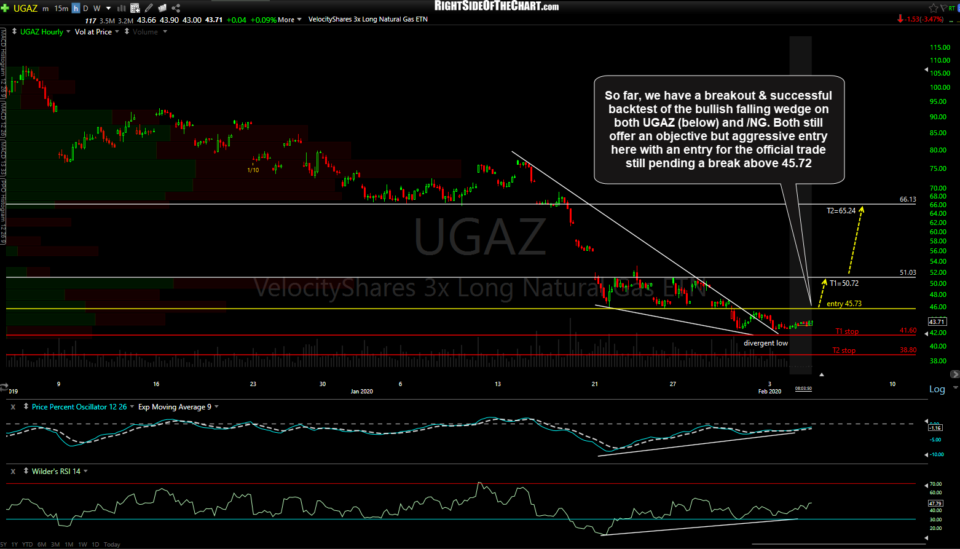

So far, we have a breakout & successful backtest of the bullish falling wedge on both UGAZ (below) and /NG. Both still offer an objective but aggressive entry here with an entry for the official trade still pending a break above 45.72. 60-minute chart below.

Likewise, /NG (natural gas futures) has made a successful backtest of the bullish falling wedge pattern following the recent breakout and subsequent break below the minor price channel with the divergences still well-intact for now. 60-minute chart below.

An update on the USO (crude oil ETN) Active Trade & /CL (crude futures) will follow in a separate post. Regarding the stock market, QQQ is trading above the 222.90ish resistance that was highlighted in yesterday’s video although how the market closes the day is what is most important. As mentioned in the comment section below the USO trade idea yesterday, I am viewing that trade as a hedge to my partial short position on the Nasdaq 100 as any additional gains in the stock market will most likely result in crude rallying off the key support level which it fell to yesterday.

Also, note that I will be away from my desk for the better part of market hours today while checking in throughout the day & working remotely until late afternoon. I plan to catch up on trading room questions as well as any other questions from the site later today.

Good trading!

-RP