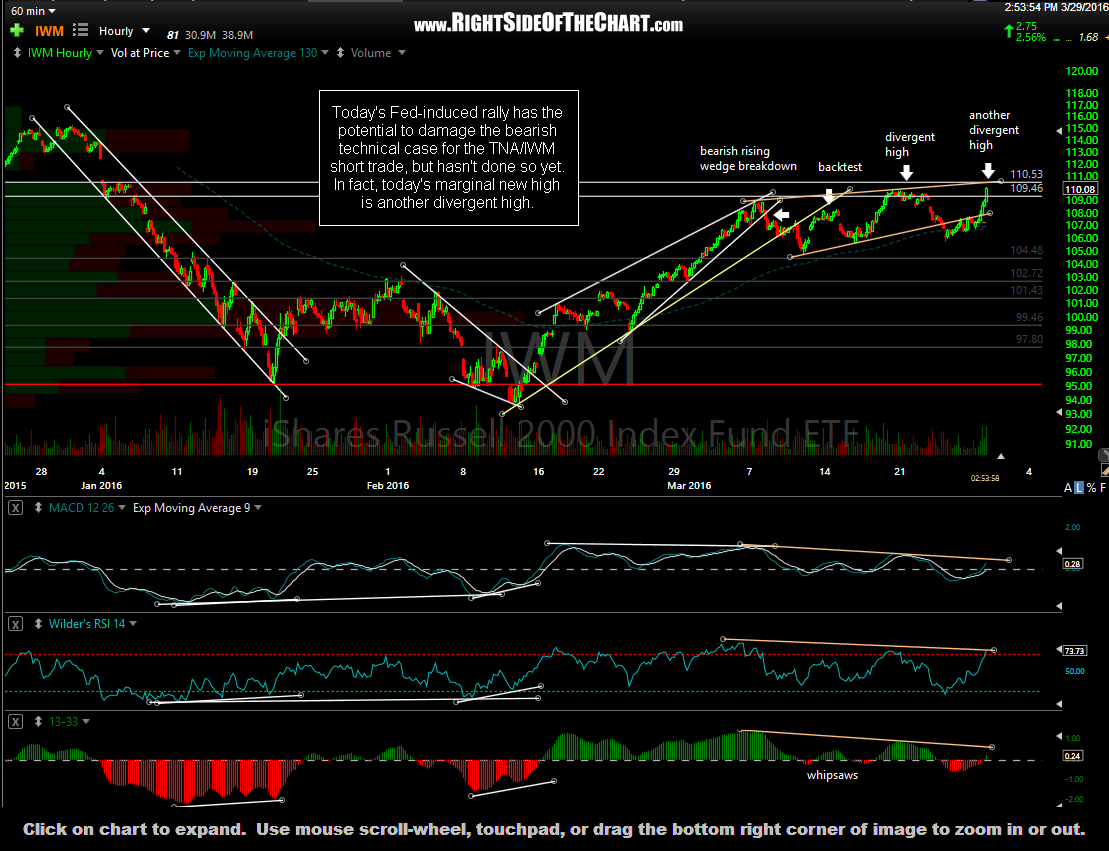

Today’s Fed-induced rally has the potential to damage the bearish technical case for the TNA/IWM short trade, but hasn’t done so yet. In fact, today’s marginal new high is another divergent high.

Essentially, the small caps have traded sideways for the last 3 weeks, with the IWM/TNA short trade actually still profitable earlier today before the Fed jawboned the markets higher, with the $RUT now trading just over 2% above the March 4th entry price & still comfortably below the suggested stop of a daily close above 1130 in the $RUT (Russell 2000 small cap index). Today’s marginal new (recent) high in QQQ/TQQQ is also another divergent high. I’ll post an update to QQQ as well as some of the other trade ideas later today.