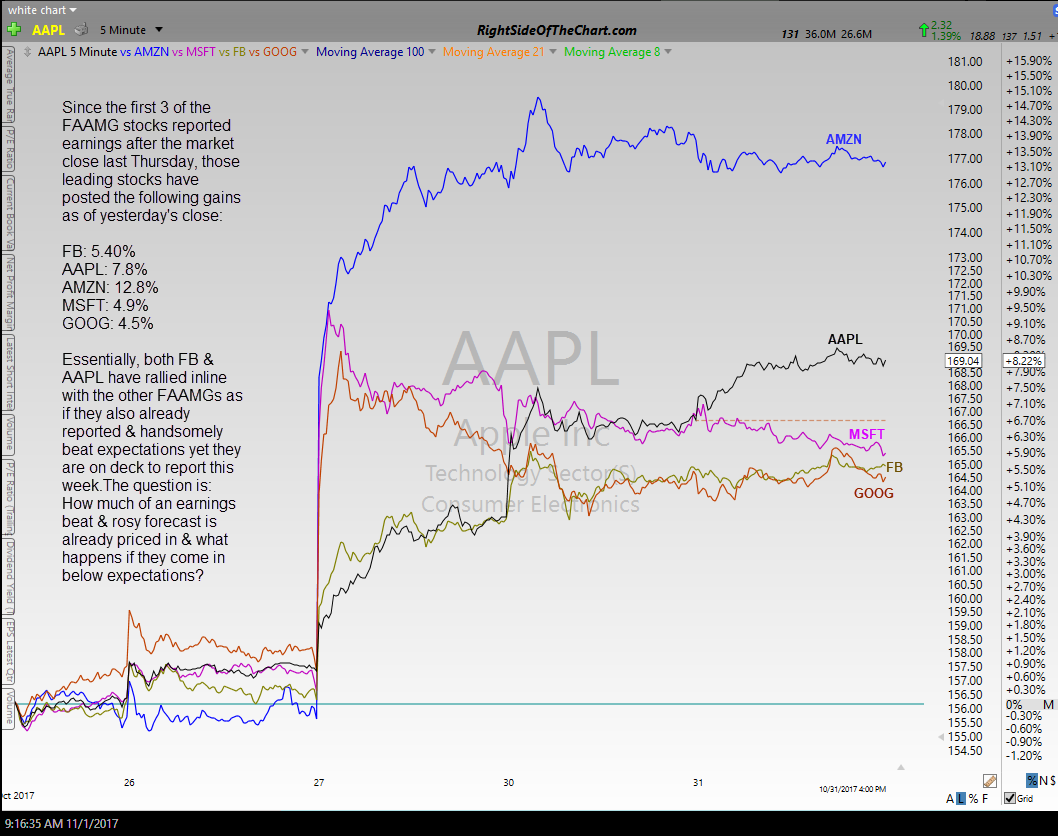

Since the first 3 of the FAAMG stocks (AMZN, MSFT & GOOG) reported earnings after the market close last Thursday, those leading stocks (in green) have posted the following gains as of yesterday’s close:

FB: +5.40% (reports after the market close today & currently indicated to gap up another 1% at the open today)

AAPL: +7.8% (reports after the market close tomorrow)

AMZN: +12.8%

MSFT: +4.9%

GOOG: +4.5%

Essentially, both FB & AAPL have rallied inline with the other FAAMGs as if they also already reported & handsomely beat expectations yet they are on deck to report this week. The question is: How much of an earnings beat & rosy forecast is already priced in & what happens if they come in below expectations?