/NQ (Nasdaq 100 futures) has impulsively broken down below the secondary (yellow) uptrend line (bearish) with the potential, but unconfirmed divergences are still intact. A solid recovery back above the trendline (bear trap) would be bullish while a drop below the 11860ish support and failure to recover the trendline quite bearish & increase the odds of another powerful wave down. Stay flexible & ready to pivot, whether short or long (or stand aside, if unsure what to do). FWIW, I’m still leaning towards & positioned for the bear trap (bullish) scenario but ready to adjust (close longs and/or open shorts), soon, if the charts convince me to do so.

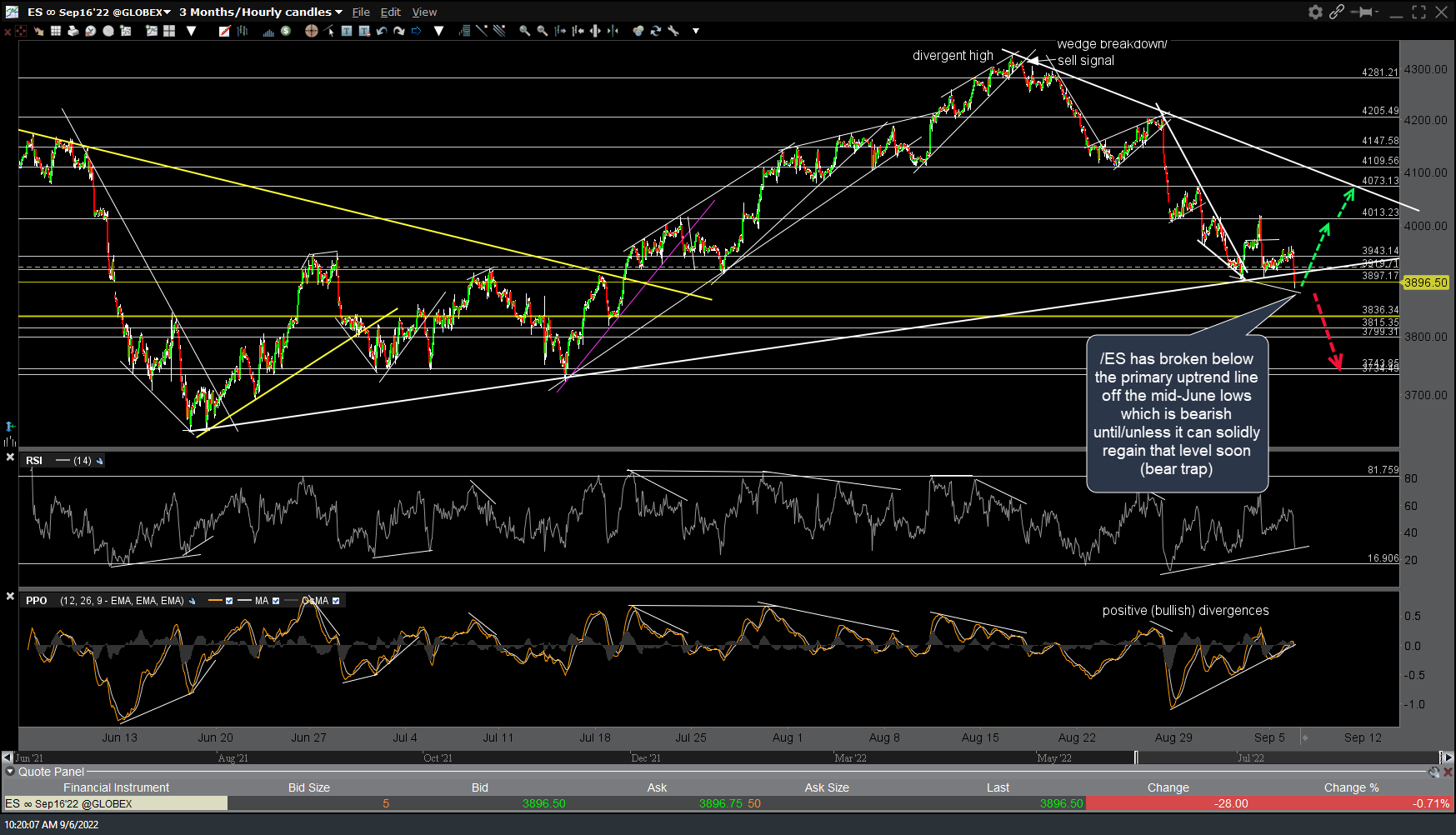

Likewise, /ES (S&P 500) has broken below the primary uptrend line off the mid-June lows which is bearish until/unless it can solidly regain that level soon (bear trap). 60-minute chart below.

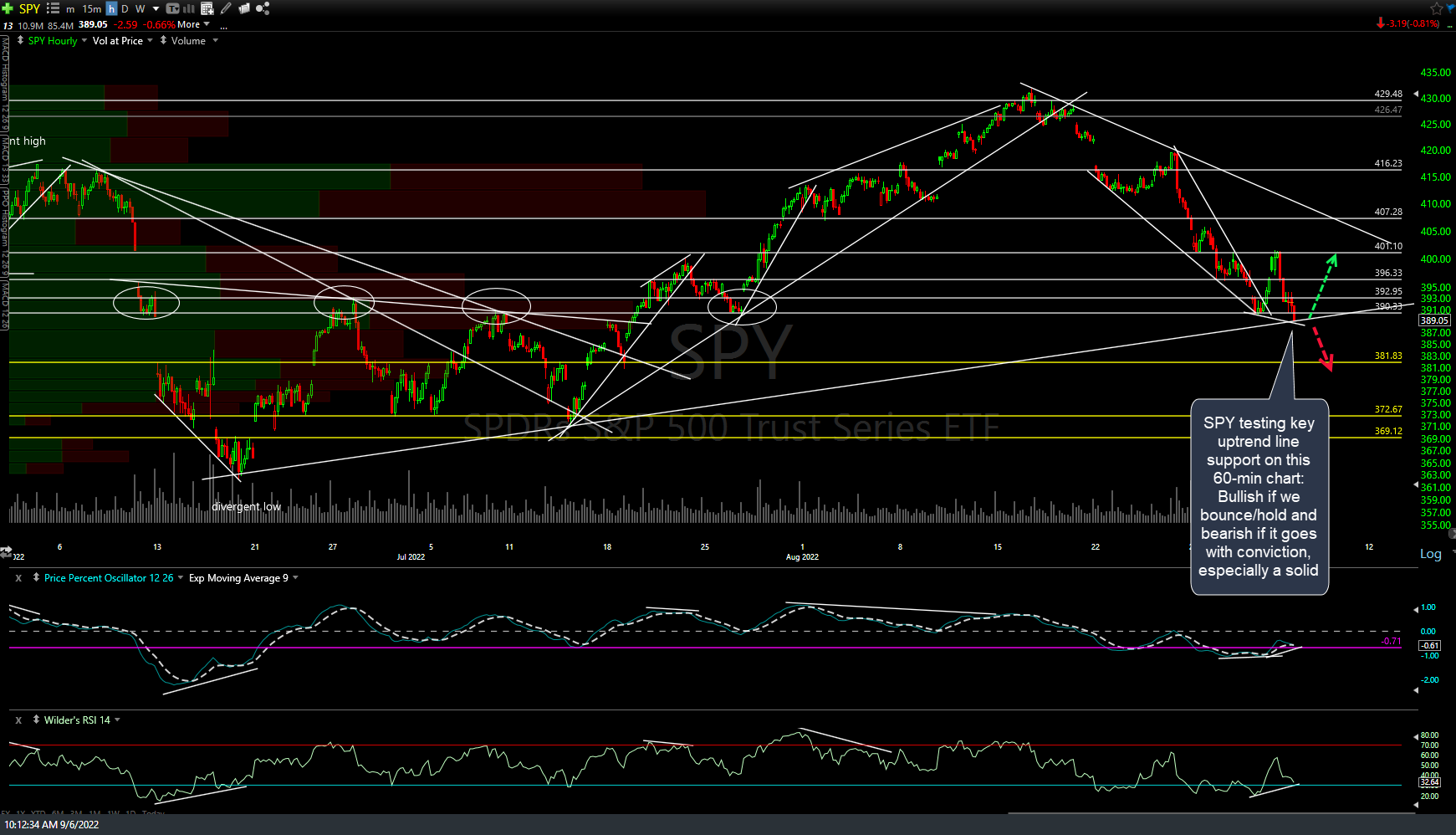

Keep in mind that the markets can & most likely will move fast today so by the time you read this, things may have changed but as of now, SPY is currently testing key uptrend line support on this 60-min chart & has yet to take it out on a 60-minute (and/or daily) closing basis. Do or die time for the bulls.