LABD (3x Bearish S&P Biotech Sector ETF) will be added as an Active Short Trade here with a sole price target of T1 at 3.69. Additional targets might be added to this trade but for now, I’m looking for a ~7% drop in XBI (the 1x, non-leveraged S&P Biotech Sector ETF) & as I expect the move to be fairly undirectional & swift, I have opted to use the 3x leveraged ETF which effectively expands the ability to short the biotech sector in both margin accounts as well as cash (non-margin accounts) that normally don’t allow for shorting stocks or ETFs like XBI.

- LABD daily March 19th

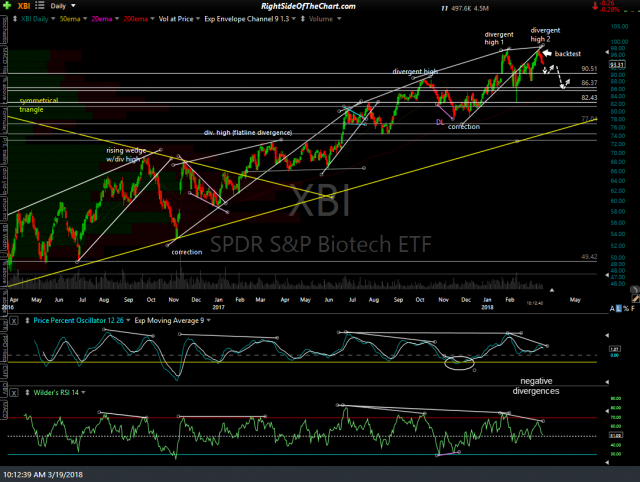

- XBI daily March 19th

As LABD employs 300% leverage coupled with the fact that the biotechs are one of the more aggressive & volatile sectors within the market, the suggested beta-adjustment for this trade will be 0.30 or about 3/10ths of a typical position size. Of course those with a margin account might opt to short XBI, especially if they decide to short the biotechs and allow for the potential of a “runner” trade, meaning a trade that might last for several weeks or months & far exceed the 86ish target zone on XBI which correlates with the price target on the LABD trade.

NOTE: Although LABD is categorized as an Active Short Swing Trade idea, one would buy or go long LABD as it is an inverse (bearish) ETF.