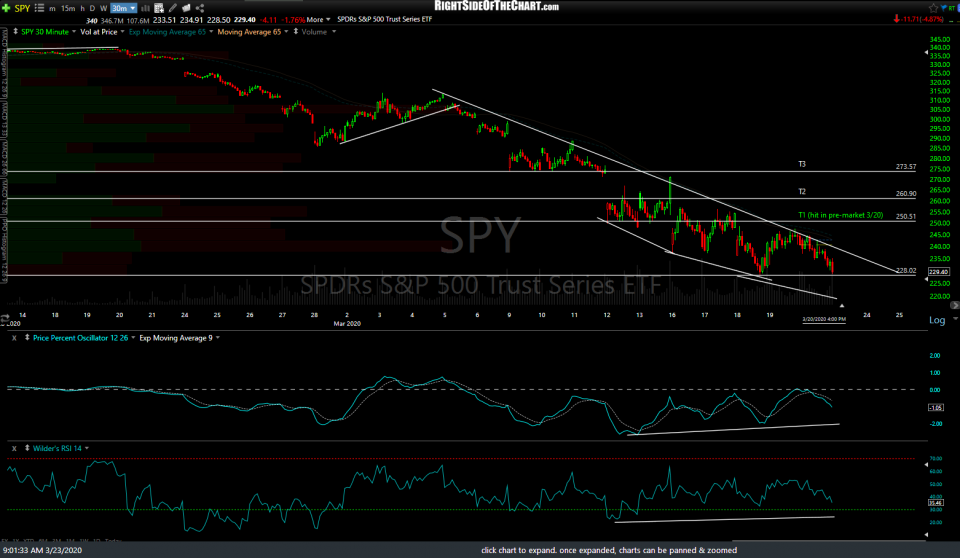

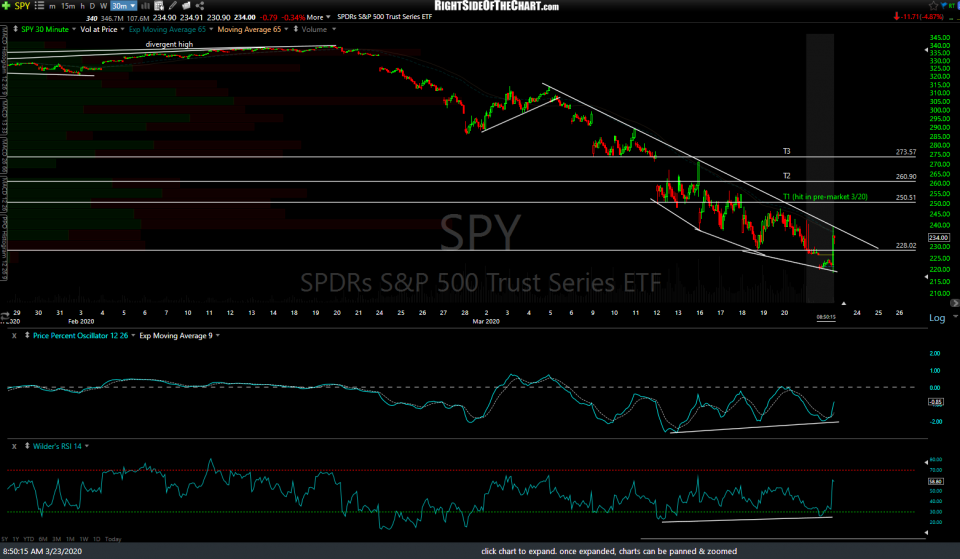

So far this morning, we’ve seen a surge of more than 8% in the stock futures in just minutes after the latest announcement of stimulus by the Fed, another good example of the risk coming into the week short while the sentiment, short interest, the $VIX & put/call ratios remain at extreme levels and the major stock indices once again closed at key support while still oversold on Friday. Here are the 30-minute charts of SPY & QQQ with the same overhead resistance levels/targets as last week still potential targets this week. Most notable are the downtrend lines off the March 4th highs (bullish if taken out with conviction). The first two charts below show today’s pre-market trades while the 2nd two charts reflect prices as of Friday’s close (no AH or pre-market trades shown).

- QQQ 30m March 20th close

- QQQ 30m March 23rd

- SPY 30-min March 20th close

- SPY 30m March 23rd

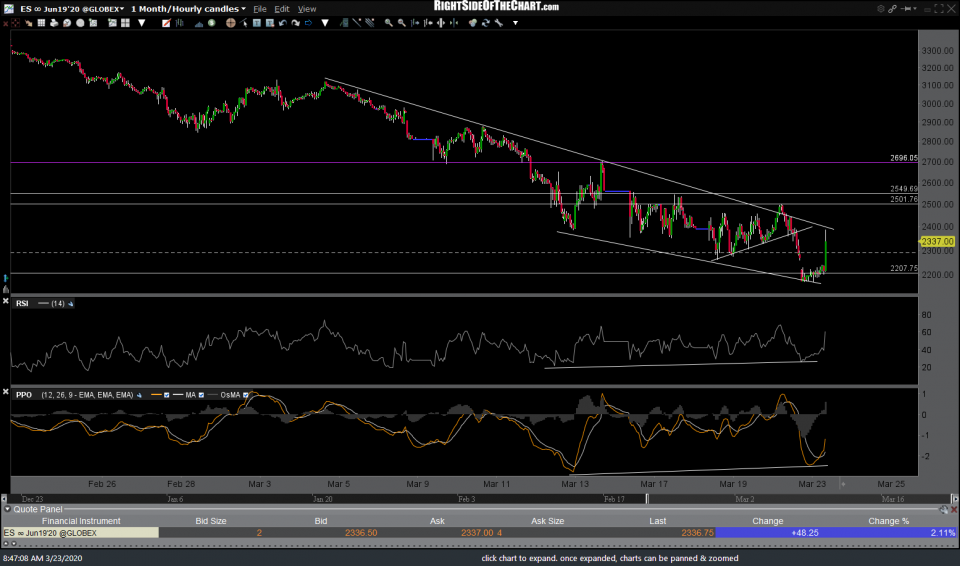

Both /ES & /NQ just tested their comparable downtrend lines in the pre-market session, rallying roughly 10% so far off last night’s lows after hitting the 5% lock-limit down restrictions. Hard to say if those upper targets zones will be reached if the index futures can make a solid break & 60-minute close above the downtrend lines or if this pop into resistance will prove to be the next ideal shorting opportunity although I will follow up with some additional analysis & thoughts after the regular session gets underway.

- NQ 60m March 23rd

- ES 60m March 23rd