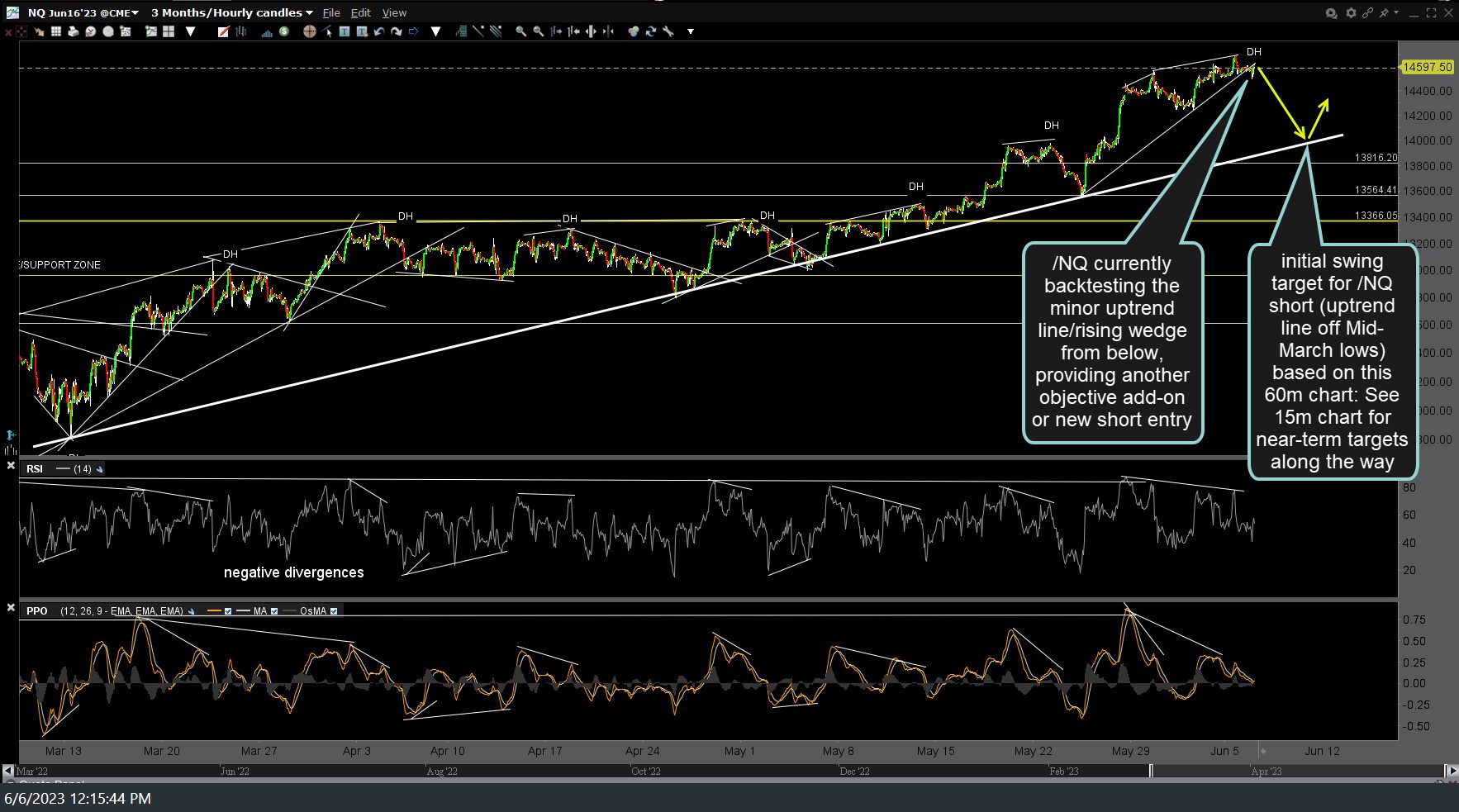

/NQ (Nasdaq 100 futures) has finally hit the primary uptrend line (off April lows) pullback target with small divergences currently in place that could be the catalyst for one more thrust up & larger DH. Bounce or no bounce, the next & more significant sell signal will come on a solid break and/or close below the uptrend line, especially if AAPL takes out the primary uptrend line (daily chart) with conviction as well. Original (June 6th) & updated 60-minute charts below.

No change in the technical posture or outlook for /ES other than this new divergent low at the 4410 minor support. Any marginal new high soon will still extend the previous (negative) divergences while a solid break below the 4371 & 4349 supports below would likely usher in additional waves of selling. 60-minute chart below.

Bottom line: The major stock indices have gone about exactly nowhere for the past month. As earnings season officially kicks off this week, the market will most likely choose its next direction over the next few weeks as earning season peaks with the big market leading tech stocks in the next 2-3 weeks.