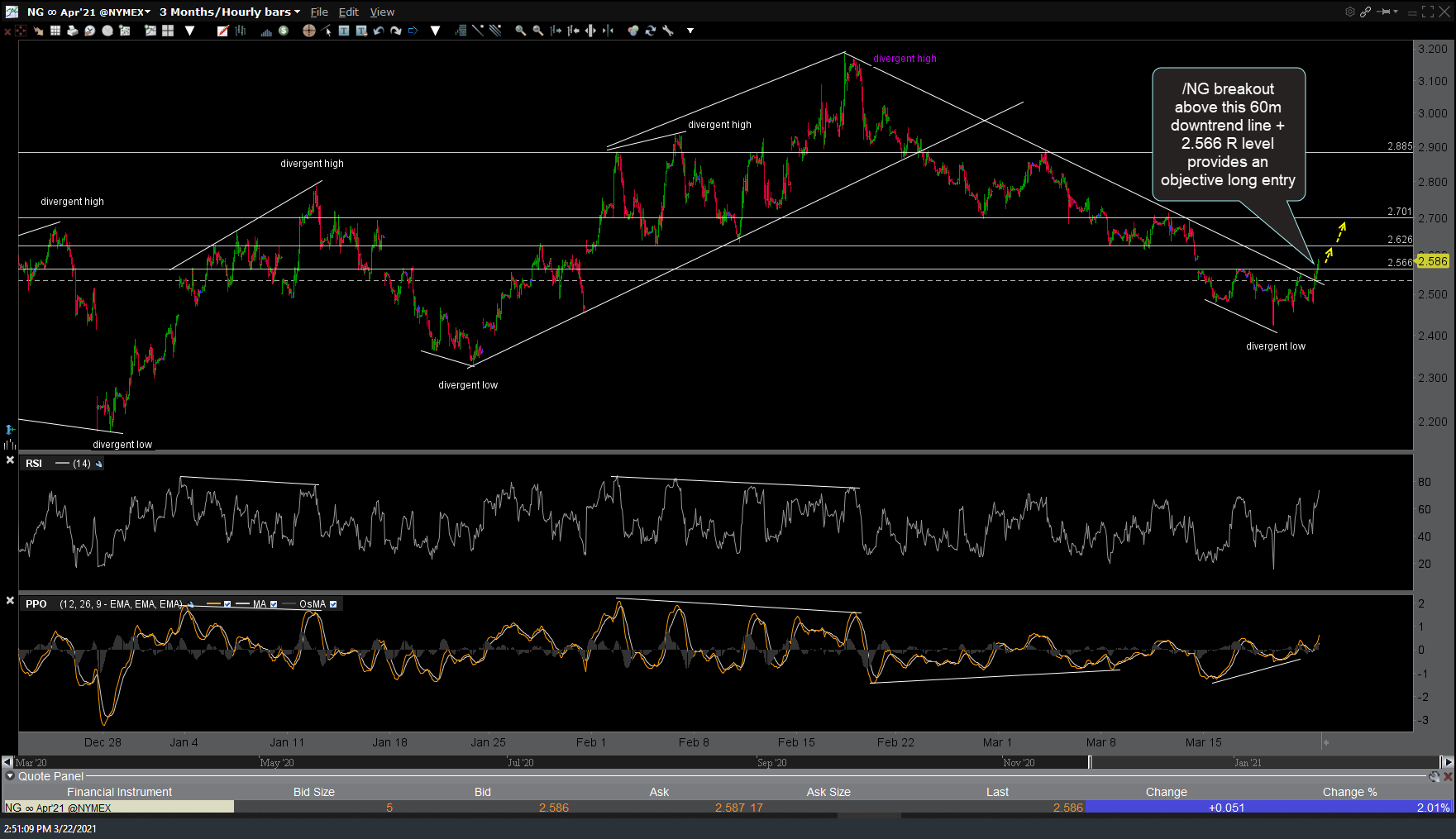

/NG (natural gas futures) has just broken out above the downtrend line + 2.566 resistance level on this 60-minute chart, providing an objective long entry here. /QG is the Miny natural gas futures contract that trades at the same price level as /NG but employs a smaller leverage factor (appx. $6,500 exposure to NG per contract). Keep in mind the chart below is the April contract which stops trading in a few days. As such, best to use the May contract which trades thru April 27th.

For those that prefer ETFs, this UNG breakout above the 60-minute downtrend line & the 9.58 resistance level also provides an objective long entry with stops commensurate with one’s preferred price target. Potential unadjusted swing targets/actual resistance levels are marked on both charts.