As I stated in the video the other day, I suspect that the current TLT (30-yr Treasury bond ETF) isn’t going to make it to T3 before another tradable pullback as the divergences continue to build. Sell signal to come on a break below this 60-minute wedge.

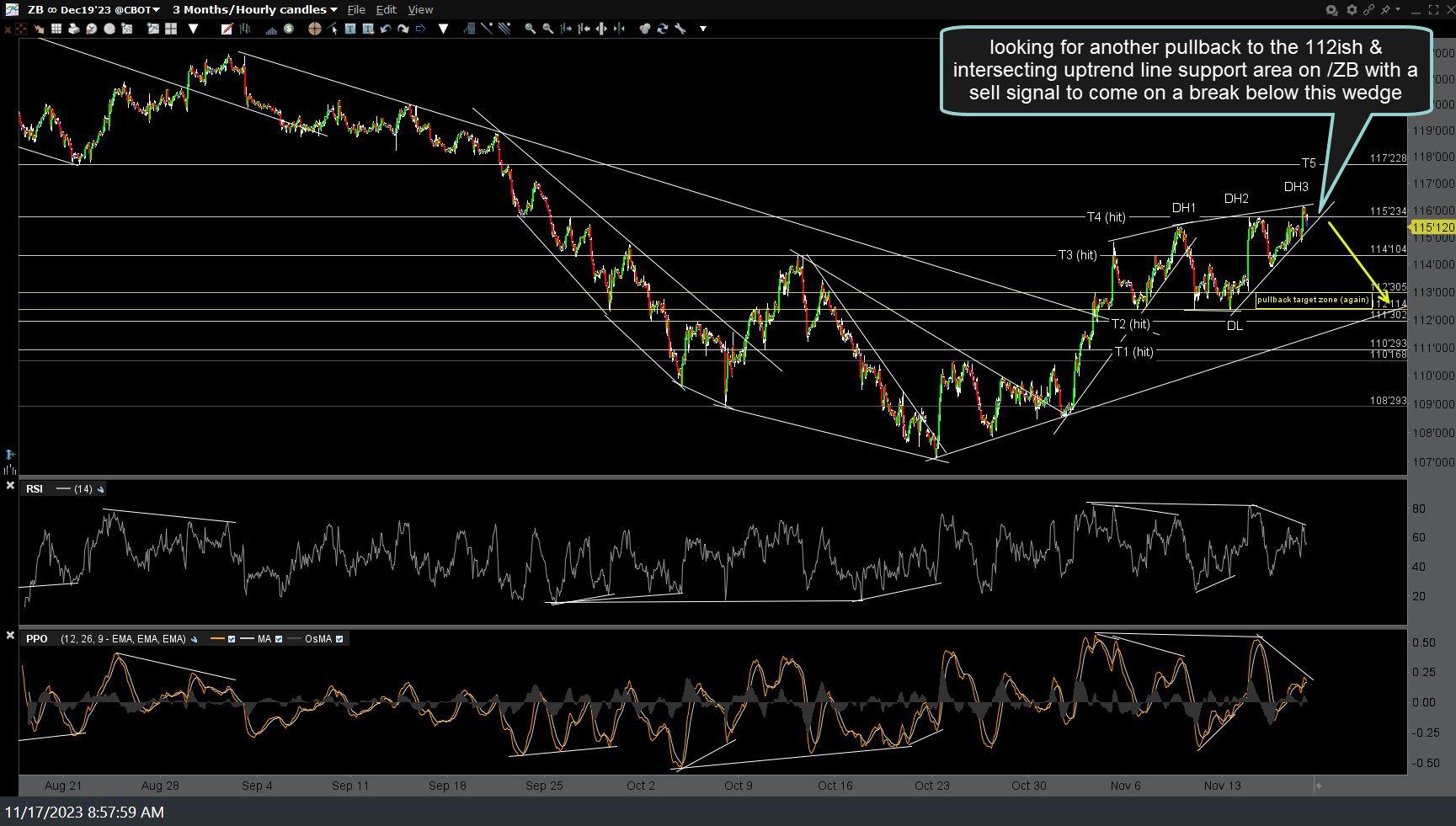

For those using futures, I’m looking for another pullback to the 112ish & intersecting uptrend line support area on /ZB (30-yr Treasury bond futures) with a sell signal to come on a break below this 60-minute bearish rising wedge.

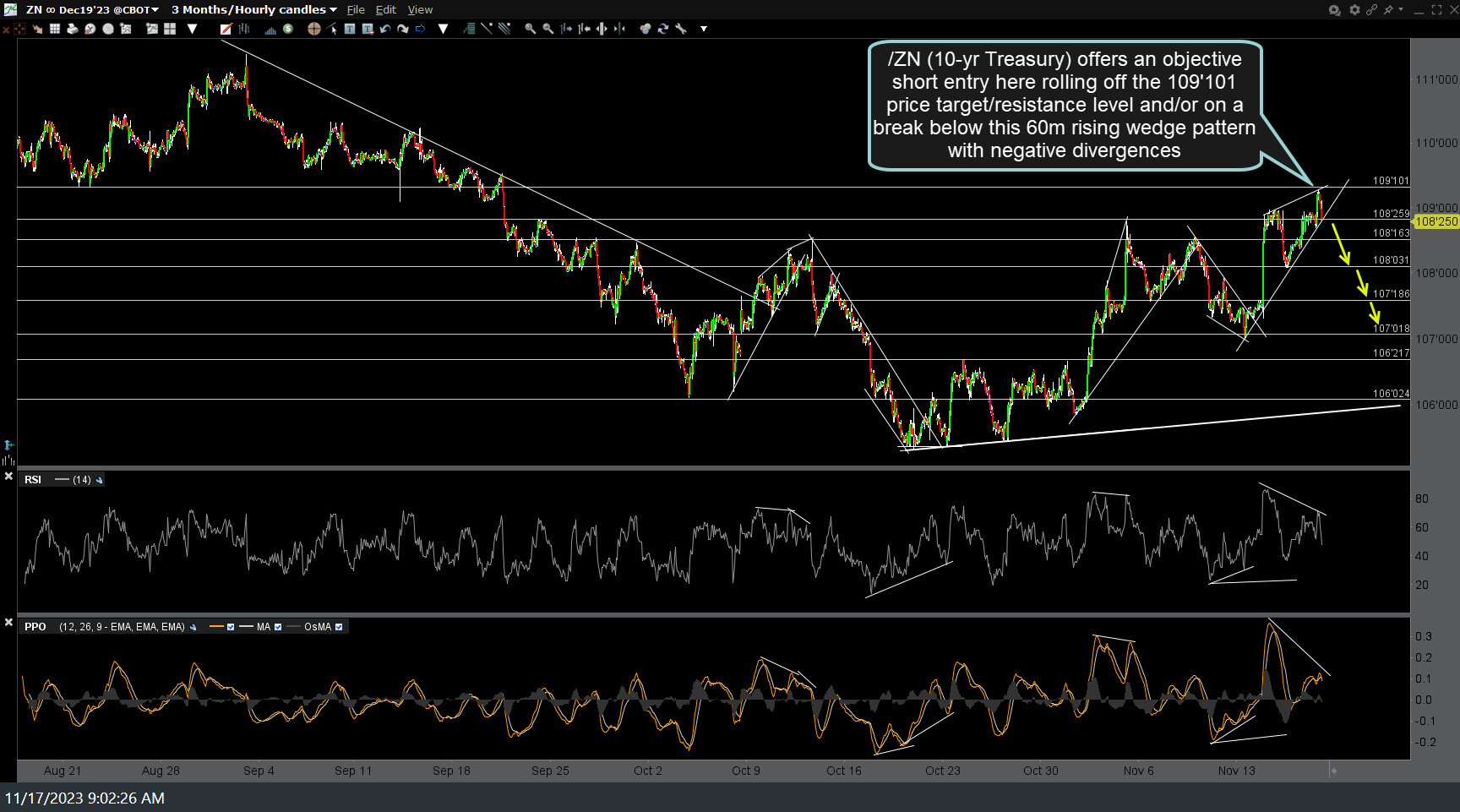

Likewise, /ZN (10-yr Treasury bond futures contract) offers an objective short entry here rolling off the 109’101 price target/resistance level and/or on a break below this 60m rising wedge pattern with negative divergences.

It should go without saying but if Treasuries do correct soon, that would most likely take the stock market down as those negative divergences that I recently highlighted on the major stock indices also play out.