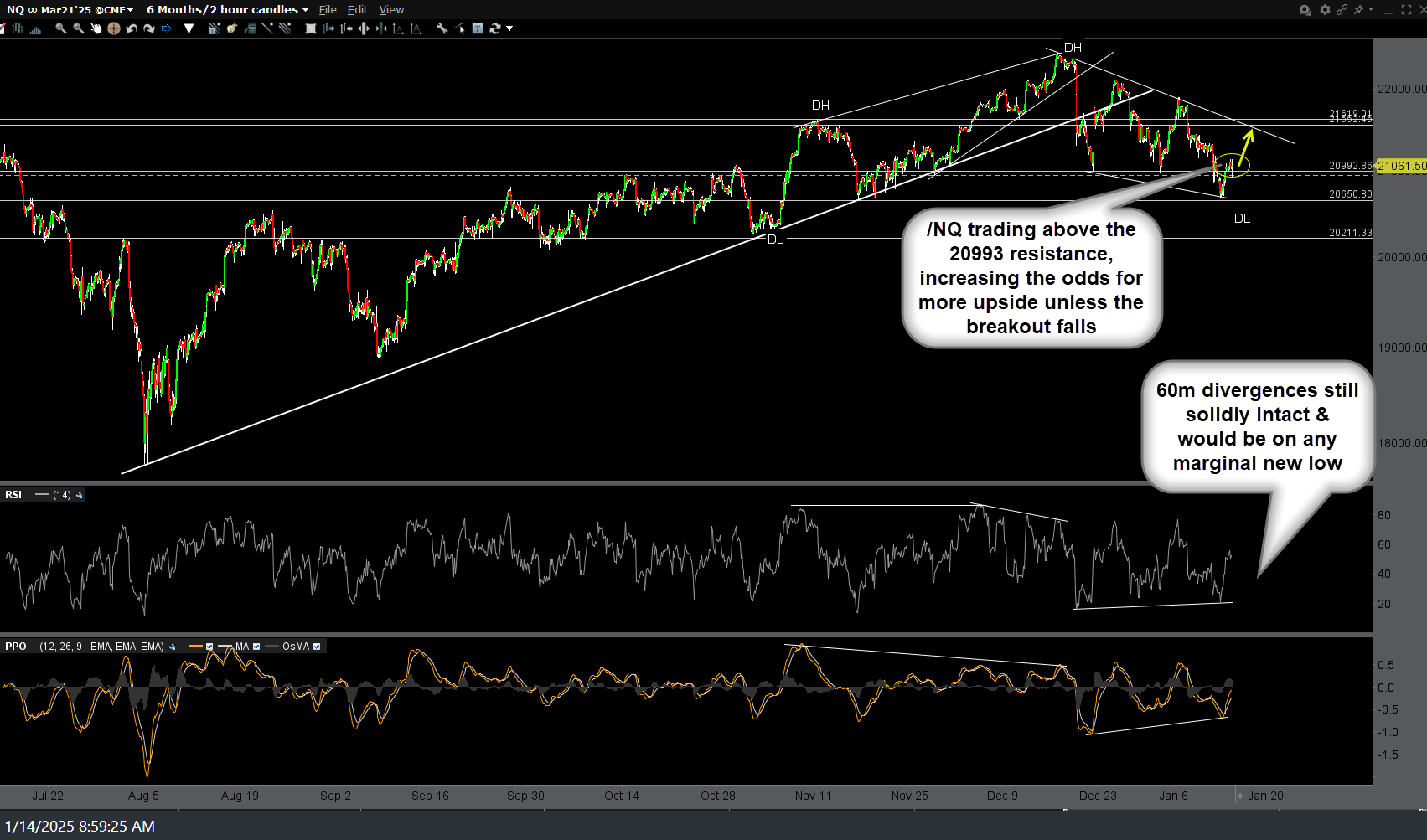

/NQ (Nasdaq 100 futures) has hit my initial bounce target hit with a tradable pullback likely. Will assess charts to determine whether or not a breakout above the downtrend line is likely. Previous & updated 120-minute charts below.

/ES (S&P 500 futures) has also hit the downtrend line bounce target hit with a tradable pullback likely. 60-minute chart below.

Should /NQ & /ES manage to breakout above these downtrend lines today, my expectation would be that the breakout would get sold shortly afterward with at least a backtest of the trendlines from above. Taking it one tick at a time & staying flexible (and still actively trading) the index futures/ETFs for now.

Treasuries (/ZB, /ZN, IEF, TLT) still look good following yesterday’s breakout with any pullbacks, ideally to support, offering objective re-entry points for those that booked profits at the first price targets yesterday.

Ditto for the grains (corn, soybeans, wheat) and related agricultural input stocks.

That negative divergence that I highlighted on the 60-minute chart of /CL (crude futures and USO) yesterday has now been “confirmed” via a bearish crossover on the PPO to effectively put in a lower low. Still short/bearish crude & long/bullish natural gas.

GDX still trading at the first price target (T1) & has a decent shot of continuing to my second & final price target (T2) if it can clearly take out T1 on a closing basis.

The mortgage related stocks that we shorted down for huge gains over the past few months (RKT & UWMC) which I highlighted recently as long-side trades have been rallying sharply due to the breakout in Treasuries & will likely continue to do so if /ZB & TLT continue to my next targets.

LMK if you’d like updates on any other recently highlighted trade ideas or anything else that you’re watching in the comments section below.