/NG (natural gas futures) offers an objective short entry here at the backtest of the key 6.578ish resistance level for a quick ~12% (or potentially more) pullback to just above the 5.931 support & potentially the 5.60 level with a stop somewhat above the 6.703 resistance level. 60-minute chart below.

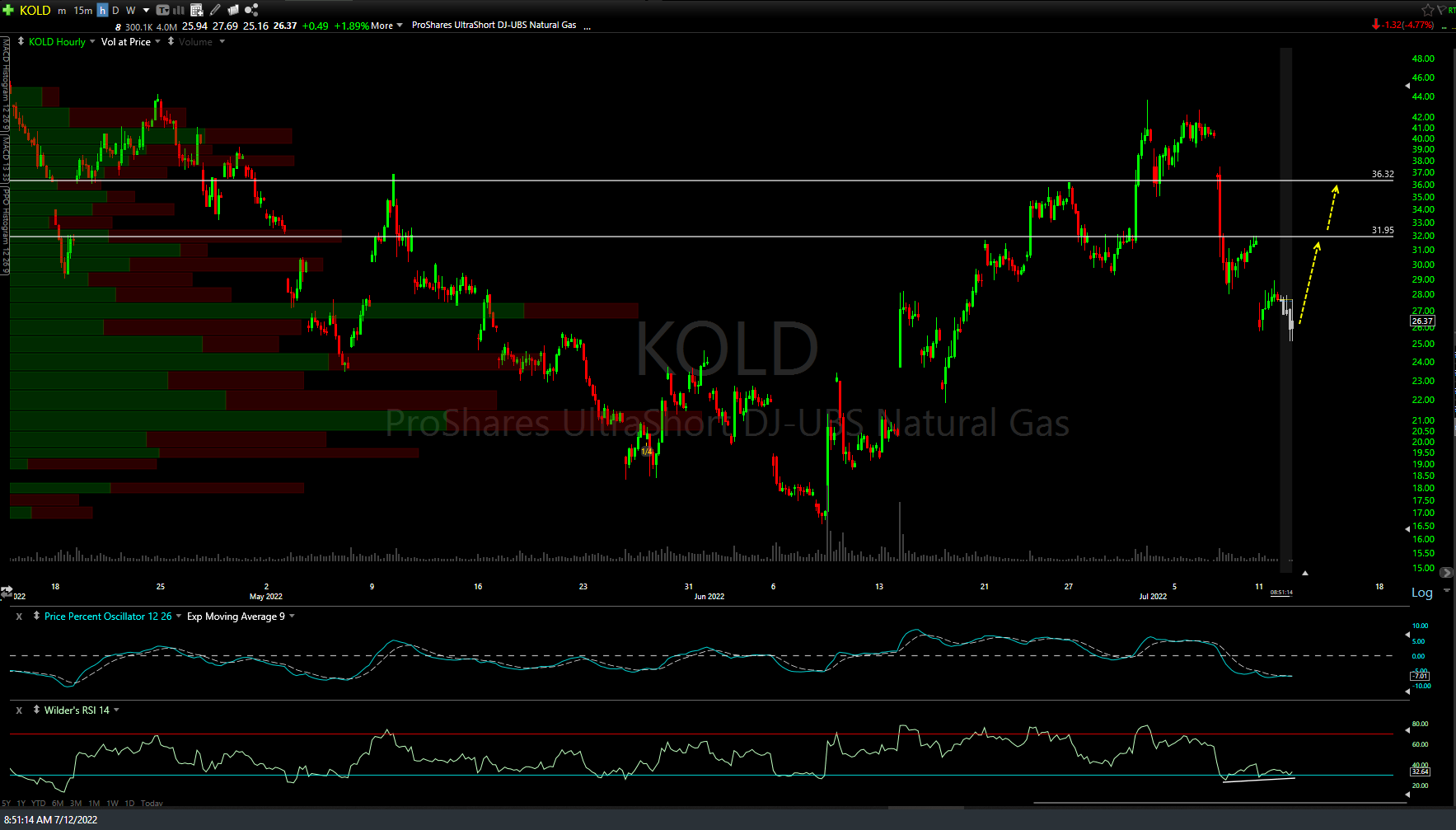

Comparable price targets (also unadjusted, best to set sell limit orders slightly below those resistance levels) for KOLD (-2x short nat gas ETN) are 31.95 & 36.32 as shown on the 60-minute chart below. Other proxies for trading natural gas are /QG (MINY nat gas futures), and UNG (+1x ETN).

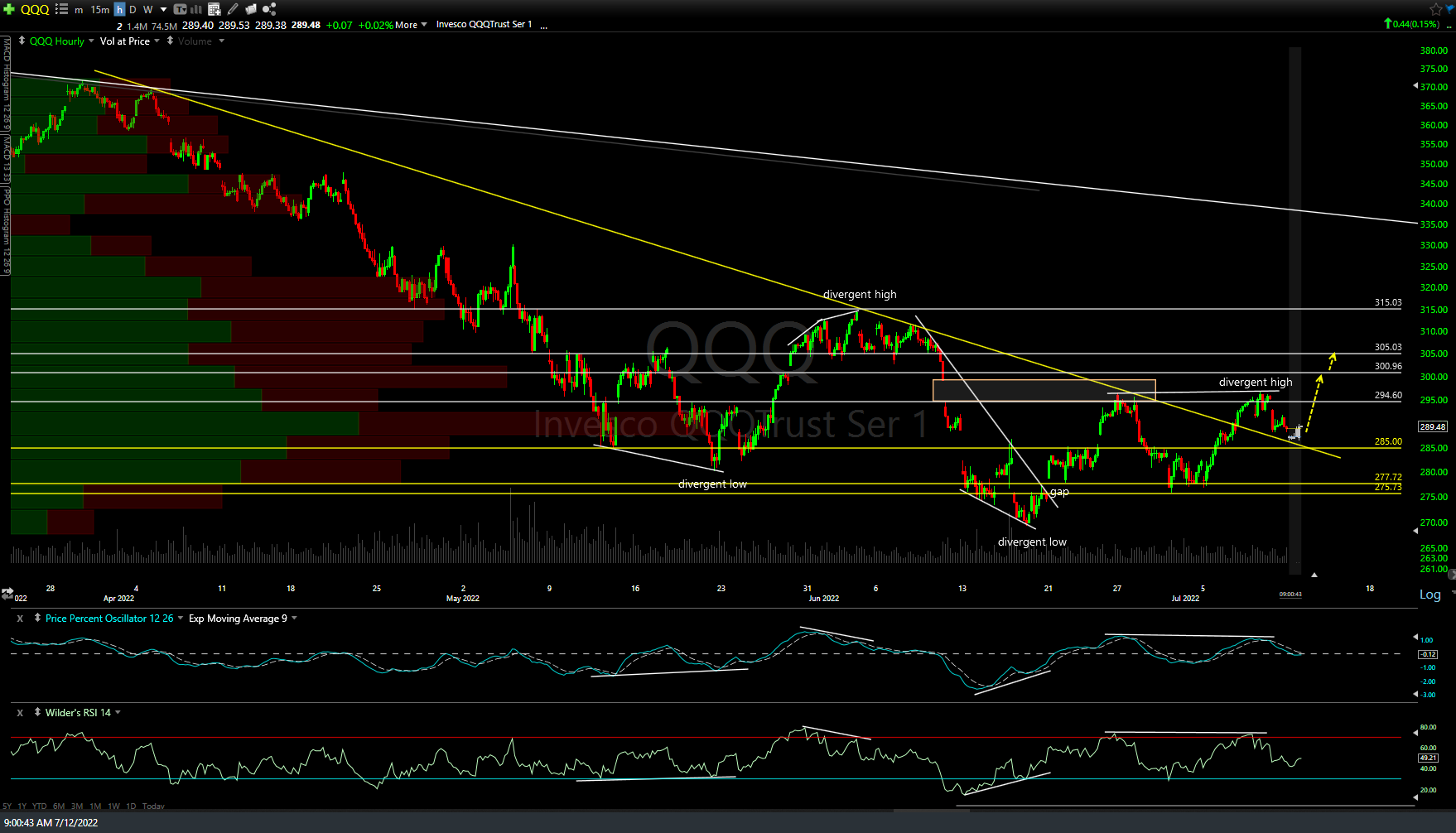

P.S.- No change in my outlook or the technical posture of the stock market at this time. Both QQQ & /NQ (Nasdaq 100) continues to offer an objective long entry on the backtest of the 60-minute downtrend line with more upside likely in the coming days to weeks although ideally, but not absolutely necessary, I’d like to see QQQ hold above the 285 support level.