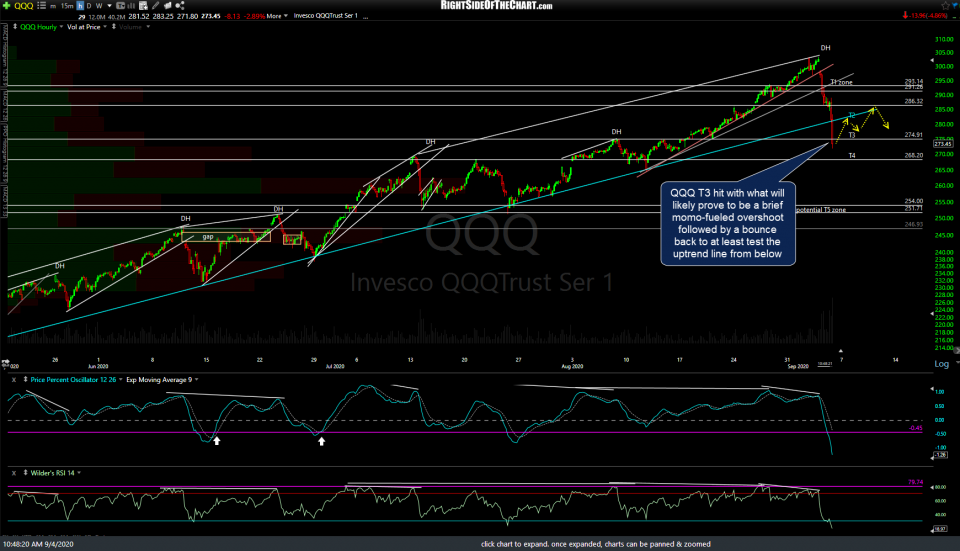

QQQ T3 hit with what will likely prove to be a brief momentum-fueled overshoot followed by a bounce back to at least test the uptrend line from below. Yesterday’s & today’s updated 60-minute charts below.

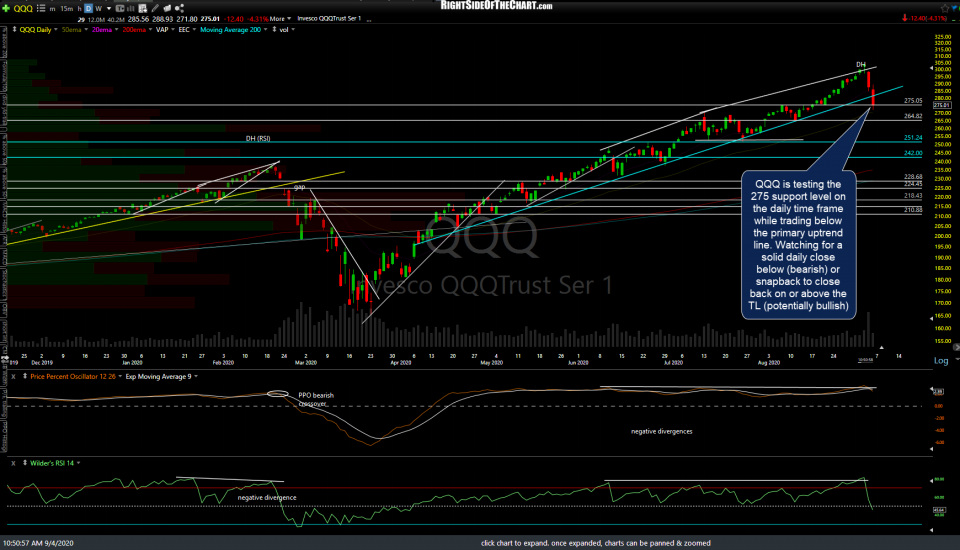

QQQ is testing the 275 support level on the daily time frame while trading below the primary uptrend line. Watching for a solid daily close below (bearish) or snapback to close back on or above the TL (potentially bullish).

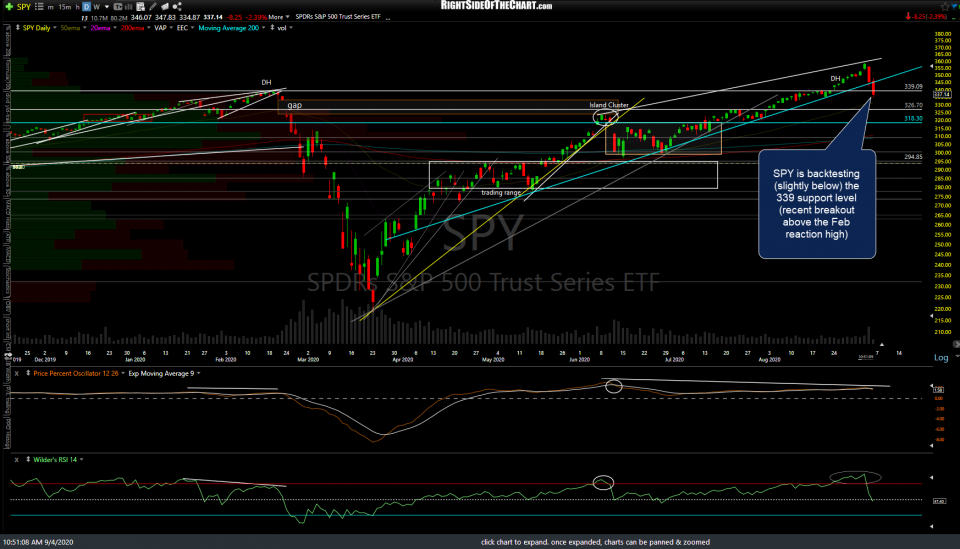

Likewise, SPY is backtesting (slightly below on what is likely a momentum-fueled overshoot) the 339 support level which is the recent breakout above the Feb reaction high.

/NQ 11274 target hit with what is likely a brief momo-fueled overshoot to the 11150 support level following the impulsive break below the bear flag & uptrend line support. Note the potential bullish divergences forming on the indicators below.

/ES 3357 target/support hit with positive divergences forming on the indicators below. Min. bounce target 3397.

Bottom line: As of now, we have some technical damage on the more significant daily charts of QQQ & SPY with both trading below their primary uptrend lines. Should both print solid red candles below at the end of the session (closing candles), that would be bearish while a rally back up to close on or above the trendlines would be bullish.

The day is still young so I’ll continue to post any significant developments asap. As of now, the odds favor a bounce up to at least those minimum targets with the potential (but still unconfirmed) divergences on the 60-minute futures worth monitoring as those could indicate a much larger bounce if confirmed via bullish crossovers on the PPO soon. I’ll also be curious to see how the candlesticks on the weekly charts are finalized at 4pm today as that might also provide some clues as to where the market goes from here.

Updates on gold, silver, & the US Dollar as well as the coal stocks to follow asap.