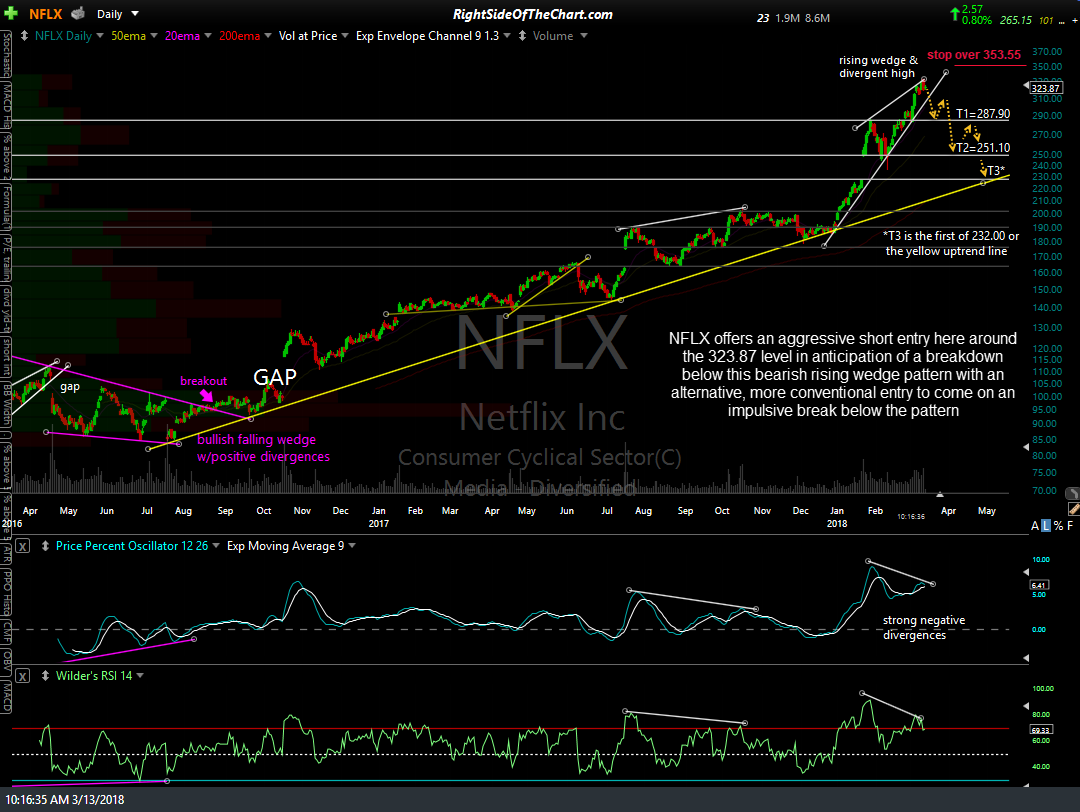

NFLX (Netflix Inc.) offers an aggressive short entry here around the 323.87 level in anticipation of a breakdown below this bearish rising wedge pattern with an alternative, more conventional entry to come on an impulsive break below the pattern. While shorting a stock that is still clearly in an uptrend without any evidence of a reversal & still above its uptrend line is a more aggressive strategy that runs an increased chance of the trade not panning out, it may offer a more favorable entry price. One could also wait for an impulsive break and/or daily close below the rising wedge pattern to initiate a short position or add to a partial short position taken inside the wedge.

The price targets for this trade are T1 at 287.90, T2 at 251.10 and T3, which will be the first (to be hit) of either the primary (yellow) uptrend line generated off the July 2016 lows or the 232.00 level, which is slightly above the bottom of the very large & technically significant gap from January 23rd, which I expect will be backfilled before year-end. The maximum suggested stop for those targeting T3 is any move above 353.55 with a suggested beta-adjusted position size of 0.85.