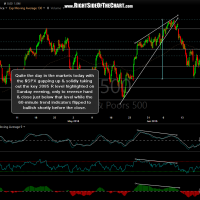

Quite the day in the markets today with the $SPX gapping up & solidly taking out the key 2085 resistance level that was highlighted on Sunday evening, only to reverse hard & close just below that level while the 60-minute trend indicators flipped to bullish shortly before the close. About 60% of today’s gains in SPY were faded (bearish) yet the fact that the SPY still managed to close up 0.65% tips the advantage somewhat to the bulls today. Bottom line: Despite a green close, both the $SPX $NDX failed to take out even my first resistance levels, or more accurately, failed to hold above those levels after briefly taking them out (i.e.- failed breakouts). As such, this fight will have to be continued tomorrow as today was essentially a draw between the bulls & bears IMO.

- $SPX 60-minute June 20th

- SPY 1 minute June 20th

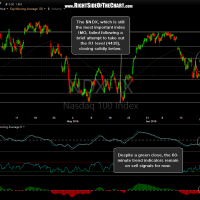

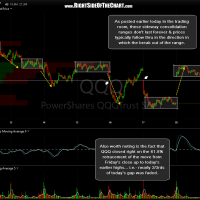

The $NDX, which is still the most important index IMO, failed following a brief attempt to take out the R1 level (4438), closing solidly below. Despite a green close, the 60-minute trend indicators remain on sell signals for now. Also worth noting is the fact that QQQ closed right on the 61.8% retracement of the move from Friday’s close up to today’s earlier highs… i.e.- nearly 2/3rds of today’s gap was faded.

- $NDX 60-minute June 20th

- QQQ 5-minute 4 June 20th

For those interested, this following video was an intraday market update posted this morning in the trading room which highlights some of the significant technical levels on both the broad markets & a few market leading stocks (12 minute duration).