NFLX (Netflix Inc.) is soaring in after-hours trading following their quarterly earnings release. When I look at the weekly chart of NFLX as well as the price & volume action along various technical indicators, I see some almost uncanny similarities between NFLX today and AAPL when it put in a major top back on April 28th, 2015. That top in AAPL was followed by a vicious bear market that wiped out over 1/3 of the value of that over-loved & over-owned stock over the next 13 months. Just as with NFLX today, that pop & top in Apple didn’t come following a disappointing earning release or horrible forward guidance. On the contrary, earnings were great & the stock soared in the after-hours session on April 27th with that rally carrying over into the next trading session, with AAPL gapping higher.

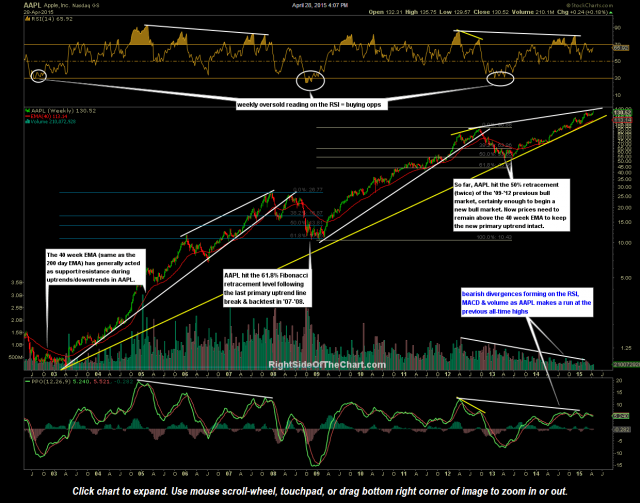

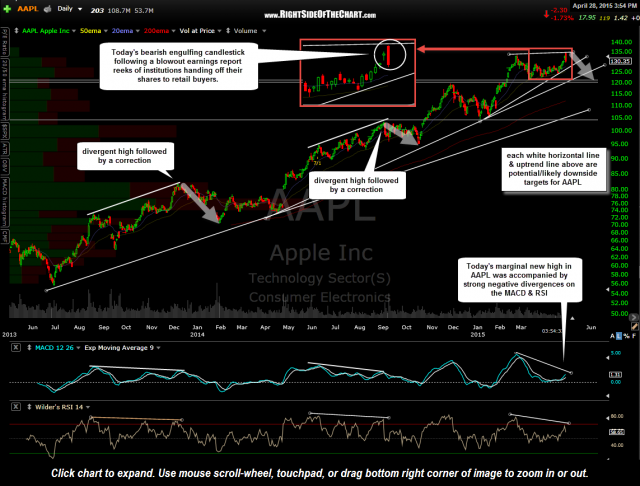

- AAPL weekly April 28, 2015

- NFLX weekly July 17th

That opening gap to new all-time highs in AAPL marked the start of one of the worst bear markets that the stock had experienced in over a decade. The post-earnings induced opening gap was immediately faded with the stock never looking back. As I had covered in detail that day that AAPL peaked in 2015, the stock finished the day (April 28th, the first trading day after the earnings release the evening before) printing a bearish engulfing candlestick which was followed through with the additional downside (i.e.- confirmation of the sell signal) in the following trading sessions.

NFLX has been posted as two official trades recently. The first short trade was entered about 5 weeks ago & quickly hit the final target for a quick (4 trading sessions) gain of 10½% on June 15th. NFLX was once again added as another short trade one week ago on the backtest of the recently broken uptrend line & went on to exceed the suggested stop of any move above 159.50 on Thursday for a loss of 4.5% (that trade will now be re-assigned to the Completed Trades category).

Just because the current technical posture of NFLX, including what is almost certain to be an opening gap higher tomorrow, nearly mirrors that of AAPL back in 2015 does not mean that the Netflix will continue to follow the same path that Apple did back then. However, I will certainly be monitoring the stock closely in the coming trading sessions for any high-probability sell signals such as those highlighted on Apple back then in this post.