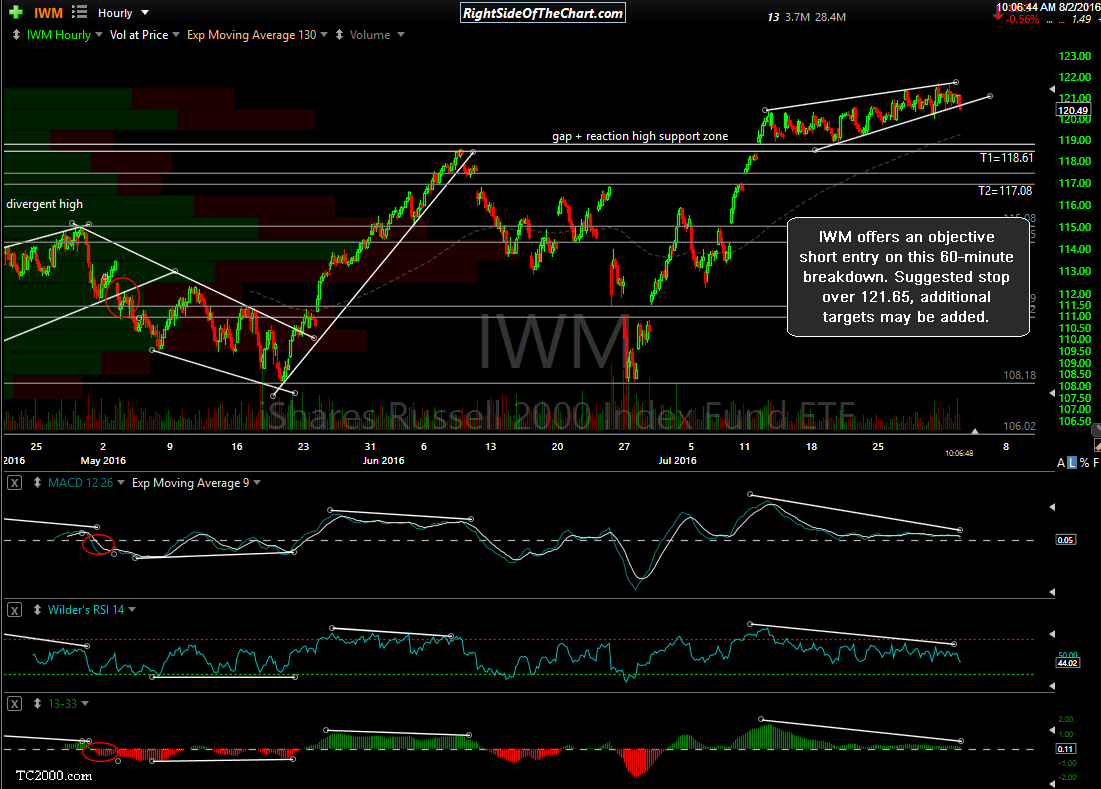

IWM offers an objective short entry here on the break below this 60-minute chart pattern. The two official price targets at this time are T1 at 118.61 & T2 at 117.08 although this trade may be extended with additional price targets added, depending on how the chart play out in the coming days.

If my read on the charts is correct, the move down to either of these targets should be relative swift & if so, one could use TZA (3x short small cap ETF) in lieu of an IWM (1x long small cap) or TNA (3x long small cap ETF), the latter of which is my preferred proxy for this potential multi-week swing short on the Russell 2000 index.

IWM current price is 120.49 with TNA around 73.77. A TNA short or TZA long should be closed if/when IWM reached your preferred target. Suggest stop on any move above IWM 121.65.