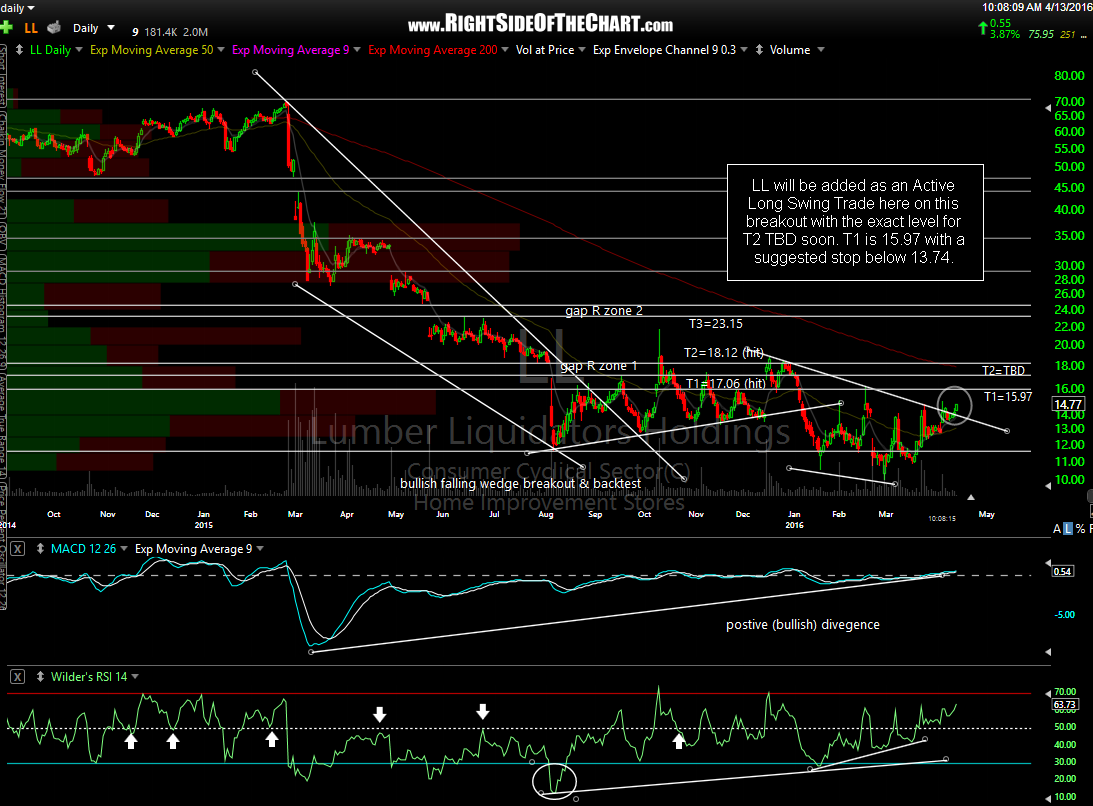

LL (Lumber Liquidators Holdings) will be added as an Active Long Swing Trade here on this breakout with the exact level for T2 TBD soon. T1 is 15.97 with a suggested stop below 13.74.

LL Swing Trade Entry

Share this! (member restricted content requires registration)

11 Comments