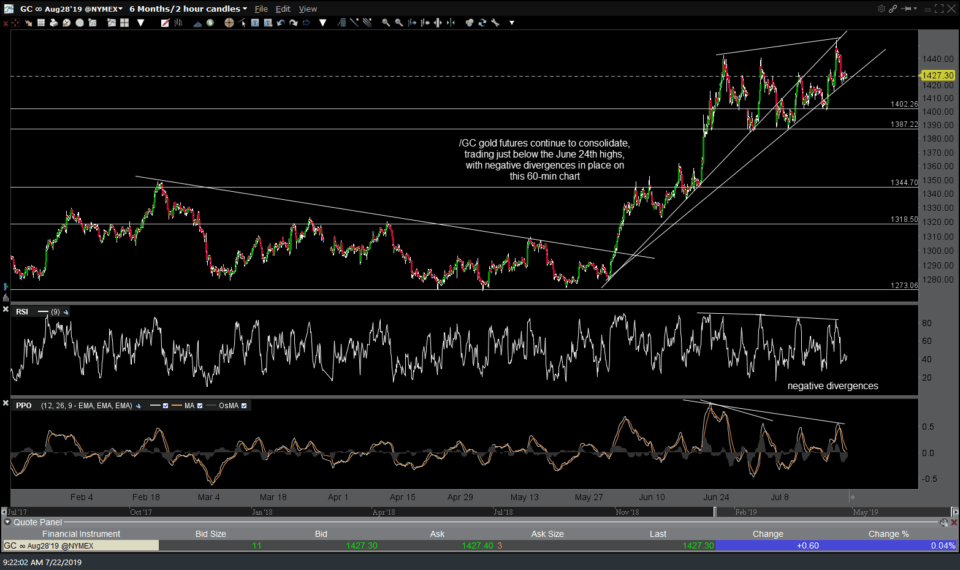

/GC gold futures continue to consolidate, trading just below the June 24th highs, with negative divergences in place on the 60-min chart below.

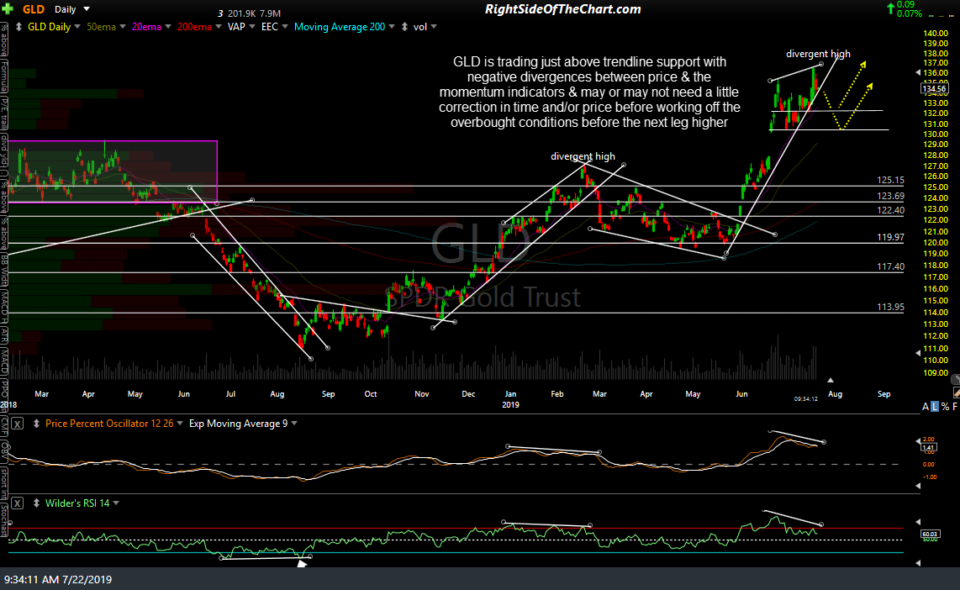

Likewise, GLD is testing uptrend line support on the daily chart with negative divergences on the PPO & RSI on that time frame as well. With the recent trend as well as the intermediate & longer-term outlook for gold & silver clearly bullish, I don’t care to short the PM’s for anything more than the occasional quick tactical pullback trades, if & when the intraday charts confirm. As far a swing & trend trading, it still appears that gold & silver are most likely just consolidation to work off the overbought conditions before the next leg higher although hard to say when that will be at this point.

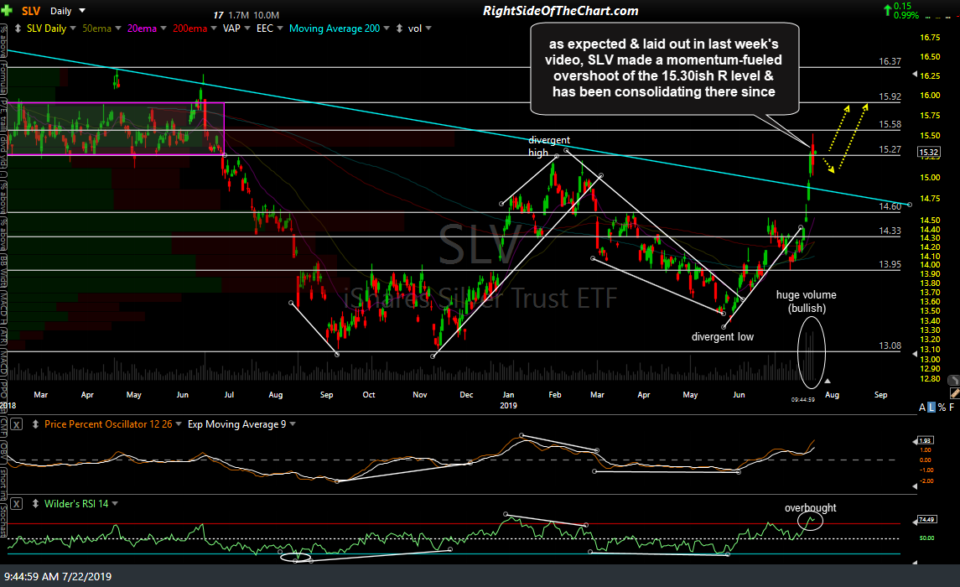

As was expected & laid out in last week’s video, SLV made a momentum-fueled overshoot of the 15.30ish R level on the daily chart & has been consolidating there since.

/SI silver futures continue to consolidate below the 16.475 resistance, working off the overbought conditions on the daily (first) chart below while /SI is testing the 16.30ish + minor uptrend line support following last week’s divergent high, 60-min channel breakdown & reversal off the 16.06ish support level.

- SI daily July 22nd

- SI 60-min July 22nd

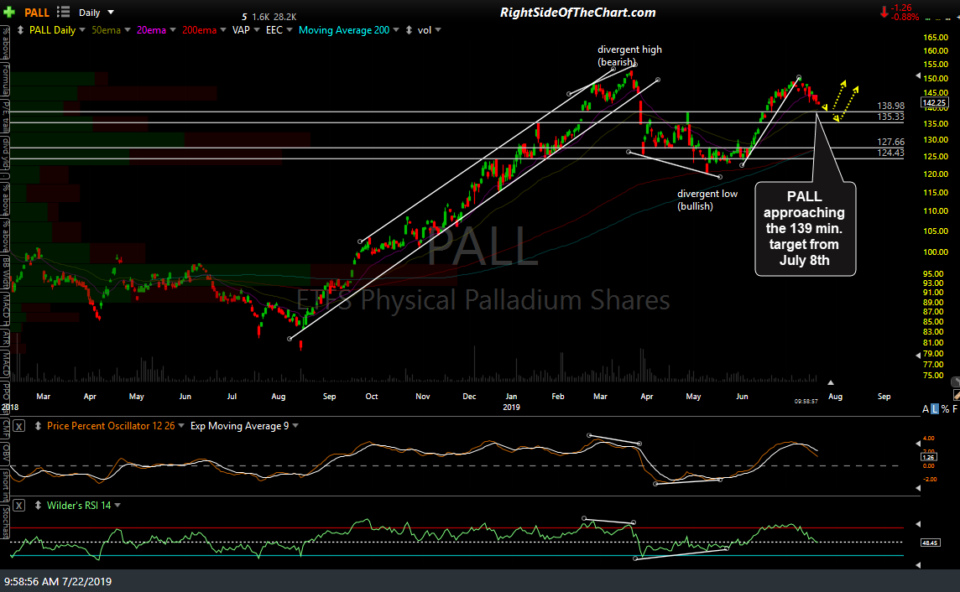

So far, /PA (palladium futures) has played out for the expected correction since the last update on July 11th although there are now some bullish divergences forming that have the potential to spark a rally before my 1455ish target is hit. Previous & updated 60-minute charts below.

- PA 60-min July 11th

- PA 60-min July 22nd

PALL (palladium ETF) is also approaching the 139 minimum price target posted back on July 8th (first chart below).

- PALL daily July 22nd

- PALL daily July 8th close