Bigger picture (for swing & trend traders), QQQ still appears headed to my 4th & final “initial bear market” target on the weekly chart in the coming weeks to months, minor zigs & zags aside.

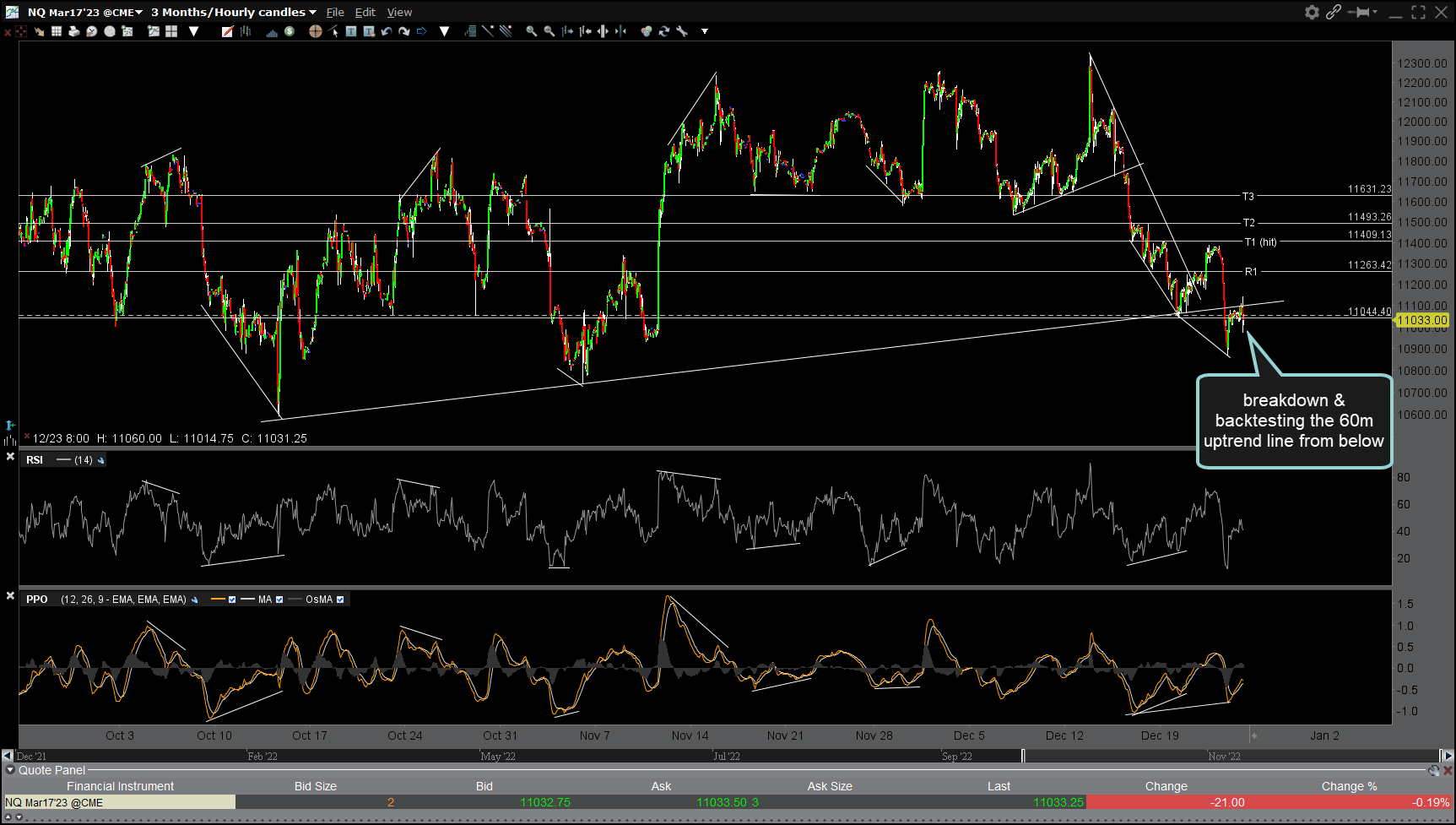

Although I was away from my desk most of yesterday doing some last minute X-mas shopping & errands, I can see it was a typical holiday low volume roller coaster with /NQ spiking down sharply more so on any lack of buyers than an abundance of sellers (as evidenced by yesterday’s low volume) with that spike immediately followed by a low-volume rip that has taken /NQ up for a backtest of that 60-minute trendline from below (former support, now resistance until & unless recovered). With over a week to go before the new trading year kicks off, I’d continue to expect some random volatility spikes in either direction.

A quick view of the QQQ 60-minute chart with QQQ trading below the uptrend line off the recent lows following the impulsive rejection from the center of my red “most likely” bounce target zone in the Dec 13th pre-market trading session.

As previously highlighted in recent videos, after breaking above the downtrend lines, $VIX tends make one brief period of consolidation before exploding to the upside with the next big surge in the $VIX likely to coincide with the next major leg down in the stock market to my next (QQQ weekly T4) bear market swing/trend target. Hard to say exactly when that will be although a break above 25.50ish on $VIX along with a break of the previous lows on QQQ should do the trick.