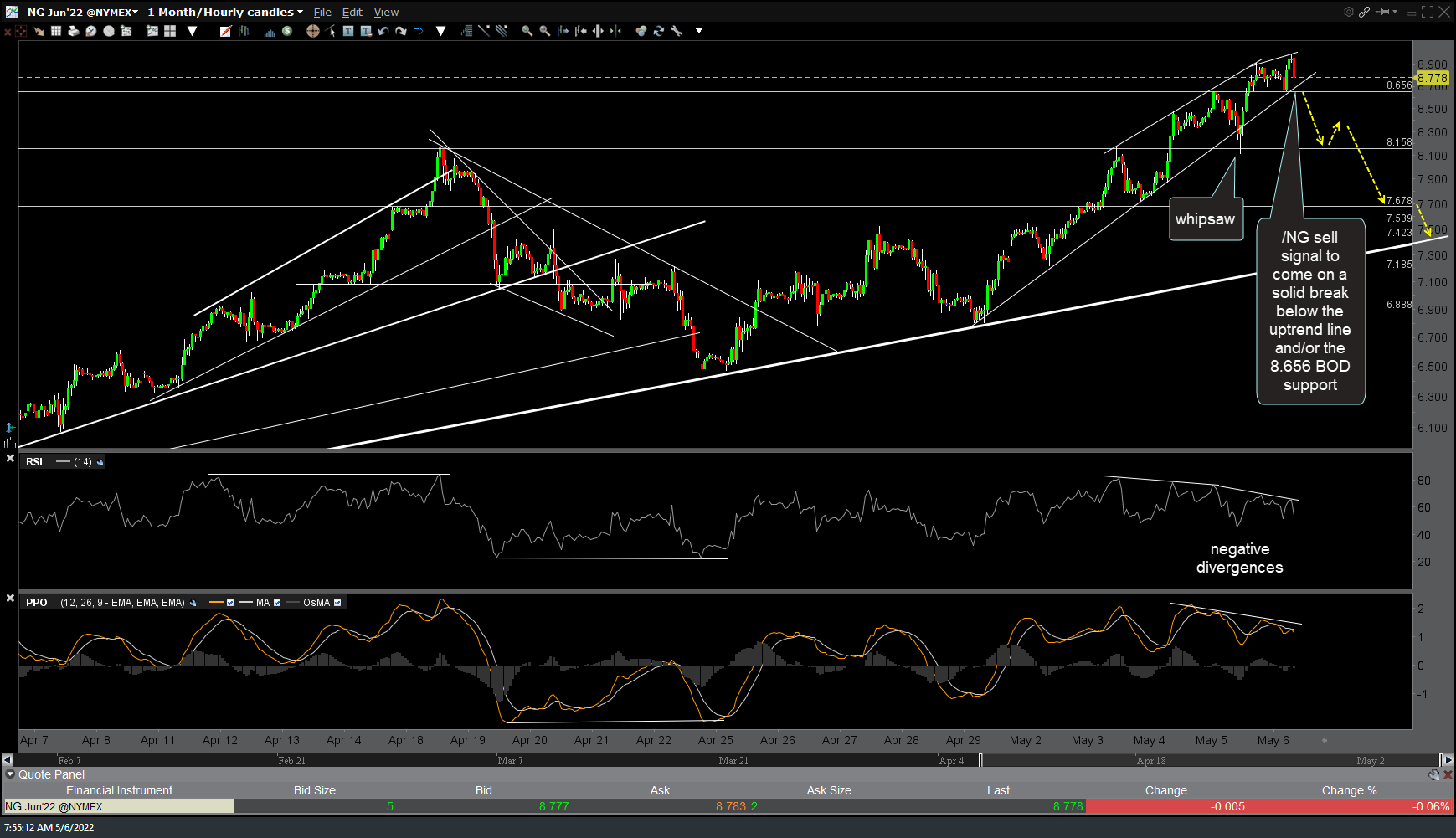

The /NG (natural gas futures or UNG, KOLD, /QG, etc..) short trade has just hit the first price target for a quick ~6% profit after the sell signal (trendline breakdown) only a few hours ago shortly after the trade setup was posted earlier today. Consider booking partial or full profits and/or lowering stops if holding out for any of the additional targets. Previous & updated 60-minute charts below.

Although we still have a few hours to go, as of now, /NG has put in both a divergent high as well as a bearish engulfing candlestick on the daily time frame. Should the bearish engulfing candle get finalized today (the body of the candle engulfs, or closes below the bottom of the body of yesterday’s candle), that would be a potential topping stick. If so, any follow-thru red candles next week would help to firm up the case for a swing/trend tradable top in natural gas.

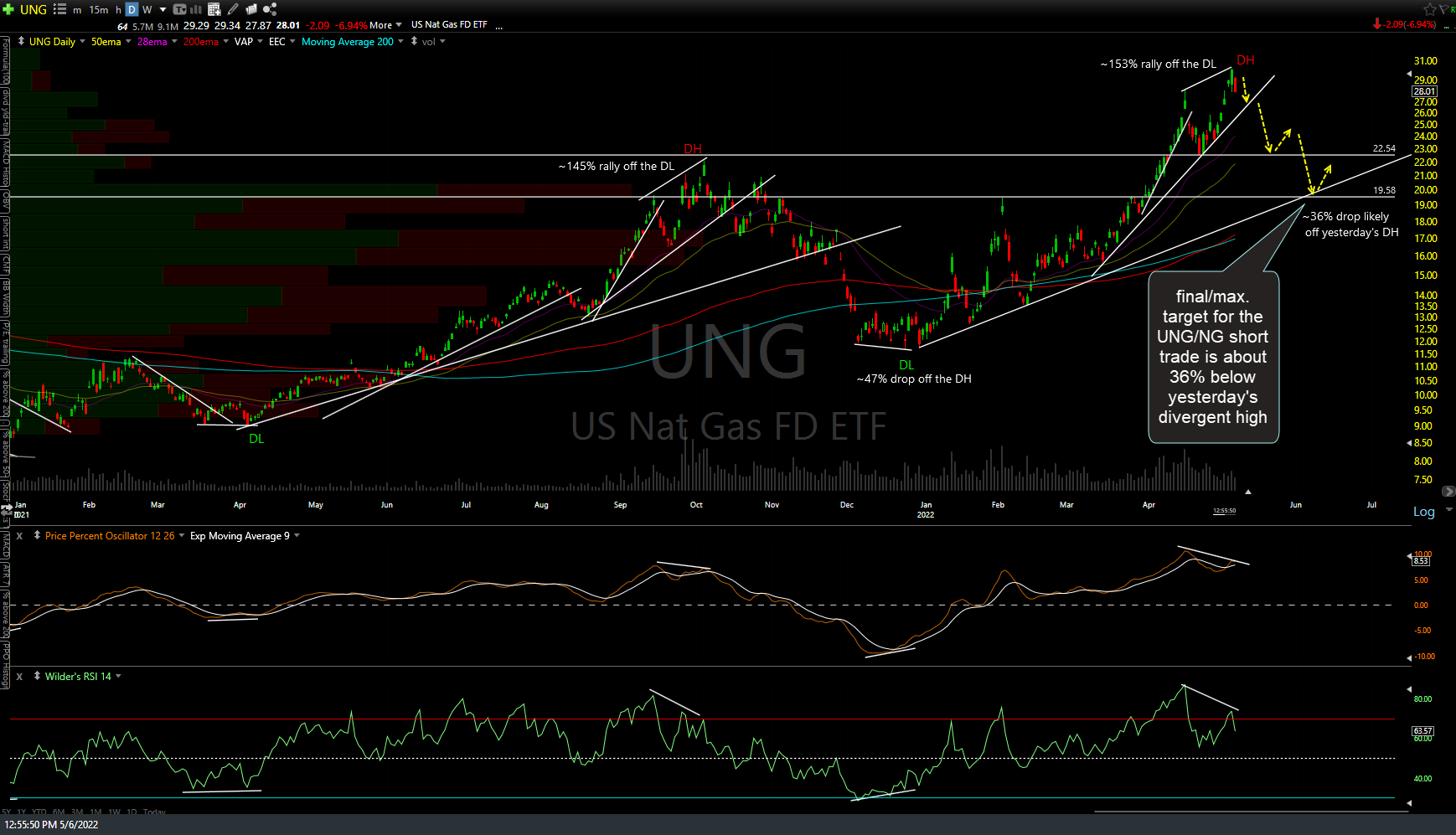

UNG (nat gas ETN) daily chart with the likely path & my max. downside target of ~36% below for reference below. Also note that /NG was highlighted as a long trade idea in the Dec 20th Market Analysis & Trade Ideas video, along with reiterating my convictions that the Nasdaq 100 put in a major top back in November with more downside to come. That was effective THE low, roughly equal to the Dec 23rd low, with nat gas rallying ~153% from there.