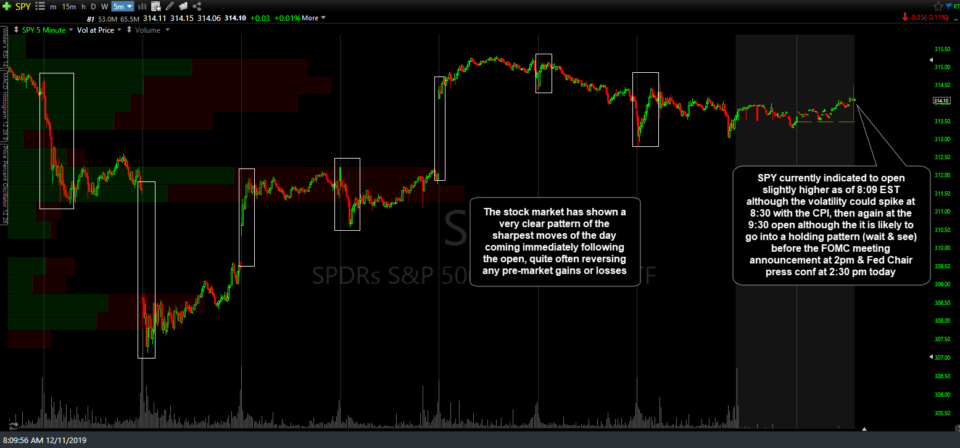

The 5-minute period chart of SPY (S&P 500 tracking ETF) below highlights the clear pattern of the sharpest moves of the day coming immediately following the open, quite often reversing any pre-market gains or losses. SPY currently indicated to open slightly higher as of 8:09 EST although the volatility could spike at 8:30 with the CPI, then again at the 9:30 open although the market is likely to go into a holding pattern (wait & see mode) before the FOMC meeting announcement at 2 pm & Fed Chair press conference at 2:30 pm today.

With stock futures essentially trading flat overnight & so far today plus the fact the market drifted mostly sideways into the close yesterday as it has locked into the typical pre-Fed wait & see holding period, there just isn’t anything new or significant to report from a technical (charting) perspective. After the Powell’s press conference today, we have Jobless Claims & the Producer Price Index reports tomorrow at 8:30 am followed by Retail Sales on Friday at 8:30 am so volatility is likely to resume later this afternoon & into the end of the week. As such, I plan to keep things light & see how the charts develop later today & into the end of the week before trying to read too much into things.