/NG (natural gas futures) has just hit & taken out the 8.460 price target/support level but only on a slight overshoot, so far, while /NG is currently testing another support level at 8.379 that I have on my 120-minute chart. Previous (Aug 30th) & updated 60-minute charts below.

The chart below is the 6-month chart of /NG with 120-minute candlesticks which shows the 8.379 support level/alternative target that nat gas is currently testing on that time frame. While the odds for a reaction on this initial tag of support are elevated at this time, bounce or no bounce from here, it still appears that a move down to my next target around 7.519, roughly 11% lower, is still likely in the coming days to weeks.

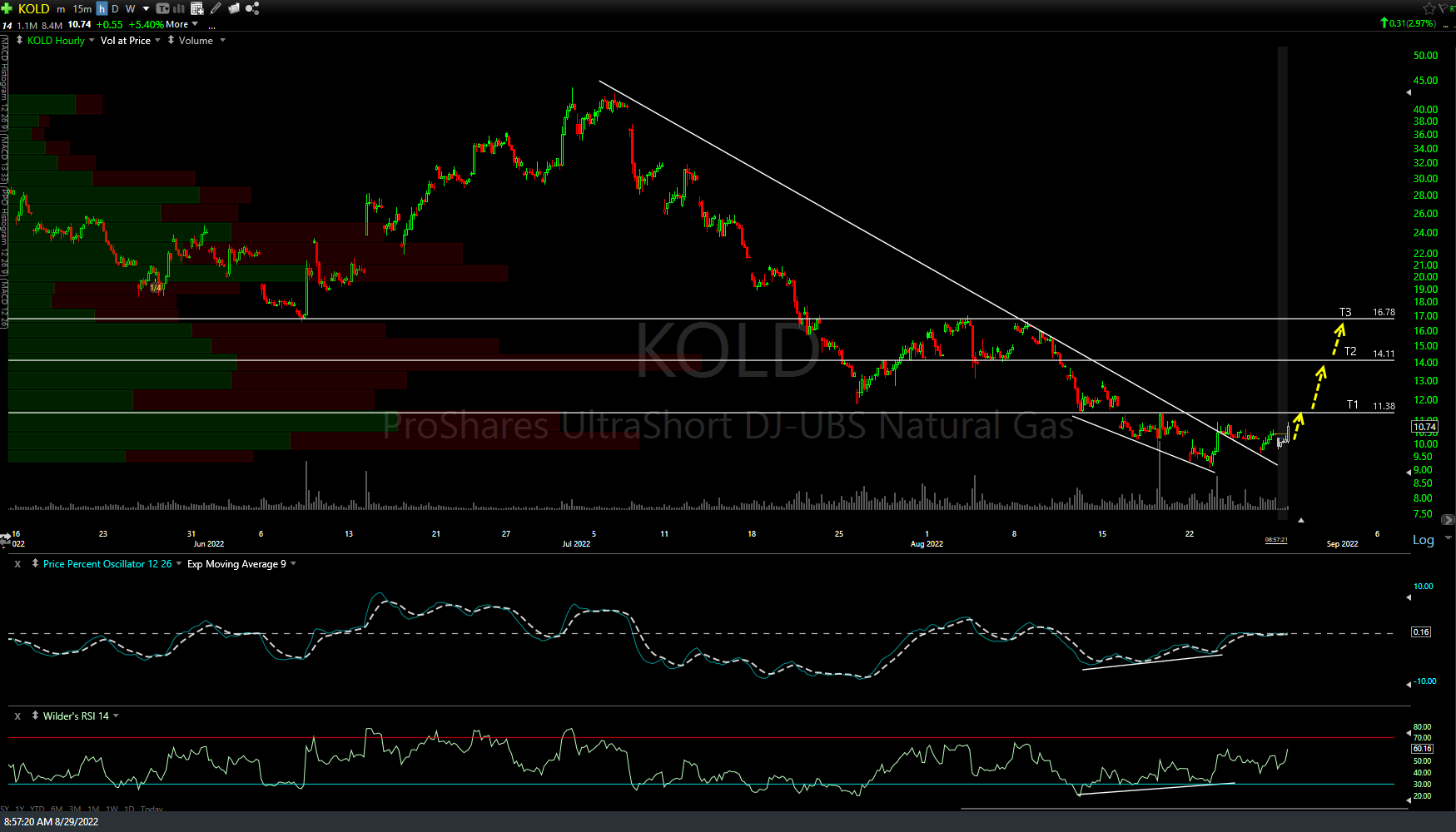

For those using the KOLD (-2x short nat gas ETN) alternative proxy, KOLD has already hit & taken out T1 & still appears likely headed to T2 and/or T3 in the coming days/weeks, following any reaction we may or may not get here at the support on /NG. Previous (Aug 29th) & updated 60-minute charts below.

Keep in mind, this drop in nat gas from where it was trading last week when Russia had previously said it would turn the Nord 2 pipeline flows back on after the maintenance was completed on Saturday, the then later renigging on Friday under the G-7’s threat of capping Russian oil prices is quite bearish IMO, as nat gas continuing to fall despite the complete cessation of the Nord 2 pipeline flows to Germany speaks volumes about the current supply/demand dynamics.