/NQ (Nasdaq 100 futures) is currently testing the bottom of the price channel (trendline support) following the most recent divergent high with a sell signal still pending a solid break & 60-minute close below although the odds for at least a minor bounce off this tag of support first are decent although I wouldn’t bet on another run back to the top of the channel this time around as the price channel is getting very long in the tooth and the weakness in the semiconductors today may soon spill over into the larger tech/FAAMG stocks. Just looking for a quick bounce trade on /NQ which just hit 9160, then out before the end of the futures trading session today while taking home a small starter swing short position with plans to add, depending on how the FAAMGs start to trade after earnings next week.

Likewise, QQQ is testing the BOD(benefit-of-the-doubt) trendline/bottom of price channel but yet to print a solid 60m close below it in order to trigger a sell signal. With today being Friday, even if we get a relatively small 60m close below, that may still prove to be a whipsaw, especially with the FAAMG earnings starting next week. 60-minute chart below.

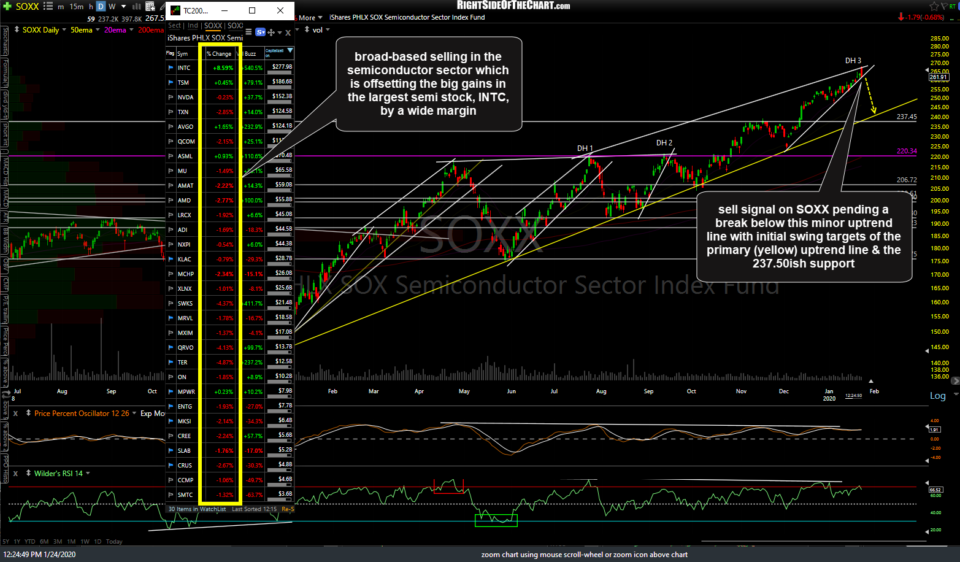

We have broad-based selling in the semiconductor sector today which is offsetting the big gains in the largest semi stock, INTC, by a wide margin. Currently, all but 5 of the 30 components of SOXX (PHLX SOX Semiconductor Sector ETF) are trading red. A sell signal on SOXX is still pending a break below this minor uptrend line with initial swing targets of the primary (yellow) uptrend line & the 237.50ish support. Daily chart below.