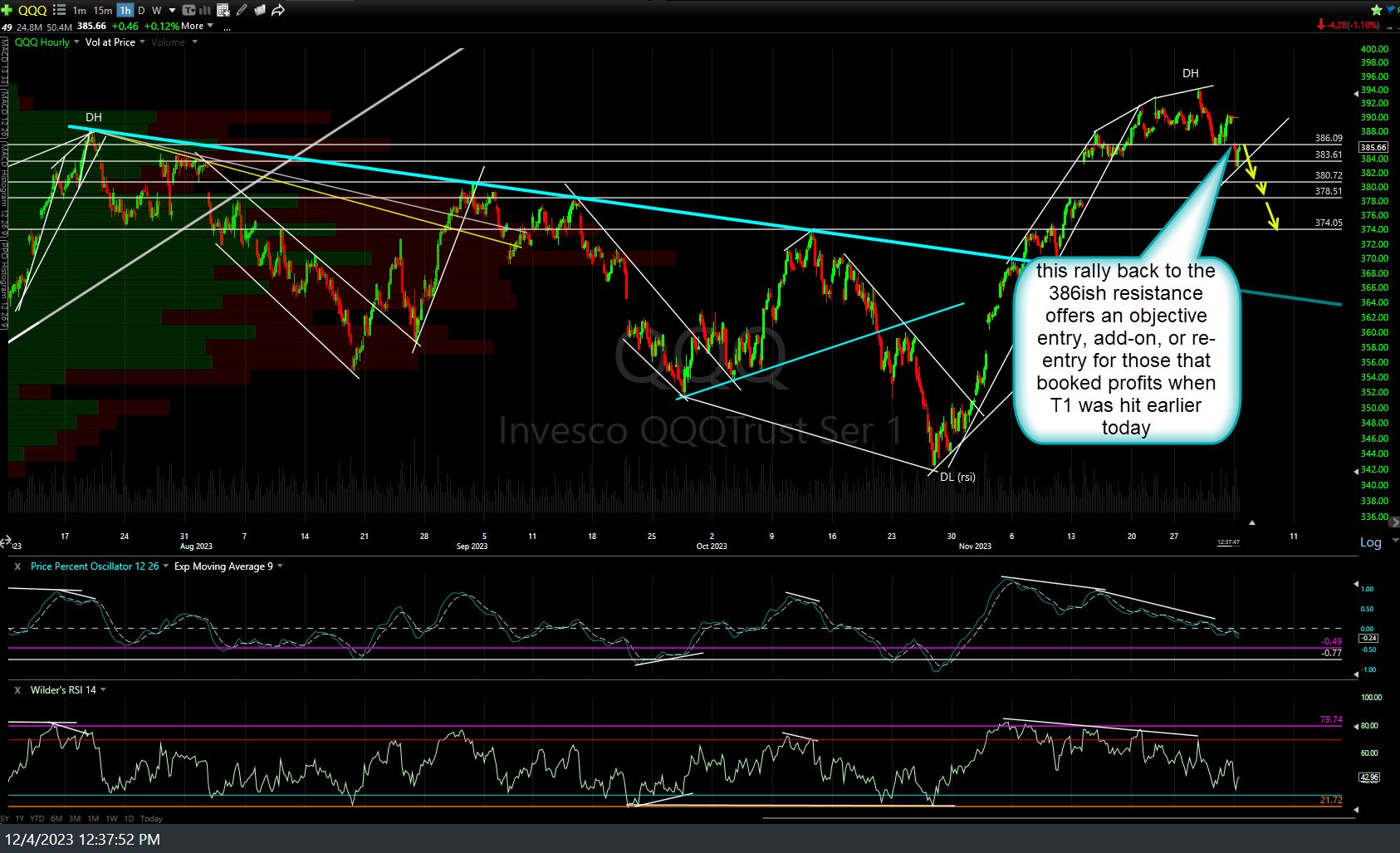

This rally back to the 386ish resistance on QQQ offers an objective entry, add-on, or re-entry for those that booked profits when T1 was hit earlier today. (note: the levels on this 60-minute chart are from a different board/chart than the 60-minute chart posted earlier today so some of the support & resistance levels may vary slightly)

Zooming down to a 15-minute time frame of /NQ, this bounce back to the 15864ish resistance offers an objective short entry, add-on, or re-entry as would any additional upside to the next two resistance levels (blue lines).

Also worth noting is the fact that with just over 3 hours left in today’s trading session, QQQ is currently poised to print the first bearish crossover on the PPO (daily chart) barring an unusually strong rally into the close. Additionally, 6 of the 7 market-leading Magnificent 7 stocks have now also triggered sell signals via bearish crossovers on the daily PPO with TSLA being the sole exception.

However, despite the current near-term bullish trend (with a longer-term downtrend since the early Nov ’21 top still very much intact), the current technical posture of TSLA appears more bearish than bullish IMO, with the stock recently rejected off the minor downtrend line off the mid-July highs with negative divergences in place at the time. 60-minute & daily charts above.