Following the recent divergent high & impulsive rejection off the primary downtrend line, /NQ is currently trading in a very precarious position, testing the 10820ish support in pre-market with slight but unconfirmed positive divergences on the 60-minute time frame.

Zooming down to the 5-minute chart, positive divergences on /NQ could lead to a pre or post-opening pop (fairly likely, IMO) while bearish if they get burned thru (taken out).

After was /ES was recently rejected at the downtrend line following the brief pre-FOMC failed breakout & divergent high, it is currently dipping below the 3750ish support but with small unconfirmed divergences that could send it back above before or shortly after the open today (fairly likely IMO). As with /NQ, /ES (S&P 500 futures) also has positive divergence on the 5 & 10-minute time frames. 60-minute chart below.

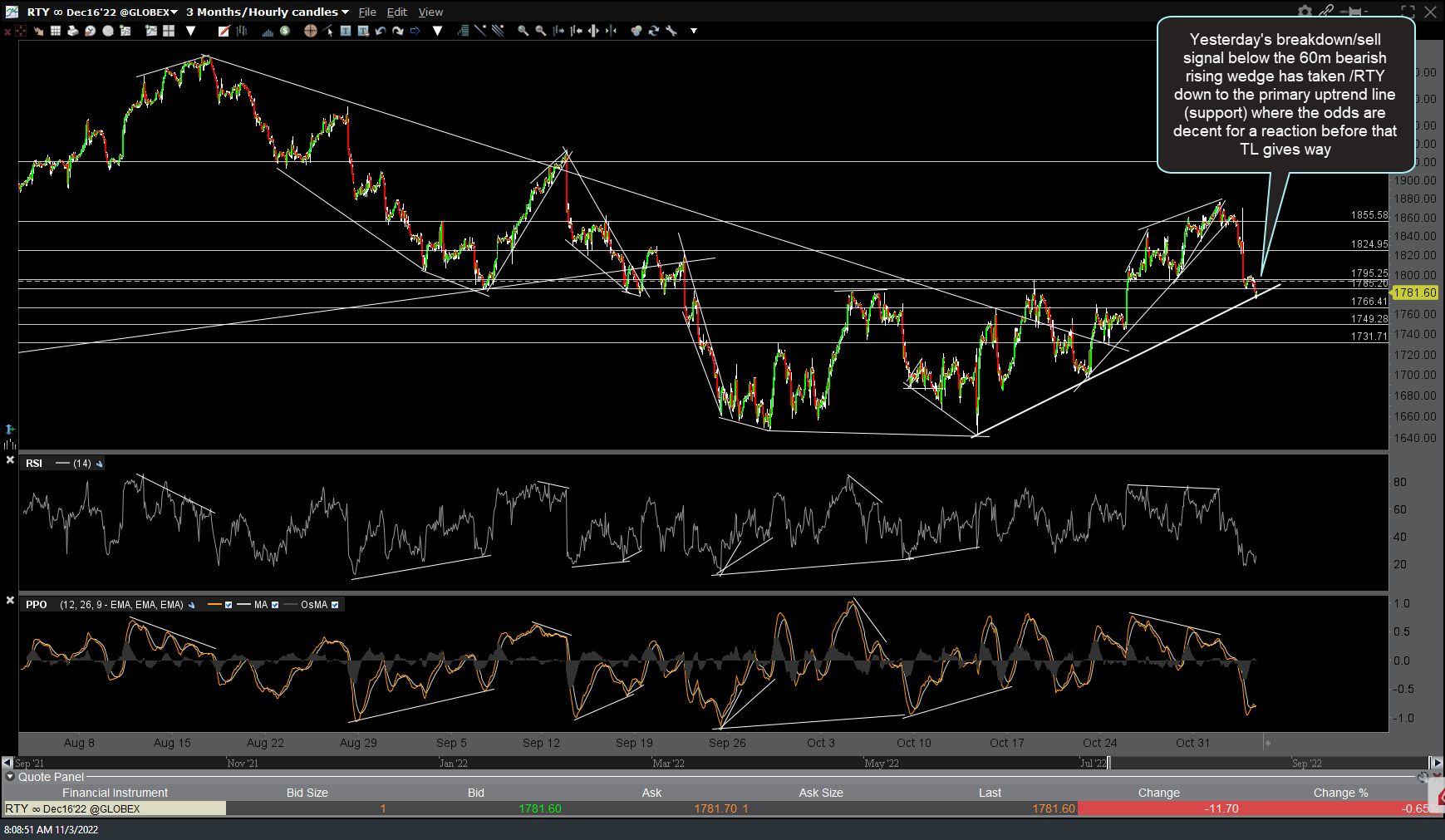

Yesterday’s breakdown/sell signal below the 60-minute bearish rising wedge has taken /RTY (Russell 200 Small-Cap futures) down to the primary uptrend line (support) where the odds are decent for a reaction before that trendline gives way (also likely, IMO, whether we get a reaction here first or not). 60-minute chart below.