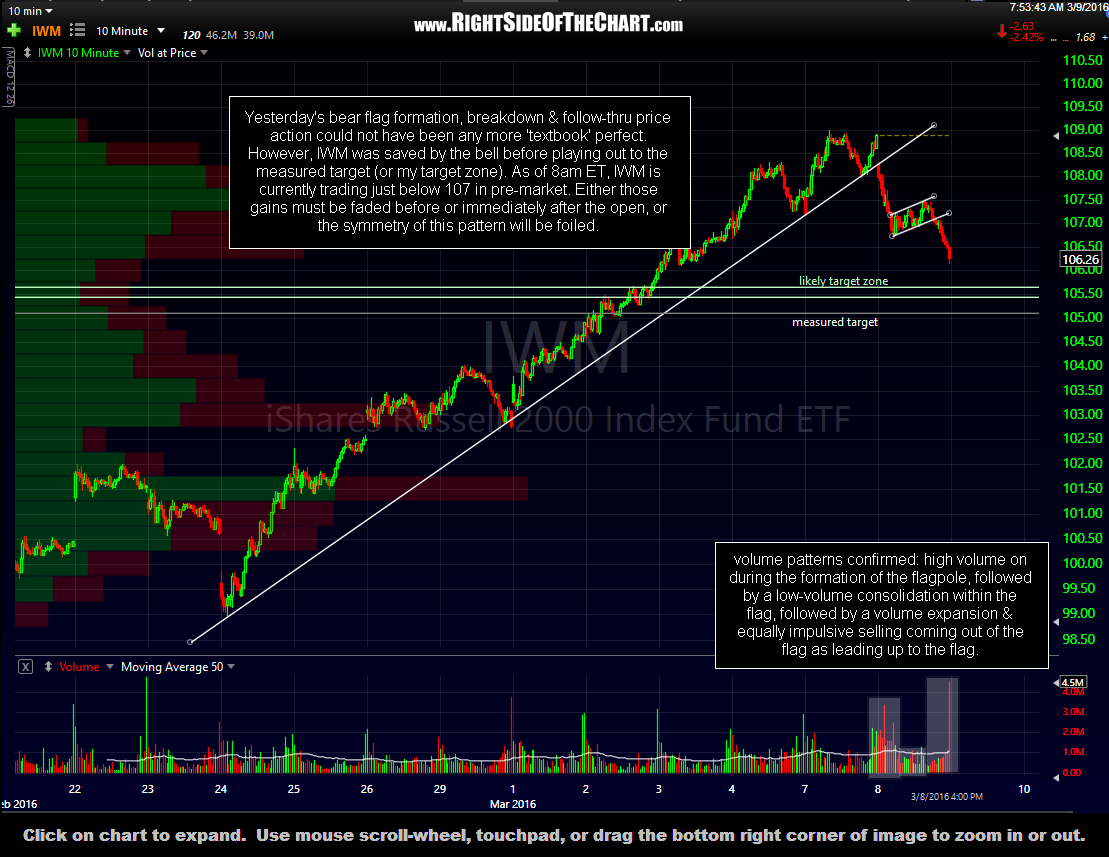

Yesterday’s bear flag formation, breakdown & follow-thru price action in IWM could not have been any more ‘textbook’ perfect. However, the small caps were saved by the bell before playing out to the measured target (or my target zone). As of 8am ET, IWM is currently trading just below 107 in pre-market. Either those gains must be faded before or immediately after the open, or the symmetry of this pattern will be foiled.

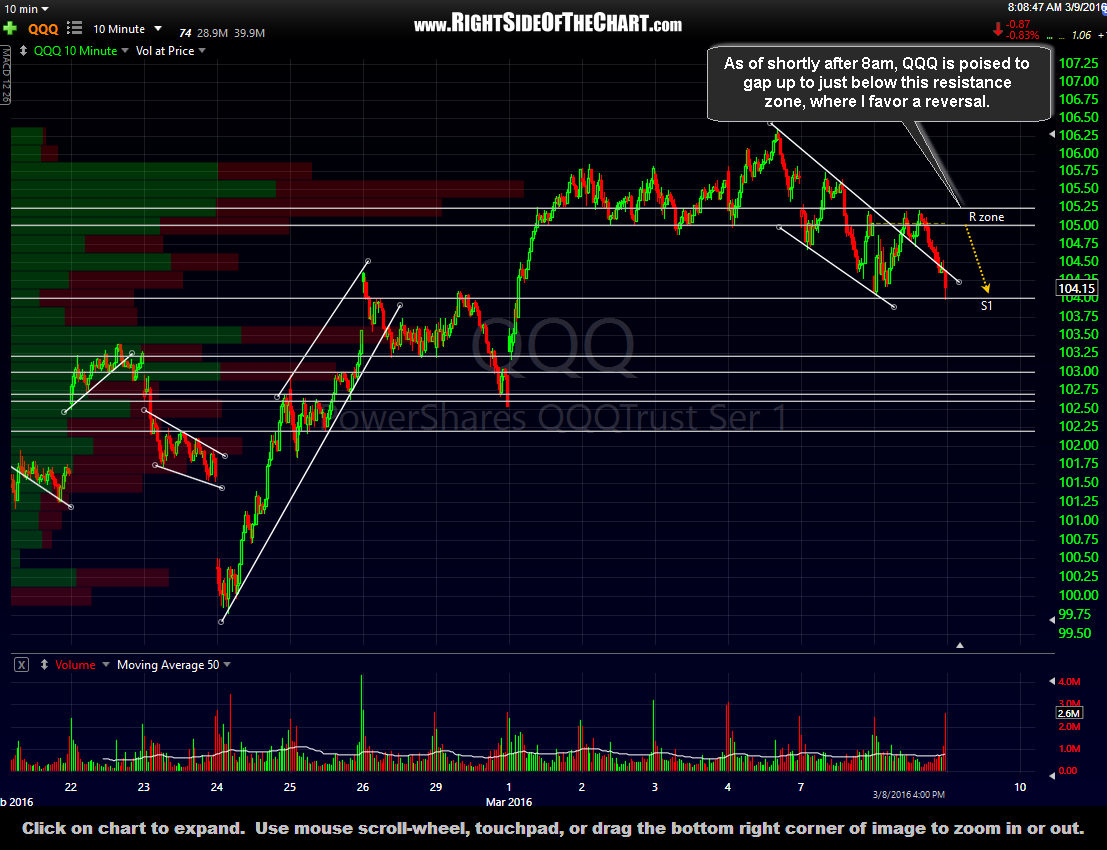

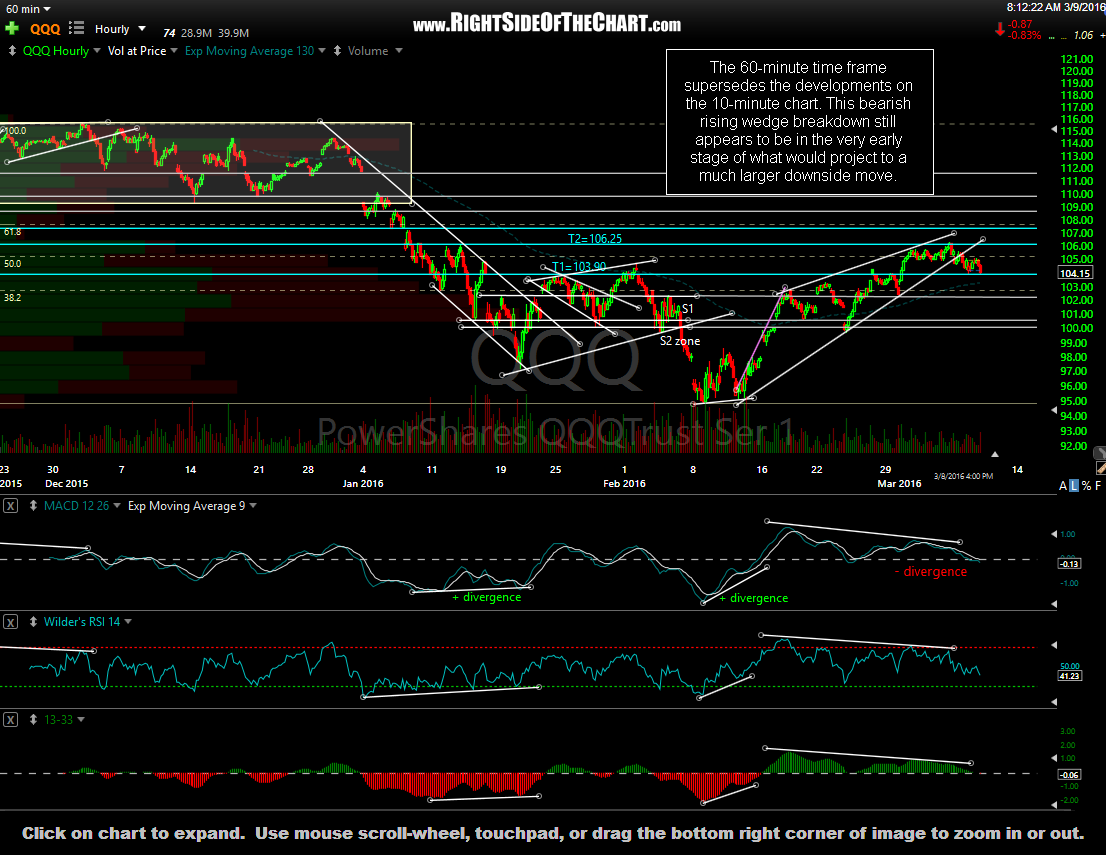

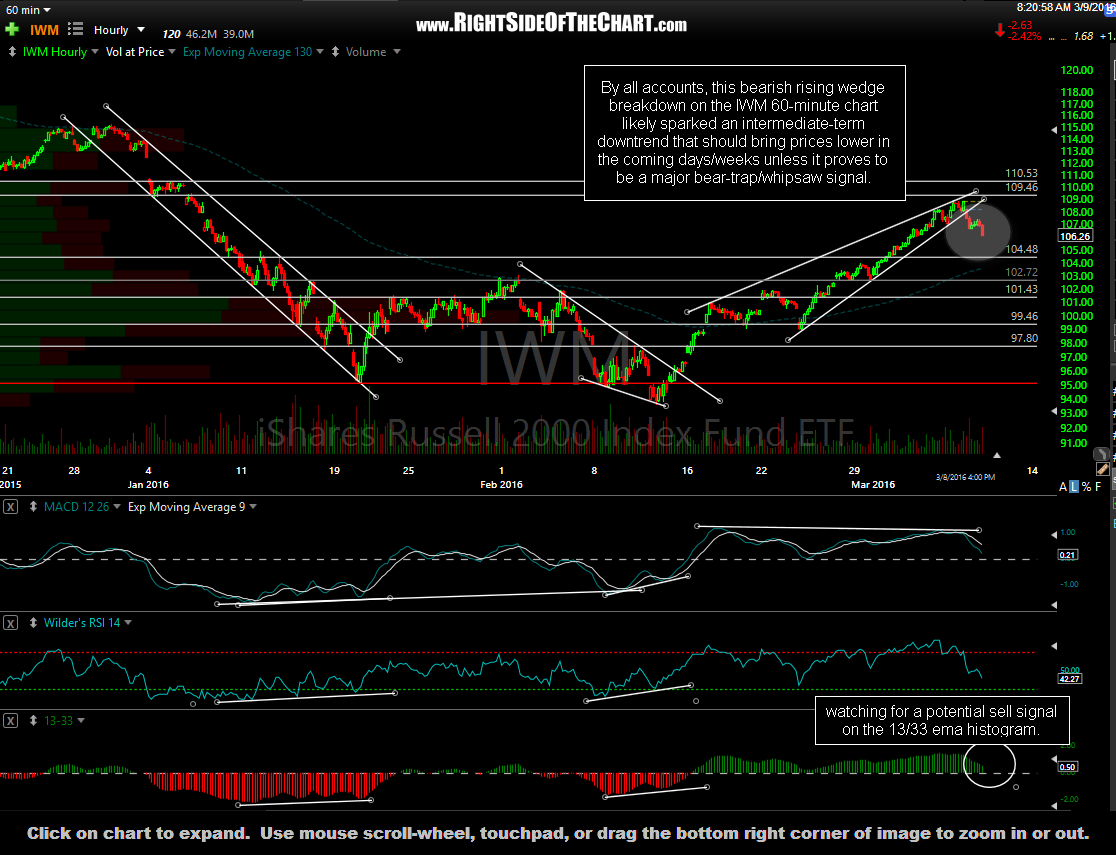

IWM & QQQ Gaps Likely to Be Faded

Share this! (member restricted content requires registration)

5 Comments