Member @dazi requested an update on NVDA. Last week, in this post (NVDA Setting Up for a Potential Trend Reversal), the case for a top & significant trend reversal in NVIDIA was made. Here’s a quick review of the longer-term outlook as well as some of the recent developments on the intraday (60-minute) time frame:

10-year weekly chart: NVDA is at overbought extremes in both scope (recently above 88 on the RSI) as well as duration (RSI above 70 for nearly 8 months). If the historical returns following the previous overbought readings that were much less severe are any indication, NVDA is poised for one heck of a correction in the coming months+. A break of this steep uptrend line will provide an objective add-on to an existing or new short position. (note: all charts will expand if clicked on & can be further zoomed & panned using a mouse scroll-wheel, touch-pad or dragging the lower right-hand corner of the chart once expanded).

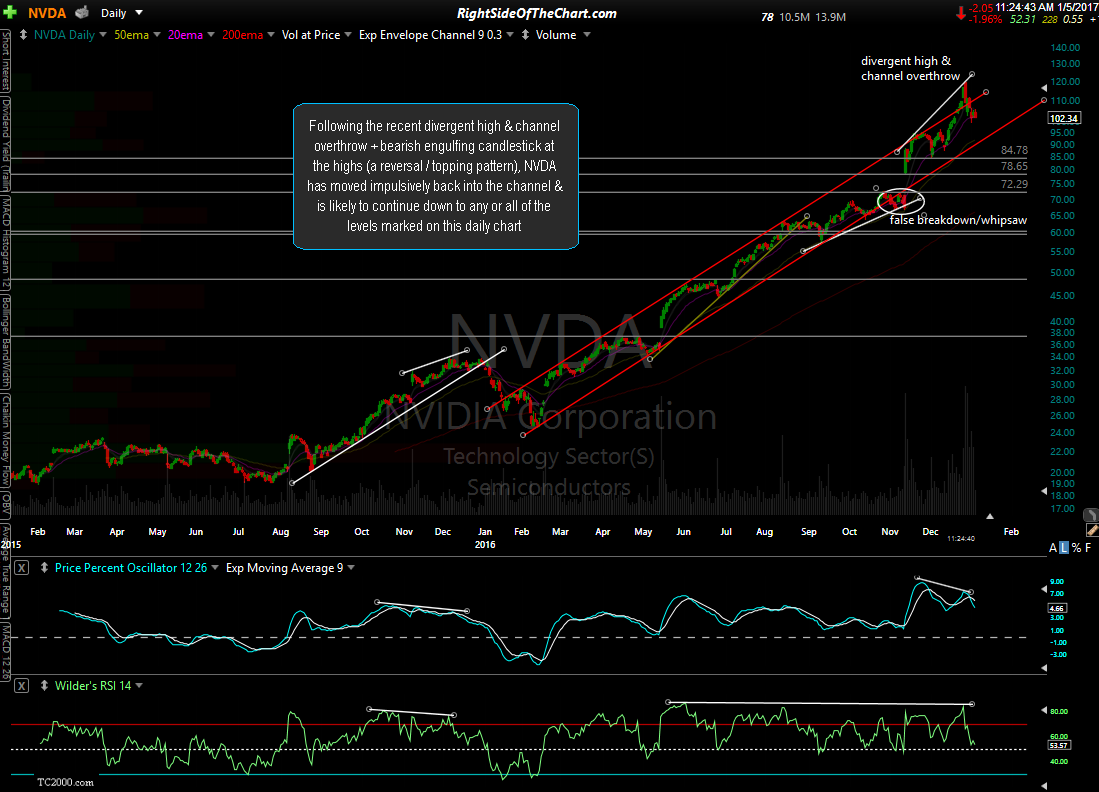

2-year daily chart: Following the recent divergent high & channel overthrow + bearish engulfing candlestick at the highs (a reversal / topping pattern), NVDA has moved impulsively back into the channel & is likely to continue down to any or all of the levels marked on this daily chart.