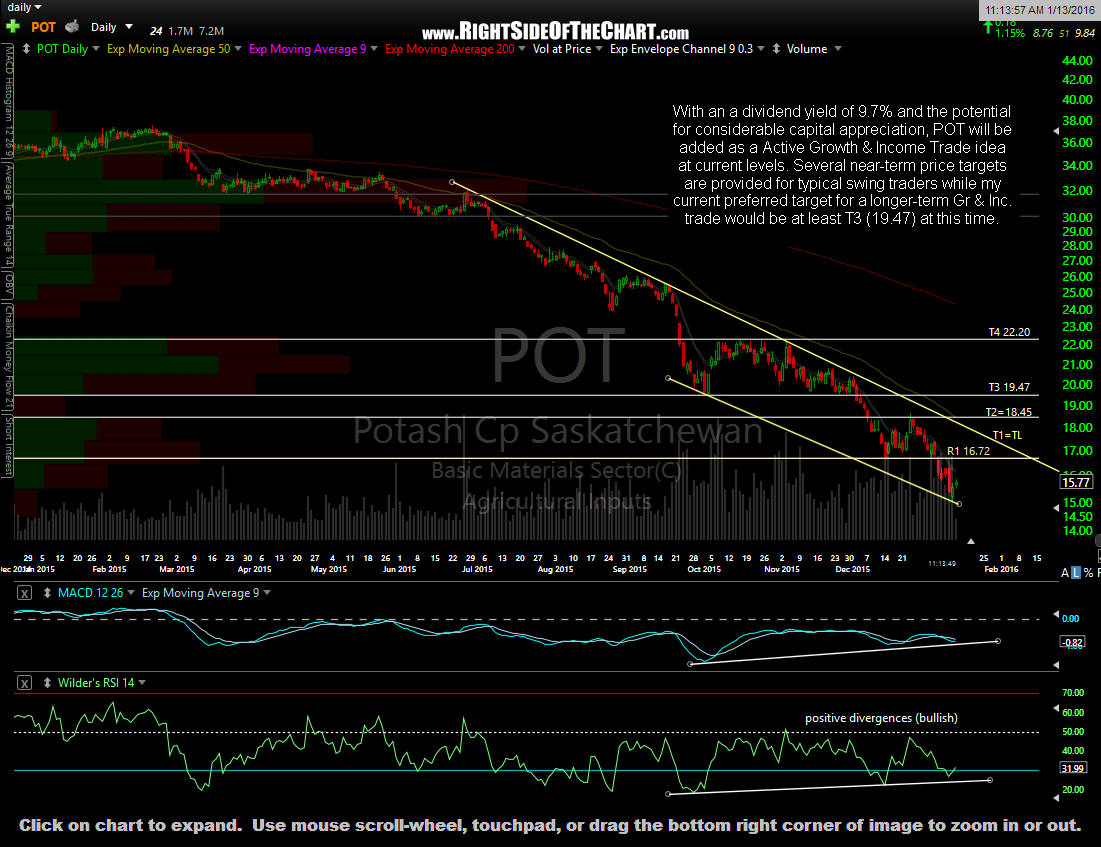

With an a current dividend yield of 9.7% and the potential for considerable capital appreciation, POT (Potash Corp.) will be added as a Active Growth & Income Trade idea at current levels. Several near-term price targets are provided for typical swing traders while my current preferred target for a longer-term Gr & Inc. trade would be at least T3 (19.47) at this time.

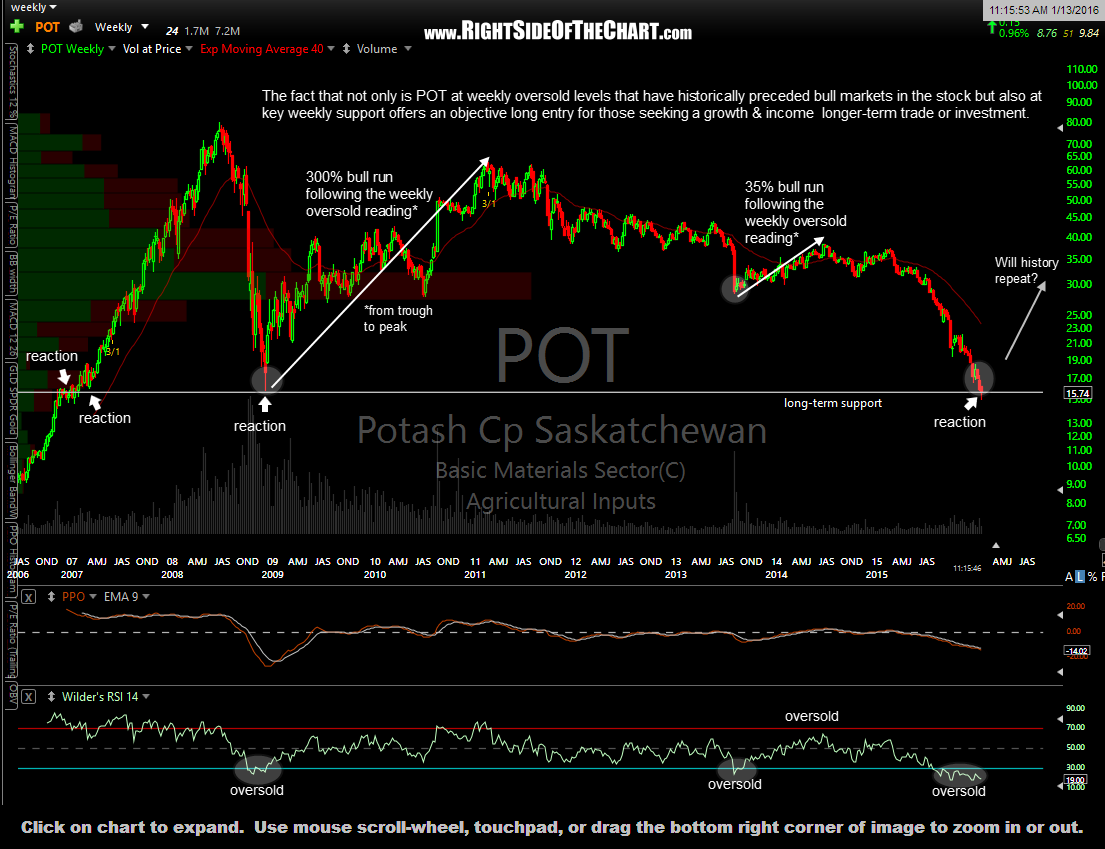

Although I believe that a decent fundamental case can be made for an investment in POT, as with all trade ideas on RSOTC, the primary reason for entering this trade is due to the fact that the stock offers an objective entry based off the charts (technical analysis). As this 1o-year weekly chart below highlights, the recent bear market in commodities, including agricultural related companies such as POT (a fertilizer producer) has dragged POT down to rarely seen weekly oversold levels, which have historically preceded major bull markets in this stock. While oversold is not a stand-alone reason, especially as a timing indicator, to buy a stock, a case for a long entry here can also be made as POT is currently trading at long-term support (weekly chart) with positive (bullish) divergences in place on the daily time frame.

The current final target, T4, is 22.20 with a suggested stop on a weekly close below 14.90 (about 90¢ below current levels), offering an very attractive R/R of roughly 7:1. Swing traders targeting any of the earlier price targets might consider a more aggressive stop, using an R/R of 3:1 or better.

Please note that Right Side Of The Chart will be rolling out a subscription service soon. Some content will remain open to the public without requiring registration on the site while some content, such as all trade ideas, select analysis on the broad markets, commodities, precious metals, etc.. will only be accessible to paid subscribers. Additional details will follow soon but over the next few week or so, we will be completing the final stages of beta-testing the membership software in which some of the posts published going forward will only require a registered user to be logged in to view the entire content of the post. The site still offers free registration now, which allows access to the Trading Room where additional trade ideas, market commentary, articles, etc… are posted throughout the day.