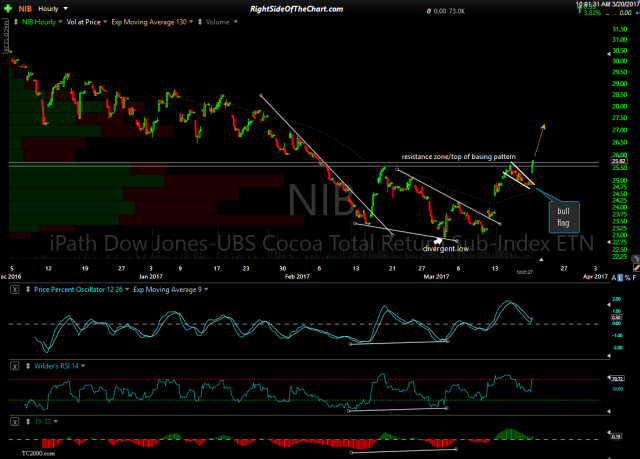

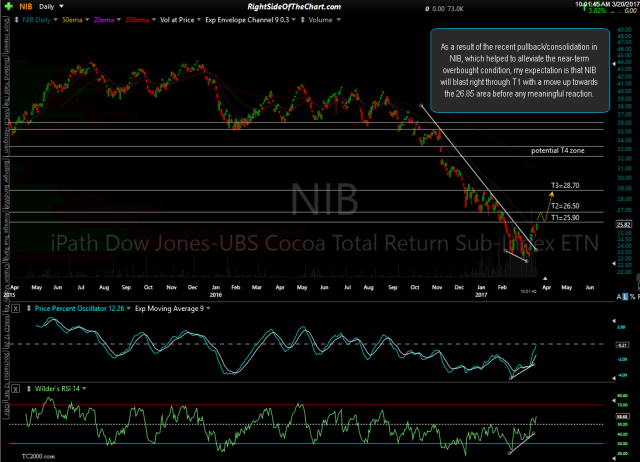

The NIB (Cocoa ETN) Active Long Trade is currently testing the top of the basing pattern which is a significant resistance zone. A break above the top of that zone, which appears imminent, is likely to be the catalyst for a move up to & beyond the first price target of 25.90. T3 at 28.70 remains the final target at this time although there is still a chance that an additional official target around the 32.20 area may be added to this trade. As a result of the recent pullback/consolidation in NIB, which helped to alleviate the near-term overbought condition, my expectation is that NIB will blast right through T1 with a move up towards the 26.85 area before any meaningful reaction. Updated 60 minute & daily charts below.

- NIB 60-minute March 20th

- NIB daily March 20th