/NQ (Nasdaq 100 futures) cut thru the previously posted 60-minute support on the big 10am ISM miss but coming up on even better support around 19114 on this 15-minute chart.. an objective add-on or new long entry for active traders looking to game a bounce before AMZN & AAPL report tonight.

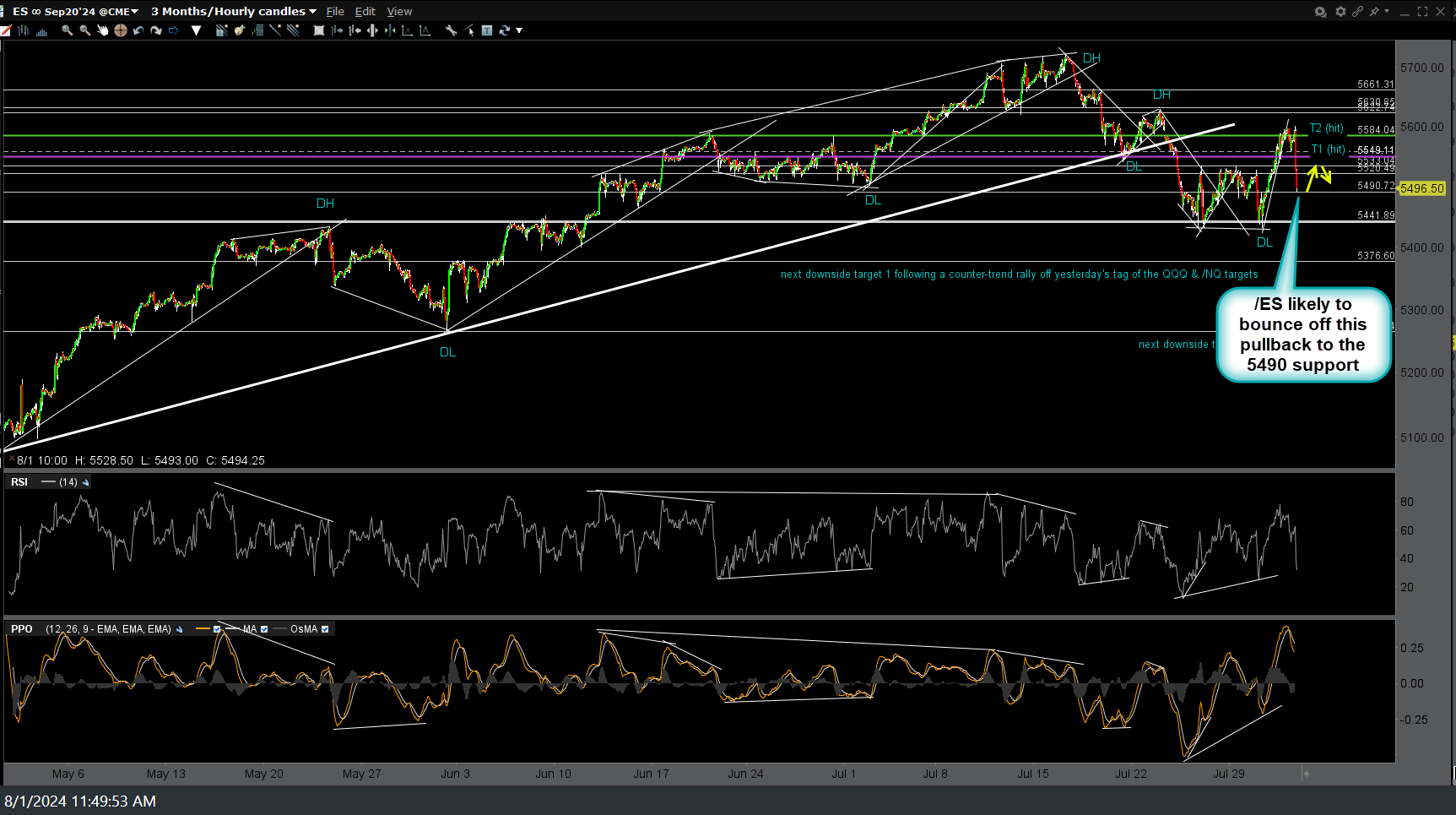

Likewise, /ES S&P 500 futures (or SPY) is likely to bounce off this pullback to the 5490 support for active traders that want to game a quick bounce. Min- max bounce targets shown at arrow breaks on this 60-minute chart.

Regarding today’s stock market dump that followed the 10 am ISM Manufacturing Report, which came in at 46.8, well below the consensus of 48.8, we’re finally starting to see that change of perception that I’ve been calling for where, up until recently, weak economic data typically resulted in a positive reaction from the stock market, as it helped to support the case for future rate cuts. Whereas now, as was inevitable, that whole “be careful of what you wish for thing” I warned of is starting to permeate through the psychology of investors who are starting to realize that rate cuts only juice the market if/when the underlying economic fundamentals are strong (i.e.- economy is in expansion/growth phase), not contraction/recession.

Regardless, the aforementioned paradigm shift will likely continue to evolve in the coming months as the economic indicators continue to roll over but these short-term knee jerk market reactions (like today’s swift dip or yesterday’s big rip) often provide objective & quite profitable short-term trading opps for active & nimble traders. Longer-term swing & trend traders as well as investors might opt to remain focused on the trend of the macro/economic indicators and the longer-term technicals (i.e.- the developments on the daily, weekly, & monthly charts, not so much the short-term intraday charts).