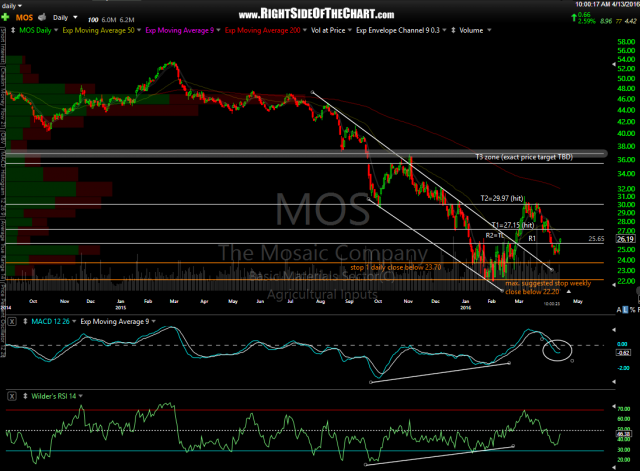

Both of the closely related agricultural input/fertilizer stocks MOS & POT were added as Growth & Income trades back in early January, with both stocks moving sharply higher & MOS hitting the final target for a quick 16% gain in just 3-weeks. At that time, I decided to close out the MOS (The Mosaic Corp) trade early at T2 vs. the original final target of T3 since the stock had moved up too much, too fast & the odds for a significant pullback were too high to warrant remaining long at that time. MOS peaked the following trading day, immediately reversed, falling 20% over the next month.

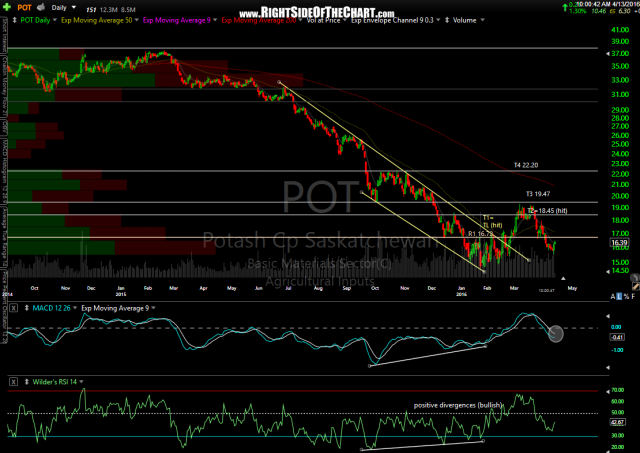

- POT daily April 13th

- MOS daily April 13th

POT (Potash Corp), on the other hand, also continued higher to peak on the same day as MOS, March 7th, although it fell a mere 9 cents shy of the T3 price target of 19.47, where I was planning to also close out the trade early if it got there but the stock fell a just 4/10th of 1% shy of that that 3rd target after hitting the 2nd target for a very quick 17% gain. As with MOS, POT was extremely overbought on the near-term & even intermediate-term time frames & as such, fell along with MOS over the next month. However, as POT has remained well above the max. suggested stop, it is still an active trade.

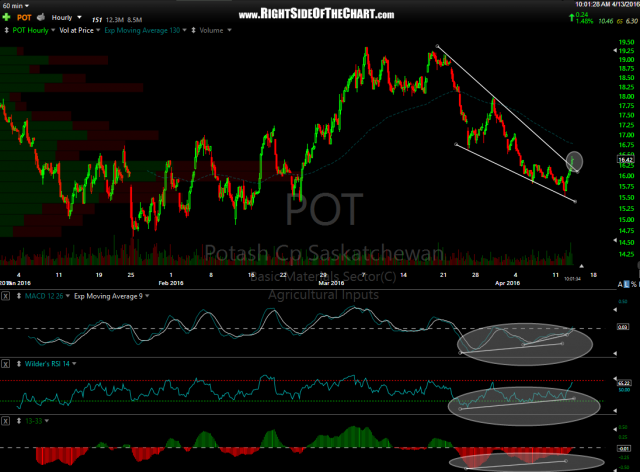

- POT 60-minute April 13th

- MOS 60-minute April 13th

Other than a quick background to on these trades, I wanted to highlight the fact that both MOS & POT appear to have come full circle after working off those overbought conditions & appear likely to embark on the next leg higher, quite possible to the T4 level on POT & the former T3 final target on MOS in the coming months. These 60-minute charts as well as the bullish posture of the MACD (turning back up) helps to confirm a new entry or add-on to either of these Growth & Income Trade ideas. POT is still an Active Trade & I am going to go ahead and also add MOS back as an Active Growth & Income Trade here on what will likely be a break above this 60-minute descending price channel (confirmed with bullish divergences). correction: prices have now broken out on both POT & MOS on the 60-minute frames since I started composing this post, thereby helping to confirm the entry on both.