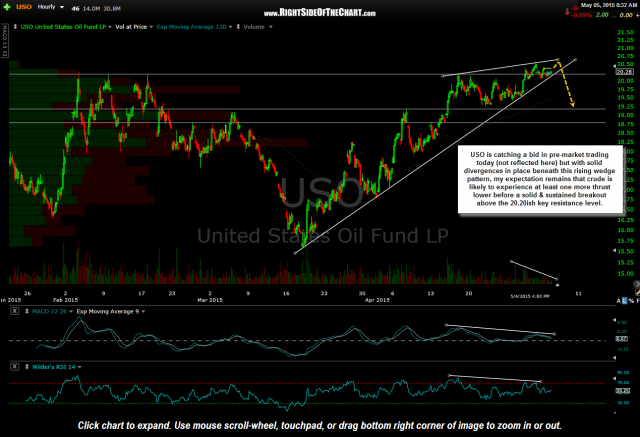

USO is catching a bid in pre-market trading today (not reflected here) but with solid divergences in place beneath this rising wedge pattern, my expectation remains that crude is likely to experience at least one more multi-week+ thrust lower before a solid & sustained breakout above the 20.20ish key resistance level. Naturally, the energy related stocks move in tandem with crude prices. At best, my take would be for a brief blow-off top (blue lines) that would be caused by a false upside breakout in crude prices although I still favor a downside resolution of this rising wedge pattern in XLE to occur within days or a couple of weeks at most.

- USO 60 minute May 5th

- XLE 60 minute May 5th

Regarding gold, silver & the mining stocks as well as the US dollar, my outlook remains the same: The near-term outlook remains somewhat unclear and as such, my expectation is for somewhat choppy price action while I remain intermediate & longer-term bullish. I continue to hold some exposure to the mining sector but have yet to add back the exposure that I reduced a week ago today.

I remain both near-term & intermediate-term bearish US equity & continue to expect considerable downside in the coming weeks.

Last night I removed the CTSH short trade from the Active Trades category as it had exceeded the previously suggested stop. In response to a question on that trade, I posted my thoughts and personal trading plan but wanted to expand on those thoughts. In the past, I have discussed my preferred trading strategy when being caught positioned long or short on the wrong side of a gap. I was aware that CTSH was reporting earnings yesterday before the bell and chose to hold my short position although the odds of a gap for or against my position was likely (more on holding through earnings can be found under the FAQ section).

When caught on the wrong side of a gap that is poised to exceed your stop (based on where the stock is trading in the pre-market session), you are faced with two options: Leave your standing stop-loss order in place, if you are using one, or manually sell/cover your position at the open for a guaranteed loss -or- cancel your stop-loss order (or hold off on manually closing the position at the open), allowing for the initial order imbalances to clear, then place a new stop-loss order slightly above the initial reaction high that occurs after the open.

How long to wait depends on a myriad of factors, including your own trading rules, tolerance for loss, position size, any support or resistance level below/above, etc…. Typically, I will wait anywhere from several minutes to about an hour and sometimes more, again depending the unique circumstances of each position. By employing this strategy, the cons are that you may allow you losses to extend beyond what they would have been had your stop-loss order been filled at the open. The advantage is that gaps are often faded and as discussed in yesterday’s CTSH post, could be an exhaustion gap, with the stock going on to not only recover all of your losses but in several cases (including some actual trades that were posted here in the past), the stock could continue on to hit one or more of the original profit targets.

In summary, you have two options when caught on the wrong side of a gap: Stop out for a guaranteed loss or modify your stops, allowing for the potential to increase those losses (only slightly, as you can control where your new stop will be) but also allowing for the potential to recoup all those losses (should the gap be backfilled) and in many instances, have the trade go on to become profitable.