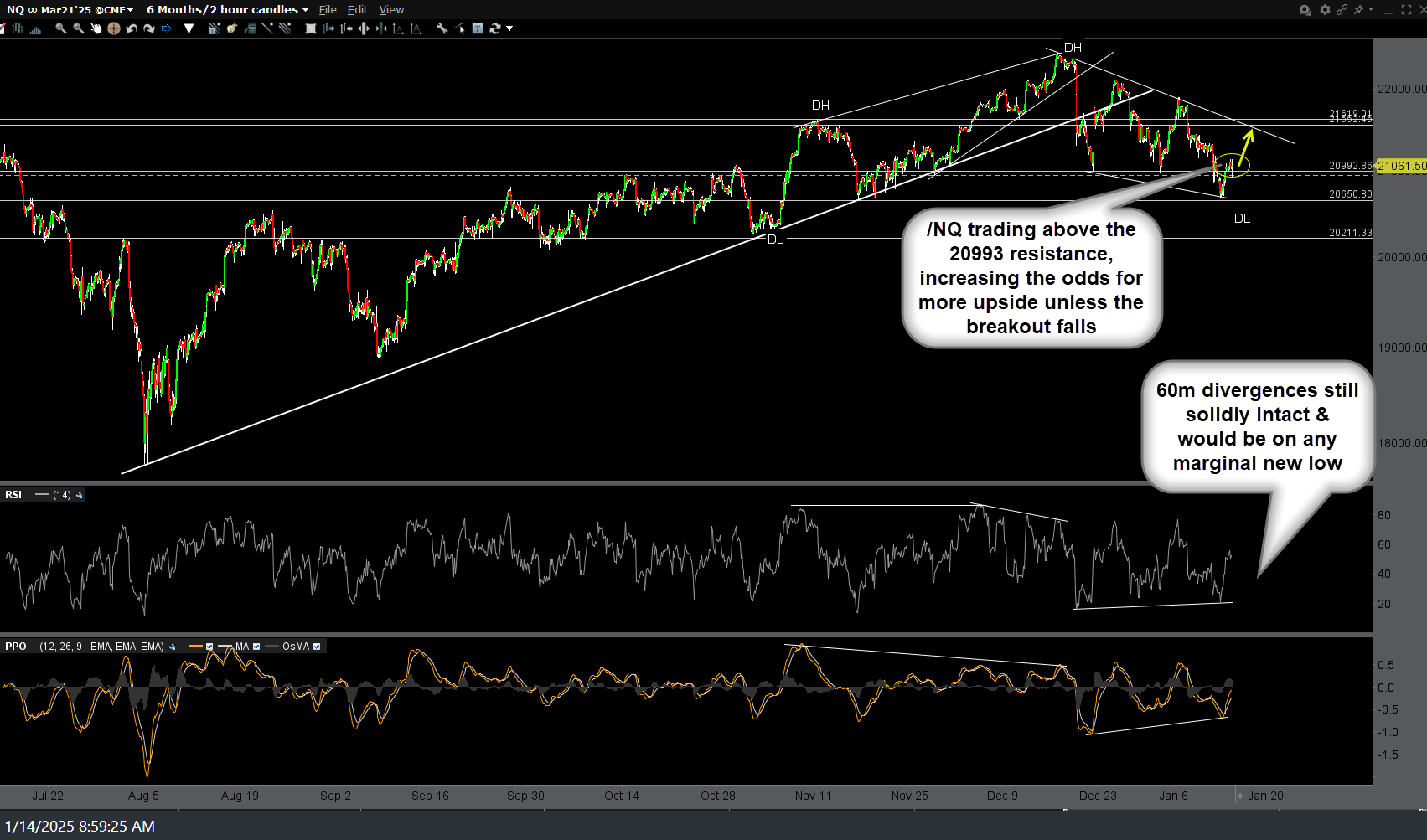

The bear-trap (i.e.- whipsaw, false breakdown) scenarios I laid out yesterday are currently in play with/NQ (Nasdaq 100 futures) trading above the 20993 resistance, increasing the odds for more upside unless the breakout fails. Previous (yesterday) & updated 60-minute charts below.

Likewise, /ES (S&P 500 futures) is also trading back above the 5871 former support, now resistance level, thereby increasing the odds for more upside unless the breakout fails. 60-minute chart below.

Bottom line: Still favoring a near-term bounce in the major stock indices, most likely lasting a few days +/- (starting from yesterday’s divergent low) & possibly into next week followed by the next leg down but staying flexible & taking the charts as they develop & ready to close the bounce longs (or reverse back to short), depending on how things develop today & throughout the week.

The grains (corn, wheat, & soybeans) and recently highlighted agricultural input stocks continue to stand out as some of the better looking long swing/trend trade idea at this time until & unless the recent breakouts clearly fail.