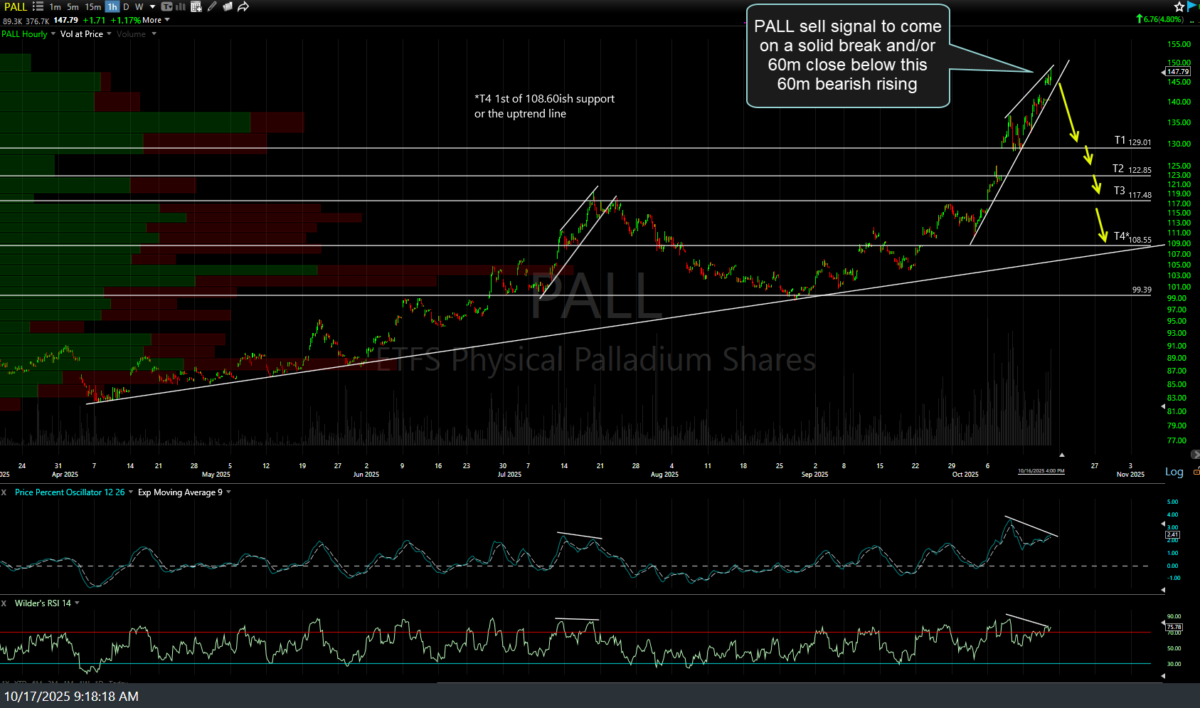

As I stated, I would follow up with a swing trade idea on palladium in yesterday’s /PA & PPLT (platinum) swing trade set-up, PALL (palladium ETF) sell signal to come on a solid break and/or 60-minute close below this 60-minute bearish rising wedge pattern.

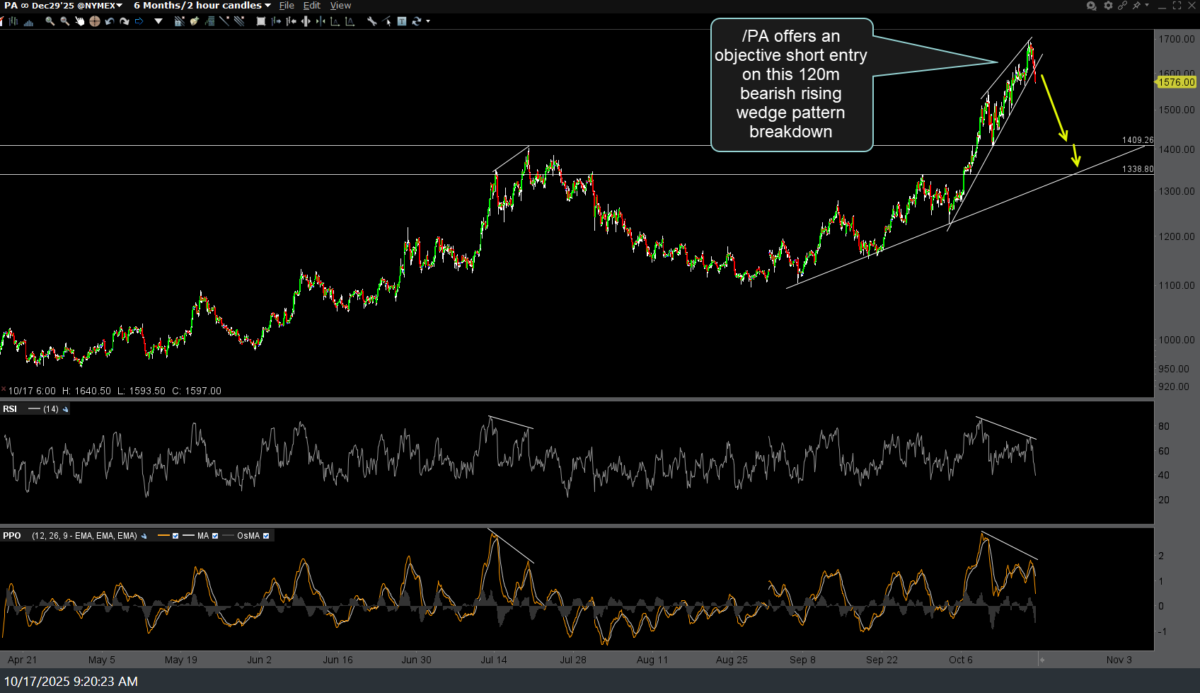

While futures traders could wait for a breakdown below that rising wedge on PALL after the opening bell today, /PA offers an objective short entry here on this 120-minute bearish rising wedge pattern breakdown.

Although gold remains above the primary uptrend line for now, /SI (silver futures) and SLV (silver ETF) have broken down below comparable bearish rising wedge patterns on the 60-minute charts in pre-market today & also offer objective short entries here or after the opening bell, should those breakdowns stick.