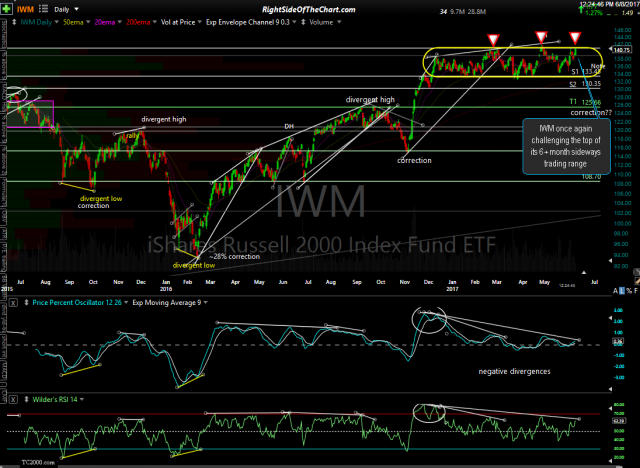

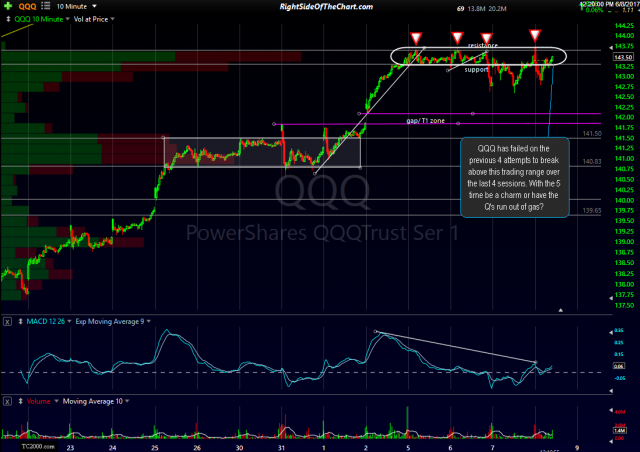

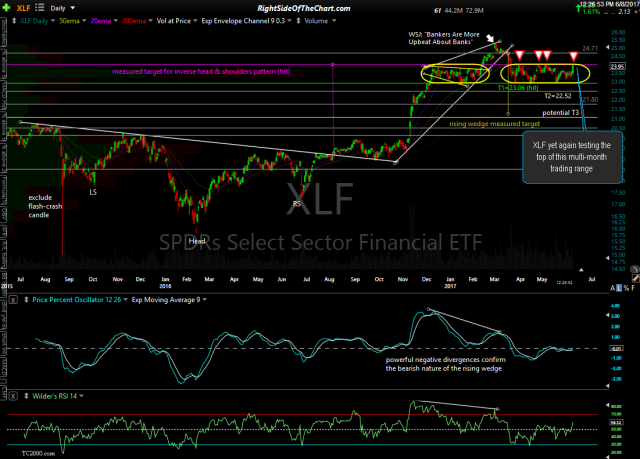

We current have some key stock indexes & sectors testing key resistance levels. IWM once again challenging the top of its 6+ month sideways trading range, QQQ is close to the 5th test of the top of the recent trading range over the last 4 session while XLF (financial sector ETF) is once again testing the top of the multi-month trading range that has capped all advances & declines in recent months. Hard to say which way these will break & although the recent price action has been bullish, then again it always is bullish on the rallies leading up to the top of the zones just as it is bearish on the sell-offs that have taken each of these securities to the bottom of these trading zones.

- IWM daily June 8th

- QQQ 10-minute June 8th

- XLF daily June 8th

I’m not very concerned with any intraday breaks above or below these ranges but more so the daily closes & any follow-through rallies or sell-offs. Whether or not these ranges hold will only be known in hindsight but what I can say is that shorting the top (or going long at the bottom) of a well defined trading range with a stop somewhat above (or below) is certainly objective with a minimal downside loss potential vs. the gain potential if these index or sectors reverse & move back down to the bottom of these ranges. Likewise, those expecting the market to make a sustained breakout & rally above these trading ranges could position long on a breakout with a stop somewhat below the top of the ranges.