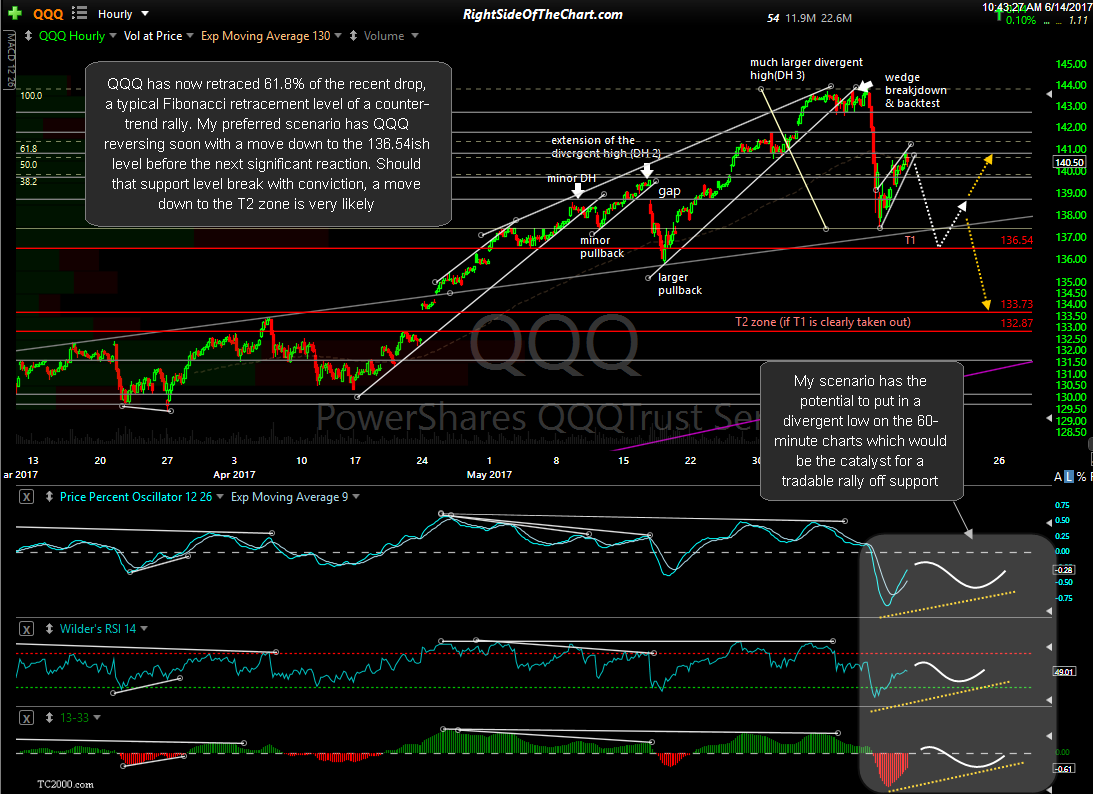

QQQ has now retraced 61.8% of the recent drop, a typical Fibonacci retracement level of a counter-trend rally. My preferred scenario has QQQ reversing soon with a move down to the 136.54ish level before the next significant reaction. Should that support level break with conviction, a move down to the T2 zone is very likely. 60-minute chart:

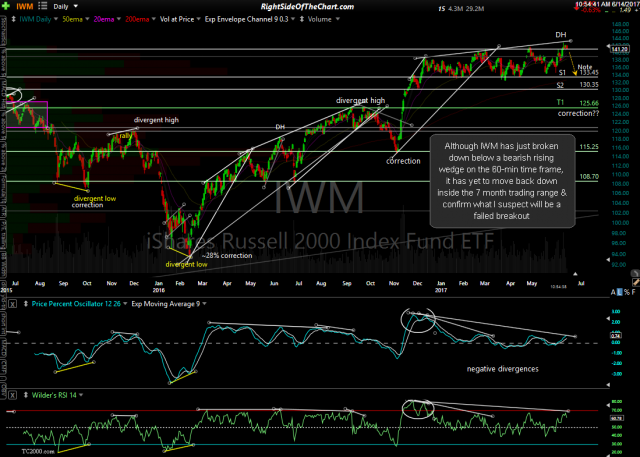

Although IWM has just broken down below a bearish rising wedge on the 60-min time frame, it has yet to move back down inside the 7 month trading range & confirm what I suspect will be a failed breakout. Daily & 60-minute charts:

- IWM daily June 14th

- IWM 60-minute June 14th

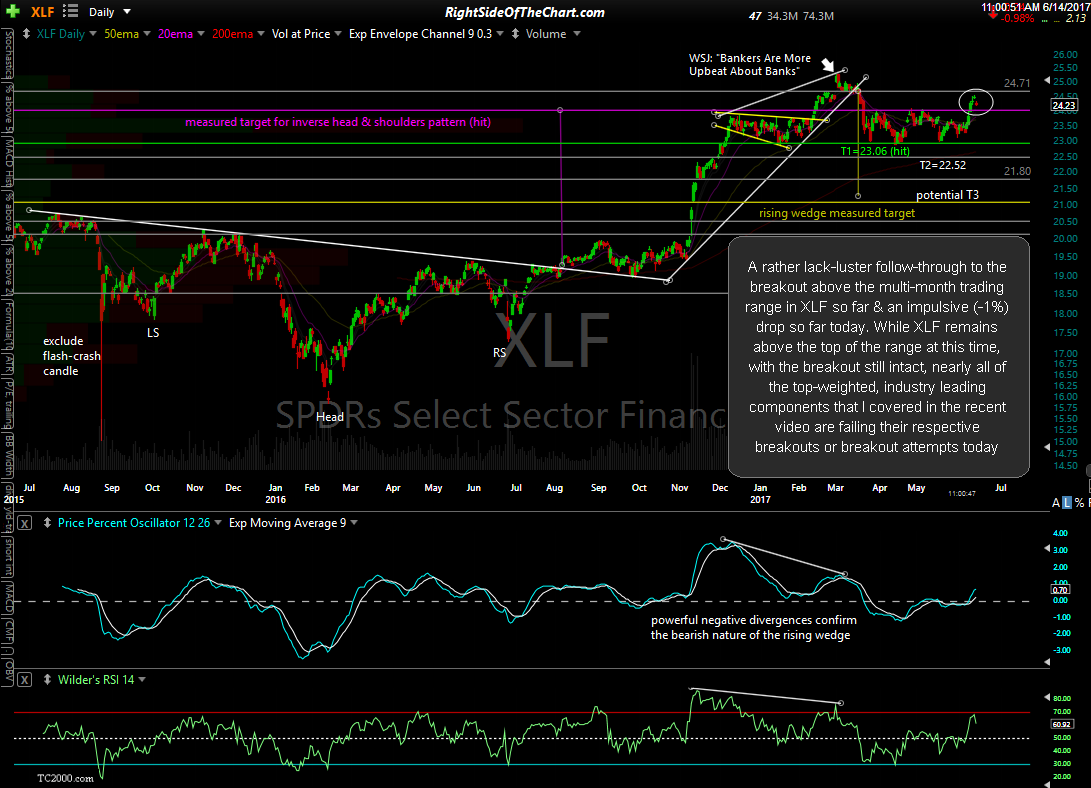

A rather lack-luster follow-through to the breakout above the multi-month trading range in XLF so far & an impulsive (-1%) drop so far today. While XLF remains above the top of the range at this time, with the breakout still intact, nearly all of the top-weighted, industry leading components that I covered in the recent video are failing their respective breakouts or breakout attempts today. As highlighted in Monday’s Market Wrap video, the breakout in XLF, as clear as it appears, was not confirmed with breakouts in the handful of top-heavy components that account for the bulk of the returns in XLF. As such, I remain skeptical of the breakout in XLF until & unless those handful of leading financial stocks also confirm with breakouts above their comparable resistance levels. Daily chart:

Bottom line: My focus remains largely on one sector ETF, XLF (financials) & two index ETFs (QQQ & IWM). QQQ, which has been the leading index for years now & especially on rally since the US presidential elections in November, incurred some significant technical (bearish) damage on Friday & into Monday morning while in a very unusual disconnect, XLF & IWM both made significant bullish breakouts recently with XLF breaking above a very well-defined multi-month trading range & IWM breaking out to new highs as well as a 7 month sideways trading range. Mixed signals for sure but with market leading FAAMG stocks all clearly breaking down along with QQQ on Friday, I still favor a failure of the breakouts in IWM & XLF but until & unless that happens, anything is possible.