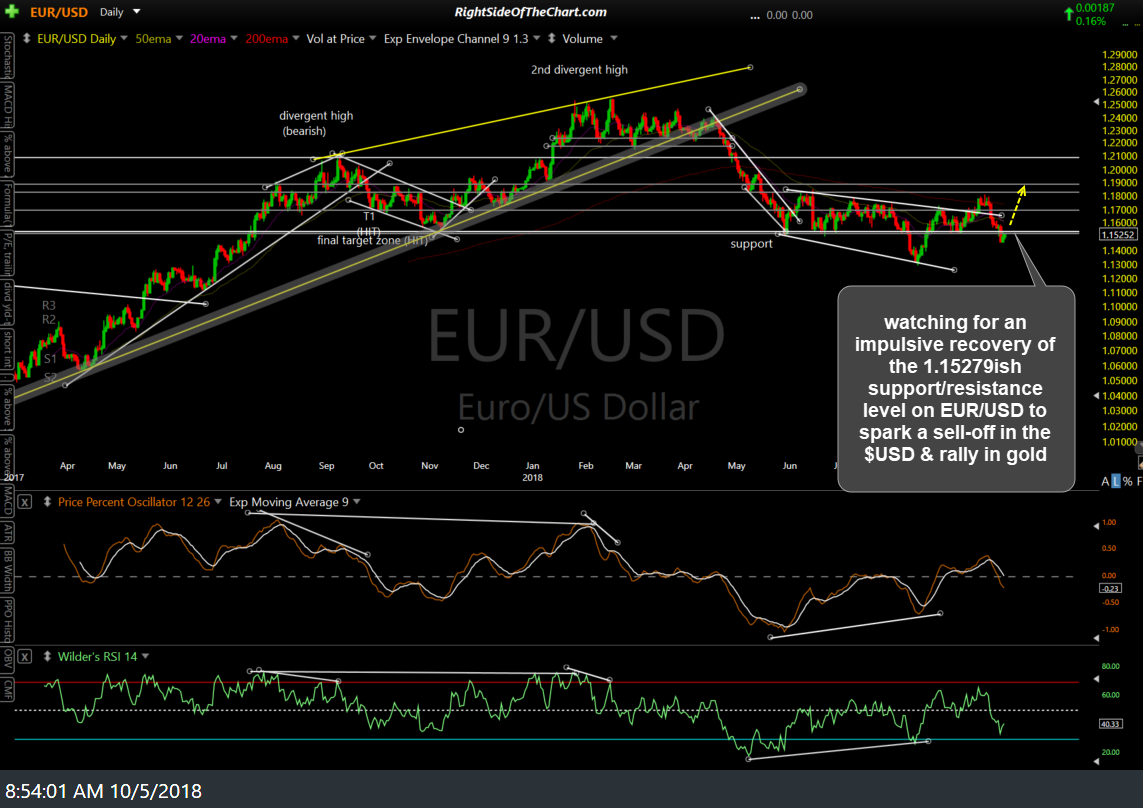

As per my analysis on the recent videos, I’m watching for an impulsive recovery of the 1.15279ish support/resistance level on EUR/USD to spark a sell-off in the $USD & rally in gold to firm up the bull-trap scenario for the US Dollar (bear trap for Euro) which would likely spark a breakout & rally in gold. EUR/USD daily chart:

Supporting the case for a recovery of that key long-term support/resistance zone on the EUR/USD daily chart is the fact that the currency pair has been moving higher since the breakout & backtest of this 60-min bullish falling wedge. Next buy signal to come on an impulsive break above 1.15306.

Last but certainly not least, I’m still awaiting & expecting a break above the downtrend line +1213 resistance level on /GC (gold futures) to spark a rally in gold & the miners. Other than gold futures, direct & indirect proxies for trading gold include GLD (gold ETF), DGP (2x long gold ETN), UGLD (3x bullish/long gold ETN), GDX (gold miners ETF) or any of the other precious metals or miners ETF. Should the case for a substantial rally in gold continue to firm up, I will continue to share some of the most promising individual gold & silver mining stock trade setups as well.