QQQ tried to break & hold above the top of the expected breakout failure range but was rejected & closed back towards the bottom of that zone with a fairly bearish stick on the 60-minute frame (not shown on this 15-minute chart). Awaiting a break below the 105.60 level for additional confirmation of the bull trap scenario. 15-minute chart:

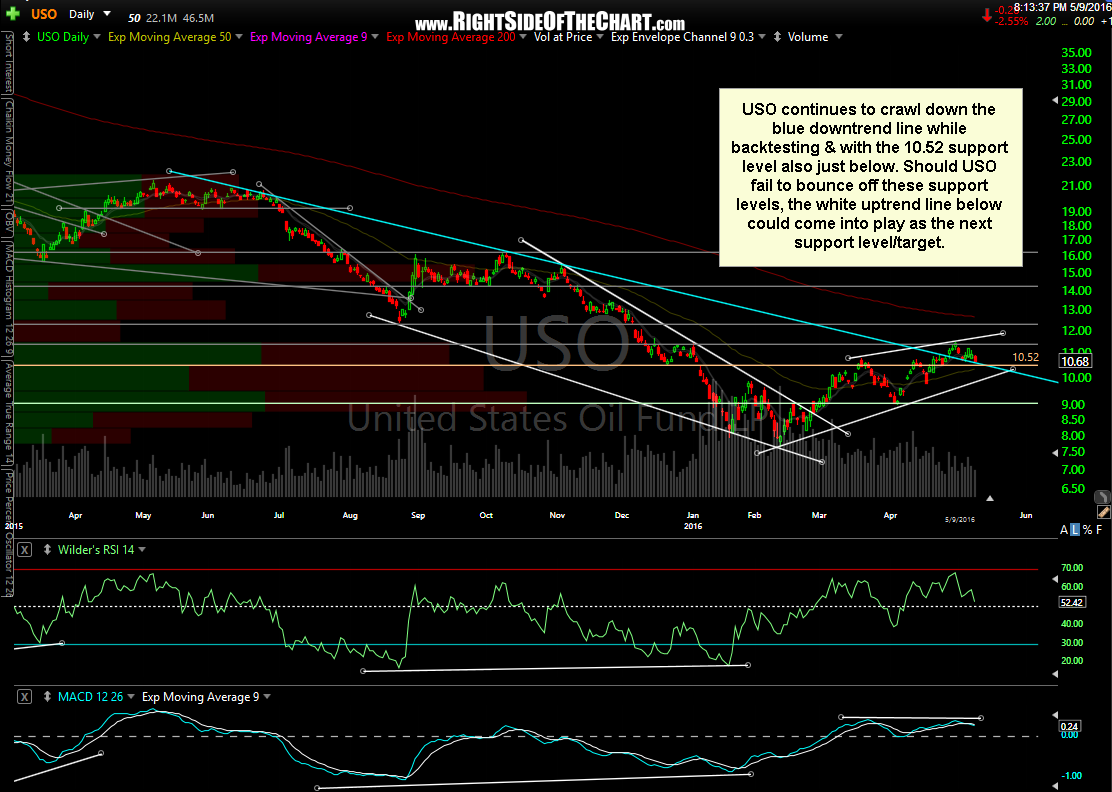

USO (crude oil etf) continues to crawl down the blue downtrend line while back-testing & with the 10.52 support level also just below. Should USO fail to bounce off these support levels, the white uptrend line below could come into play as the next support level/target. Daily chart:

In summary, I remain near-term bearish on most equity sectors although crude oil & energy sector etfs such as XLE & XOP are at or very close to key support levels where a reaction is likely. As such, I remain neutral on the energy sector at this time while still near & intermediate-term bearish on precious metals & the mining sector as well as the broad market (SPY, QQQ, MDY, IWM, etc..).