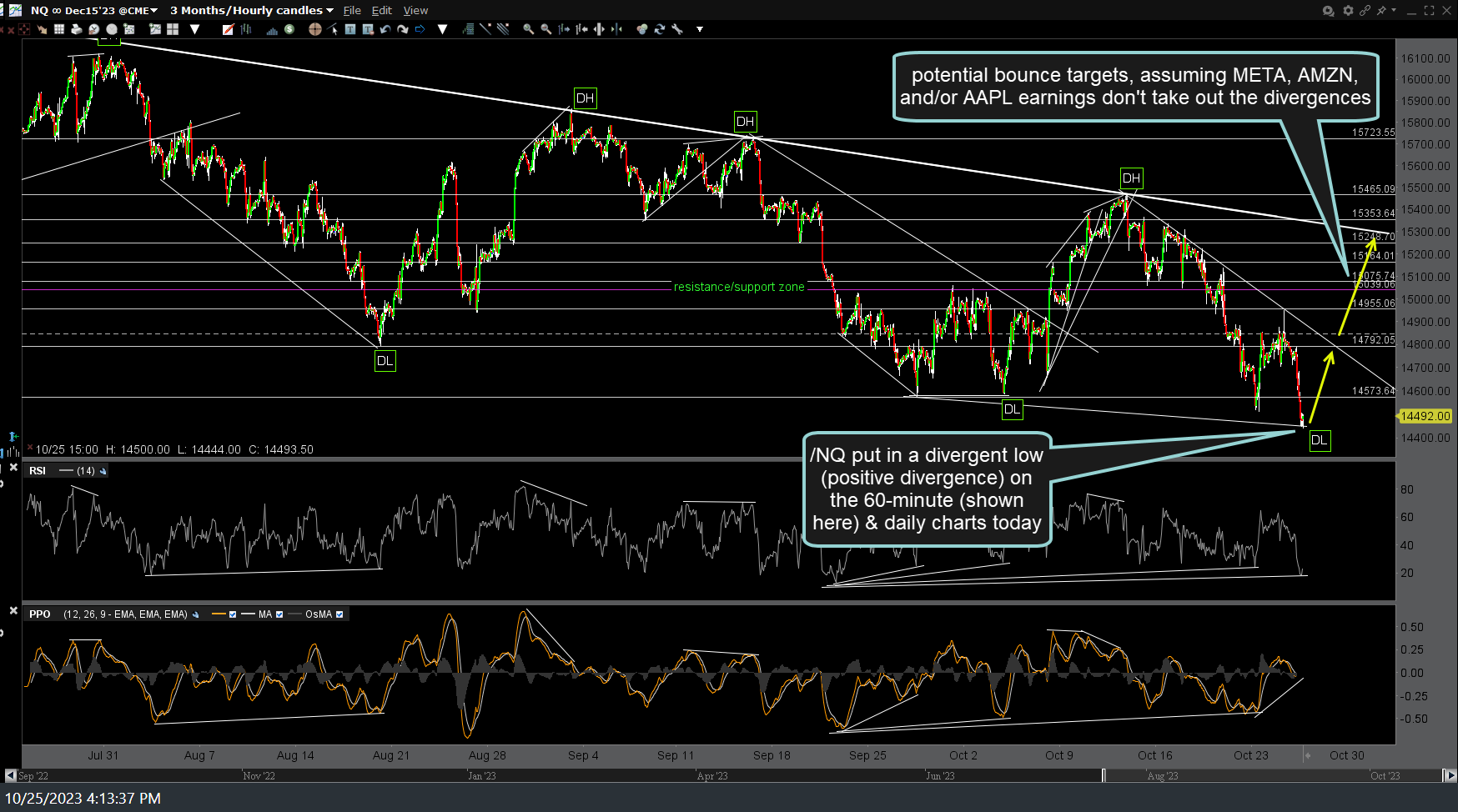

QQQ (Nasdaq 100 ETF) put in a divergent low (positive divergence) on the 60-minute & daily (shown here) charts today but printed a daily close below the key 354ish support. If QQQ can make a solid recovery back above 355 this week, that would likely spark a tradable rally; if not, T2 & the 200-day MA’s are the next downside targets. While I can make a decent case for both bulls & bears regarding the near-term direction of the market and don’t have a very strong conviction (or positioning) either way, until & unless those positive divergences are taken out, I think the odds for a tradable rally, especially if 355 is regained tomorrow, are decent. Not great, but decent.

Then again, if QQQ can’t snap-back & hold above 355 soon, it could be a quick ride down to test the key 200-day moving averages below. Bottom line: I don’t think the R/R before being aggressively long or short if very favorable at this time. 60-minute & daily charts of /NQ & QQQ below.

Again, I will be away from my desk tomorrow morning so this will be the final update until late-morning/early afternoon tomorrow.