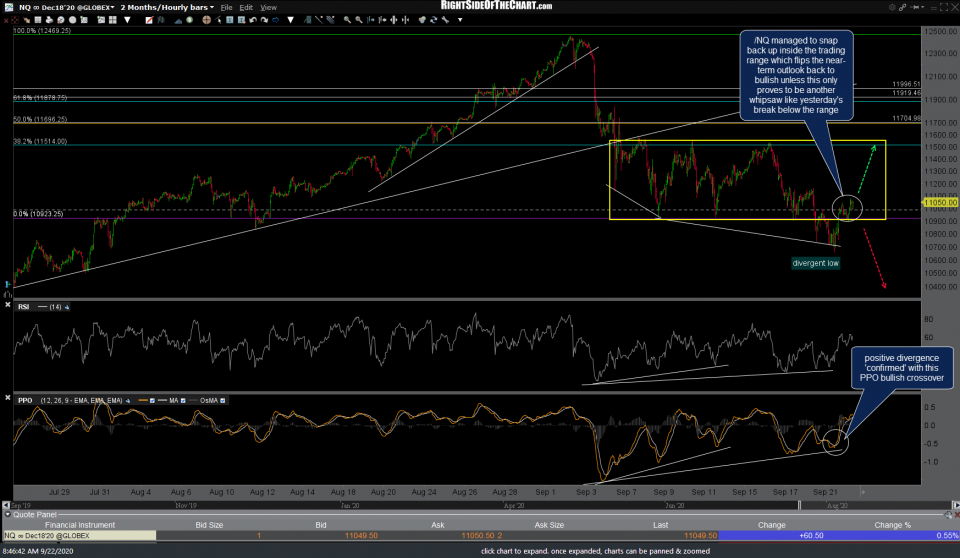

Both QQQ & /NQ managed to snap back up inside the trading range which flips the near-term outlook back to bullish until & unless this only proves to be another whipsaw like yesterday’s break below the range. In addition to yesterday’s whipsaw/false breakdown, the positive divergence was ‘confirmed’ with a bullish crossover on the PPO. 60-minute charts below.

As I had mentioned yesterday, I had to go offline after the video was posted due to remodeling inside my house. Turns out the cable line was cut so I’m without high-speed internet until tomorrow morning. I’ll be able to check the market & post some chart by tethering off my cell phone although I have to cut out once again to head over for a home inspection on the other house I’m in the process of selling. Those usually run at least a few hours so I should be back back at my desk early afternoon.

Bottom line: As long as QQQ & /NQ remain back above the bottom of the recent trading ranges (yellow boxes), the near-term outlook is bullish as that means yesterday’s breakdowns were foiled with the buyers stepping in to ramp the Q’s back above that key broken support level. Likely bounce targets are the same as before; 274.90ish & then the top of the range. A solid break above the range would once again open the door to a backtest of the primary (blue) uptrend line and 292ish level but first things first and that would be to see how we finish today. Another solid break below the trading range would once again provide a sell signal & even better if/when yesterday’s lows are taken out (which would put the odds at over 90% that T5 will be hit in short order).

Good trading & stay flexible as whipsaws have been the norm for months now.

-rp