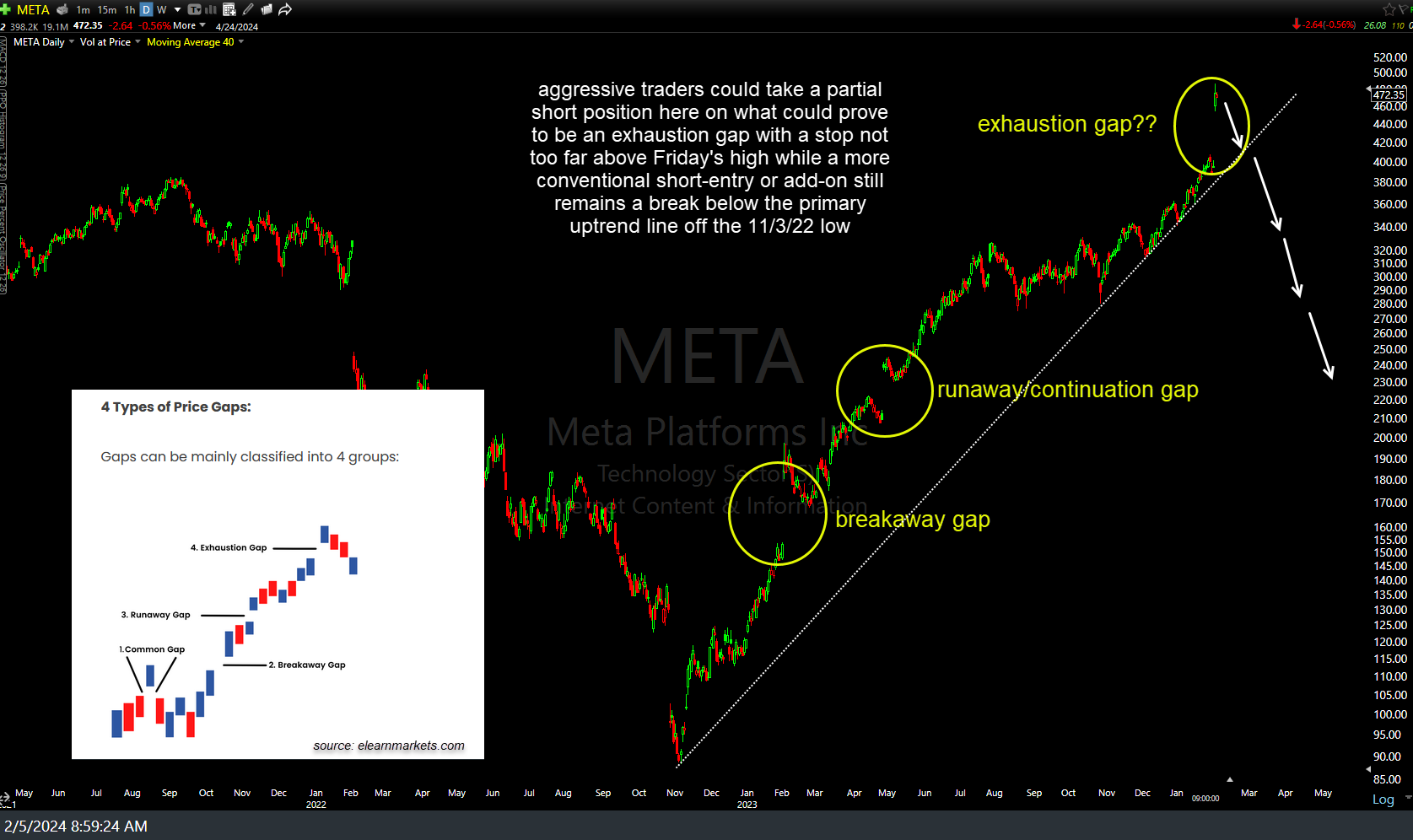

On watch for what could prove to be a exhaustion gap on META (via a reversal & backfill of the gap in the coming days/weeks or even drop below Friday’s low & into the gap, for a somewhat aggressive entry). A quick google search of the term ‘types of gaps’, especially including the terms: common, breakaway, continuation, & exhaustion will provide detailed explanation on how to recognize & trade each.

Aggressive traders could take a partial short position here on what could prove to be an exhaustion gap with a stop not too far above Friday’s high while a more conventional short-entry or add-on still remains a break below the primary uptrend line off the 11/3/22 low.

On a somewhat related note, the recent divergence between the stock market, or more so mainly the mega-tech top-heavy Nasdaq 100 and EUR/USD continues, with EUR/USD starting to crack below the primary uptrend line with a solid daily close below to increase the odds the breakdown will ‘stick’.

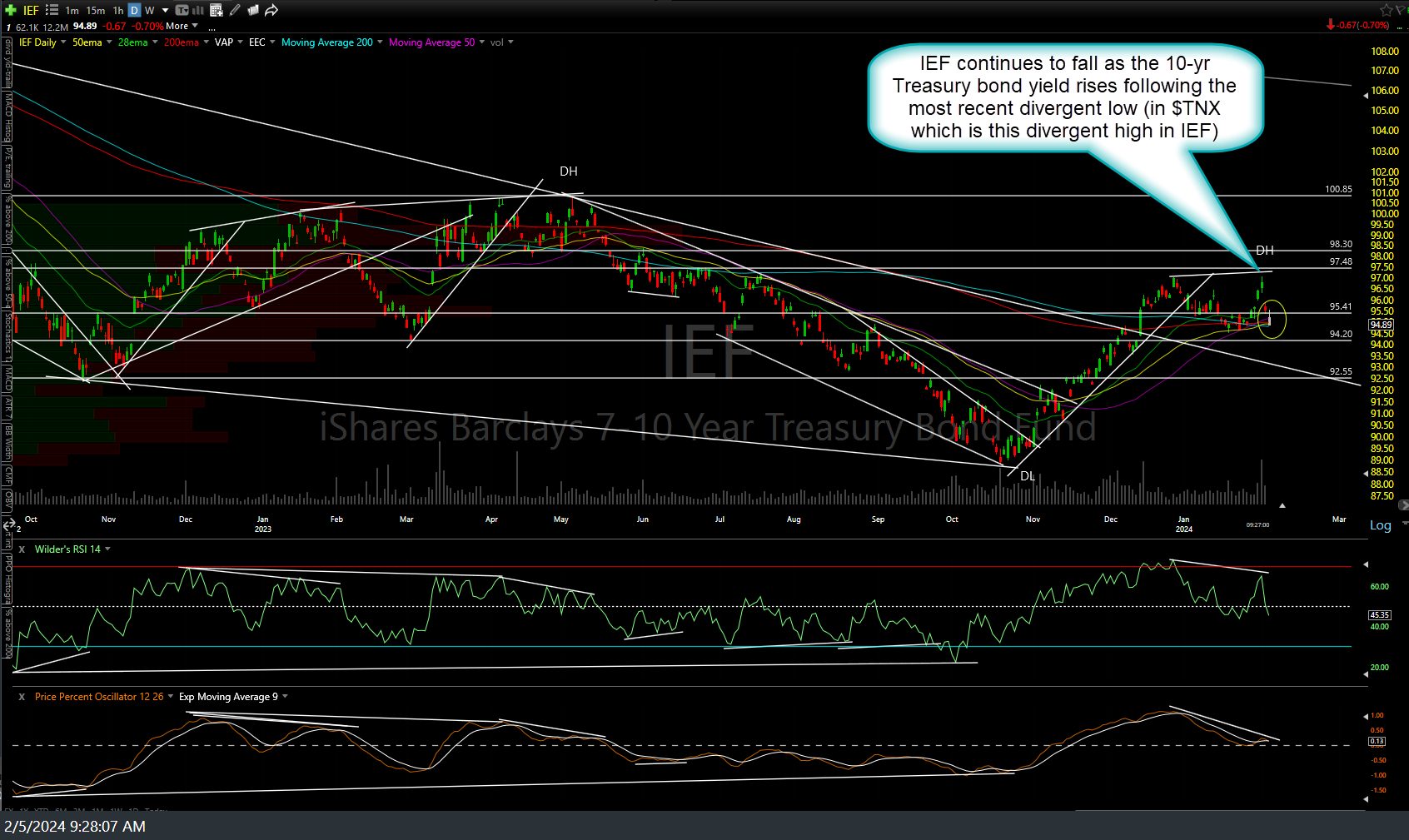

The recent disconnect between the positive correlation on IEF (7-10 yr Treasury bond fund) and the stock market also warrants monitoring as IEF continues to fall with the 10-yr Treasury bond yield rising, following the most recent divergent low (in $TNX which is this divergent high in IEF).